Overview:

Polygon is a firm believer in Web 3.0 and aims to introduce it to the entire world. It focuses on scaling Ethereum and eliminating some major issues that act as a barrier to mass adoption. It is one of the most well-known layer 2 solutions on the market.

The CMP of MATIC on the 1st of April 2022 is $1.65

What is Polygon?

Polygon is a decentralized Ethereum scaling platform that offers multiple scaling solutions. It has been built by an Indian software company called “Polygon technologies” and close to 7,000 Dapps have used Polygon to scale their performance. It has close to $4.1 billion in total value locked.

It is currently #16 (based on Mcap) in the cryptocurrency market. Polygon’s native token “MATIC” has a maximum supply of 10 billion MATICs and currently has 7.7 billion MATICs (77%) in circulation. It is currently listed on all the major exchanges.

What problem does Polygon solve?

The current internet that we all know is dominated by organizations that provide services in exchange for the user’s personal data. If no fee is charged for a service, then your data is the fee. The prime examples would be Facebook, Twitter and Google. Another aspect when it comes to the current web 2 players is that the ownership of assets and power is with the organization. For example, Twitter can ban you or delete your account without your consent. The banks have made reckless investments with the publics savings and have lost it as well.

The trust that people need to place in organizations has dropped to an all-time low. This is why Web 3 has been gaining traction. With Web 3, you can throw the trust aspect out of the window. It is decentralized in nature and it cannot censor you & it does not prevent you from making payments. Unlike Web2, Web3 does not exist on 1 centralized server but rather on a network of 1000s of computers (in case they use Ethereum). Bitcoin’s core function is to decentralize money and it is still working on doing so as it gets more and more adoption. “If we can decentralize money, imagine what else we could decentralize” were the thoughts of the founders of Ethereum. Ethereum, the 2nd largest cryptocurrency, is an open-source decentralized platform (1000s of computers) upon which developers can create decentralized applications or Dapps.

It has $121.59 billion dollars in total value locked and has the lion’s share when it comes to blockchain developers. However, Ethereum’s current structure is not scalable thus acts as a barrier to mass adoption.

Here is a detailed elaboration on the issue. Every time you need to use a Dapp on Ethereum, you need to pay a fee (Gas fee). Ideally for mass adoption, the fee is supposed to be insignificant, however, for small to medium investors, the gas fee is extremely high. There were instances where the investors had to pay $125 to sell $200 worth of assets on a decentralized exchange or wait for days for their transaction to go through. This stumps the evolution of the internet and makes Ethereum useless for a significant part of the world.

How does Polygon solve the problem?

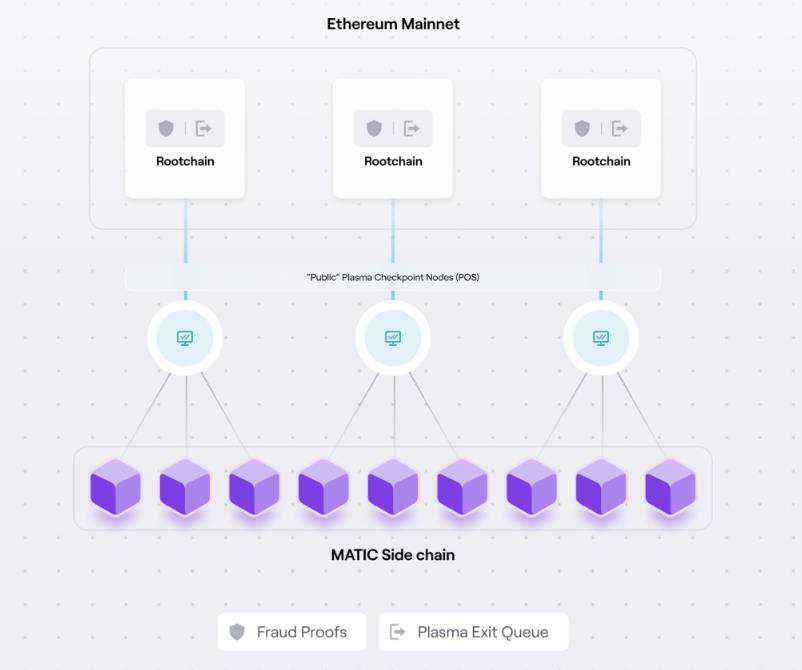

The answer to the above-mentioned problems is “Scaling solutions” and Polygon offers a suite of scaling solutions. The most popular solution is the “Polygon PoS” which has achieved high transaction speed and cost savings by utilizing side-chains for transaction processing. At the same time, POS ensures asset security using the robust Plasma bridging framework and a decentralized network of Proof-of-Stake validators.

