Research summary:

This research report is focused on Rarible which operates in the NFT space. We will focus on what NFTs are, how Rarible works, and review its pros and cons.

The CMP is $12 as of 6th August 2021.

What is an NFT?

NFT stands for non-fungible token. The non-fungible aspect signifies its uniqueness and such tokens can’t be replaced by anything else. For instance, the US dollar is fungible, which means that one USD isn’t unique and can be traded for another USD. For example, I borrowed 1 USD from my father. When I pay him back, I can send him any USD and not specifically the USD that he gave me. While on the other hand trading cards, art, collectibles, and more are non-fungible. For instance, a Ronaldo Trading card is not the same as a Messi trading card.

An NFT’s uniqueness is authenticated by the blockchain it is on. People started to apply the technology to authenticate uniqueness to digital art thereby creating a whole new world of digital arts and collectibles.

The above digital art was bought by Metakovan, a south Indian Bitcoin billionaire for approximately $70 million. Although I have attached a copy of the art above, he is the sole owner of the artwork and this is confirmed on the blockchain.

Video games are also another massive driver for the NFT industry. A virtual economy is essentially a system of online jobs, assets, marketplaces, and traders which has emerged across a range of online platforms such as Minecraft, SecondLife, and Decentraland. There is a virtual currency within these virtual economies, which is used to buy and sell in-game assets (such as land, houses, weapons, vehicles). Currently, within the centralized games, all the assets are controlled by the company and are siloed. NFTs can solve this problem.

During the pandemic, virtual economies have been exposed to over 2.5 billion people and it is expected that approximately $129 billion worth of digital game spending would occur. It is safe to say that the NFT space is not only soaring but also has a lot more potential than expected.

What is Rarible and what does it do?

Rarible is an NFT marketplace where anyone can mint, buy and sell digital collectibles without any coding skills. There is a huge problem of artists not knowing how to create NFTs and may not have any idea about cryptocurrency. Rarible is the platform that helps them out.

The marketplace has a variety of NFTs to offer such as art, Metaverse assets, domain names, and DeFi

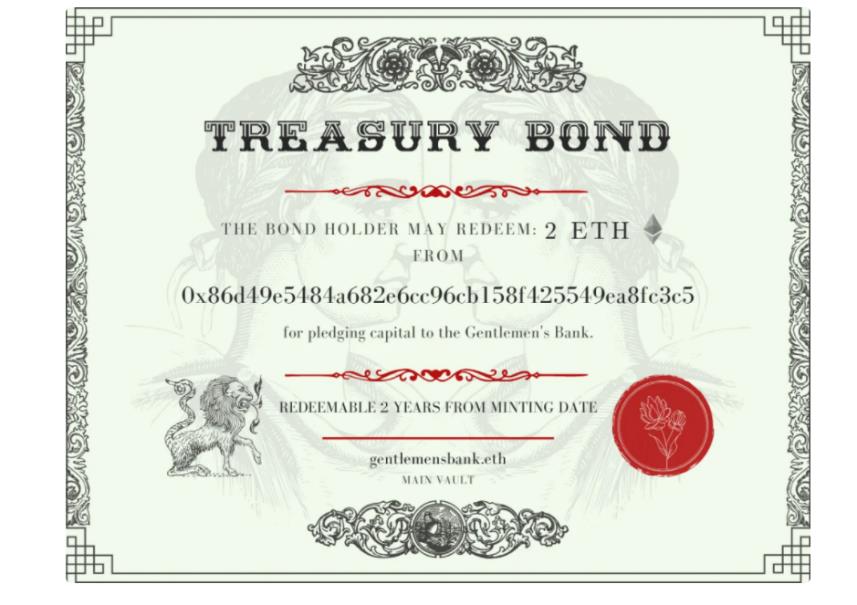

DeFi NFTs are quite interesting. Here is a Treasury Bond NFT which will mature after 2 years of minting.