A simple translation would be that it is a separate blockchain with its own set of validators. It essentially bundles up a bunch of transactions on its own chain and then sends that to the Ethereum chain.

• It can process 65,000 transactions per second (TPS) vs Ethereum’s 20 TPS

• The cost per transaction comes down to approximately $0.002 vs $15 (average cost per transaction on 31st March 2022)

Polygon PoS is also EVM compatible, which means that Ethereum Dapps can be quickly deployed on Polygon without changing much of the Dapp. This is one of the reasons Polygon was able to bring 80+ major Dapps from Ethereum over to Polygon. This includes the likes of Uniswap and AAVE.

Will Ethereum 2.0 make Polygon obsolete?

To tackle the gas high issue, EIP-1559 was proposed and implemented. This changed the structure of the reward mechanism for miners and added a deflationary mechanism for Ethereum. The fees were reduced but eventually returned to high levels.

With the upcoming “Merge” event, Ethereum will be moving from the publicly condemned “Proof of Work” consensus mechanism to the “Proof of Stake”. The big misconception is that the Gas fees are going to drop tremendously and Ethereum will become extremely scalable. PoS is actually going to be implemented only on the consensus layer while the execution layer (Where you pay the gas fees) will not change.

When Ethereum 2.0 materializes, it will spread the network load across 64 separate shards. In simple terms, it will have 64 main chains (It is just 1 right now) thus increasing its scalability by 64x. This number might seem huge but we have to compare it with the demand for network usage. Days when the Ethereum network is congested (due to an increase in demand to use the Dapps on it) the gas fees have gone up to $200. Assuming that the ideal gas fee would be just $1 (Which is also quite high) one can assume that the demand is already 200x. So, When Eth 2.0 does materialize, it would reduce the gas fees, but it will still be high enough to act as a barrier when it comes to large-scale adoption.

Tokenomics

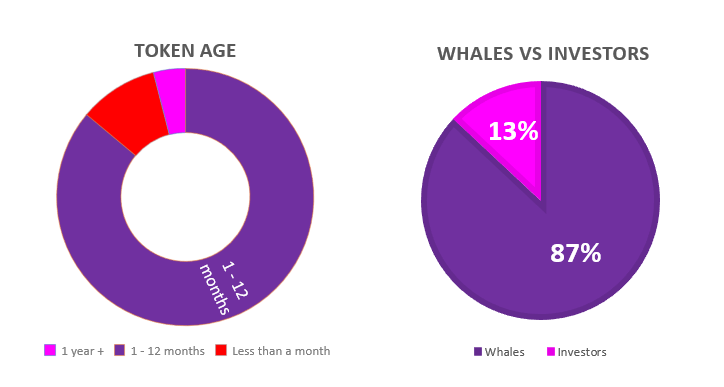

“Matic” is an ERC-20 token and is the native token to the Polygon ecosystem. It has a maximum supply of 10 billion and 7.7% is currently in circulation. The ownership is heavily concentrated and only 4% of the tokens have been HODLed for at least a years’ time.

Its primary utility is to pay for gas fees on the platform and for securing the network.

The correlation between Matic and the recent (excellent partnership) updates from Polygon might weak as the price has not moved towards the upside. We can infer that the price is currently being suppressed by the whales.

Competition Analysis

One can argue that essentially all the Layer1 and the Layer2s are competing with Matic. To put above sentence in context, some major Dapps, that exist on both Ethereum and Polygon have more active users on Polygon due to their low cost and high speed.

Some other competitors include Arbitrum, Optimism, Fantom and MINA. However, Polygon is also expanding its suite of solutions. It recently acquired Hermez, a zero-knowledge cryptography-based scaling project for $250 million in MATIC tokens.

Team, Media & Community strength

Polygon was founded by 3 Indian engineers and later added Mihailo Bjelic as the 4th co-founder of Polygon. The team has excellent technical knowledge and they have worked wonders in terms of increasing adoption for Polygon. Their Media and community strength is exceptional. They have 1.3 million followers on twitter and have 70,000 members on telegram.

Conclusion

Pros: Polygon is solving one of the biggest problems that exists in the cryptocurrency space. It is playing a vital role when it comes to the adoption of Web 3 applications and has close to $4 billion in total value locked. As the need for Dapps increases (Even beyond current levels), Polygon is ready to take full advantage by providing a suite of solutions.

Cons: When it comes to tokenomics, Polygon is taking a hit. Although the price 100xed over the past year, the price has been suppressed by the MATIC whales. The ownership is heavily concentrated.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today