It is a non-custodial marketplace and also has a royalty feature. A royalty feature essentially allows the creator of the NFT to earn a certain percentage from future secondary sales.

The marketplace came into existence in the early 2020s and has already started growing in market share compared to other major NFT marketplaces such as Opensea and SuperRare.

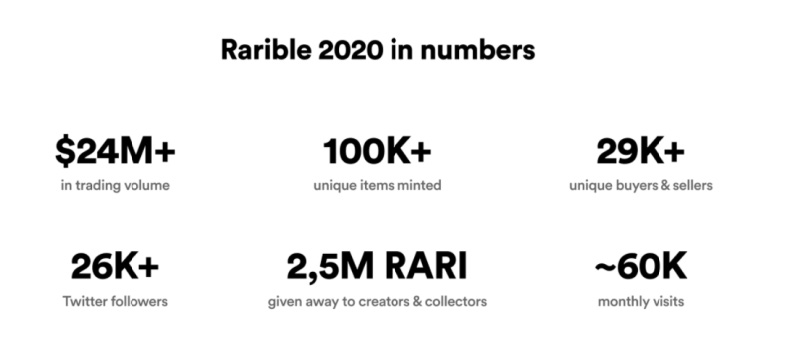

At the end of 2020, Rarible published a yearly review which indicated that the adoption was increasing at a quick pace.

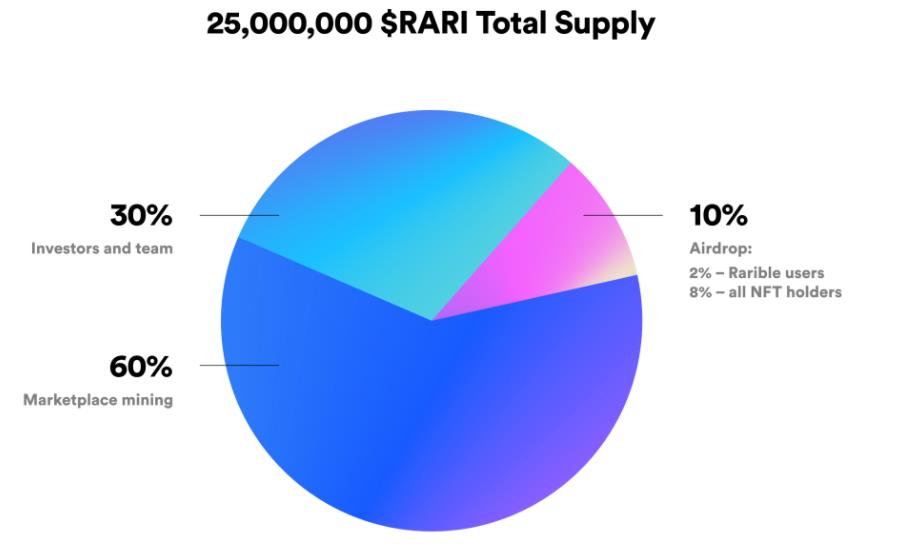

It is currently ranked at #441 (based on Mcap) in the cryptocurrency market. There is a total supply of 25 million tokens out of which 4.5 million tokens (18%) are in circulation. It is currently listed on Uniswap and Gate.io.

NFT minting process:

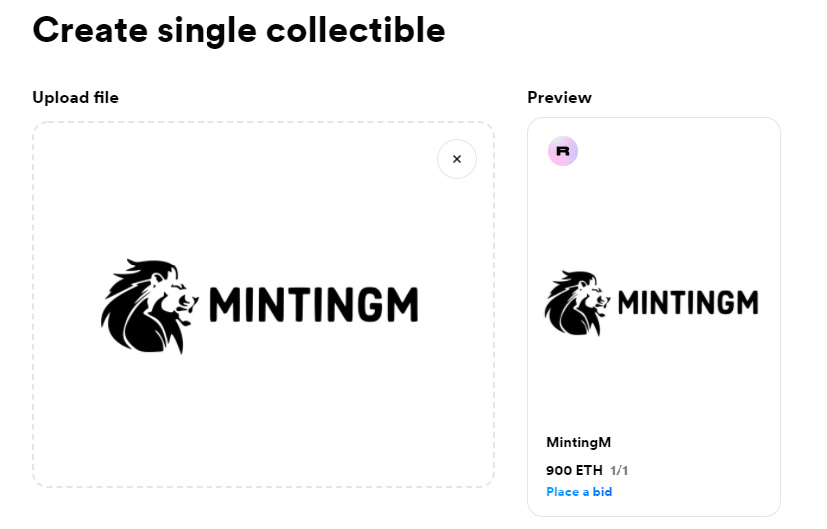

The minting process is extremely simple to perform and can be completed within 5 minutes without having to write any line of code.

Upload the art, set a price, choose a title & description and then pay the gas fee to mint the NFT.

Here is an NFT we created with a price of 900 Ethers.

Tokenomics and Token utility:

The ultimate goal of Rarible is to evolve into a fully Decentralized Autonomous Organization (DAO), where all governance and decision rights belong to the platform users. By providing creators and collectors with the opportunity to propose and vote on platform upgrades, they make sure that the platform becomes public, responsive directly to its community members.

$RARI the native token within the Rarible ecosystem was created with the sole intention of it being a governance token. However, Rarible isn’t a DAO yet and currently has only 2 functions:

1) Community voting: RARI holders can vote on proposals on how to decentralized even further, trading fees, and new features. These are however advisory in nature, where the team will have the final say.

2) Curation of NFTs: RARI holders can also curate the NFTs that should be displayed front and centre.

$RARI is also being used to attract marketplace participants to its platform via something referred to as marketplace liquidity mining. This practice is essentially giving away $RARI tokens just for participating in the marketplace. Every Sunday 75,000 $RARI is distributed equally between the buyers and the sellers. As mentioned above approximately 18% of the tokens are in circulation and 60% of the supply is allocated for marketplace liquidity mining.

With $RARI tokens being supplied every Sunday, the supply rate is high with at least 3.9 million tokens coming into circulation every year. The spike in sales compared to its peers could be credited to the marketplace liquidity mining.

There is also an issue of wash trading, which is a process of creating multiple accounts and then buying and selling within those accounts, thus capturing the $RARI via the MLM program.

Competition:

Opensea is the major competitor in the NFT marketplace which began its journey 2 years prior to Rarible however Opensea does not have a native token. So in order to get exposure to the NFT marketplace, Rarible is the only option.

Team, Media, and community strength.

Rarible is the brainchild of Alexei Falin and Alexander Salnikov. The founders are serial entrepreneurs and have strong experience in marketing.

Rarible does not have a strong media presence but they have a strong community with over 179,000 Twitter followers & 11,000 Telegram followers. They also raised $14.2 million from Venrock Capital, CoinFund, 01 Advisors to take the digital creator economy mainstream.

Conclusion

Pros:

1) Rarible is operating in the NFT marketplace which has huge potential for growth. It is also quite simple to use and minting an NFT is quite simple.

2) The project is backed by marquee investors such as Coinbase Ventures

Cons:

1) Rarible does not have a whitepaper and this is quite ironic as a marketplace places top priority on transparency. The information regarding the team is also not mentioned anywhere on the website.

2) $RARI has a high supply rate due to the marketplace liquidity mining. This also brings problems such as wash trading to Rarible, which has thrown doubts regarding the true number of sales they have mentioned.

MintingM rating for Rarible is 3/5

| Criteria | Score |

|---|---|

| Industry | 3.75 |

| Opportunity Size | 5.00 |

| Competitive advantage | 2.90 |

| Tokenomics | 2.13 |

| Team | 3.00 |

| Overall Score | 3.00 |