The Kava Research Report – 29th October 2021

Overview:

Kava is a software protocol that allows users to borrow and lend assets without the necessity of a typical financial middleman by utilising several cryptocurrencies. In this report, we lay emphasis on how the project works, its problem solving capacity and review the pros and cons.

The CMP is $5.61 as of 29th October 2021.

What is Kava?

Kava is a cross-chain DeFi Hub for decentralized financial services and applications. The Kava DeFi Hub operates like a decentralized bank for digital assets connecting users with products like stablecoins, loans, and interest-bearing accounts so that they can do more and earn more with their digital assets. Users obtain weekly incentives in the form of KAVA, Kava’s cryptocurrency, by collateralizing coins to mint USDX.

Why Kava matters and its problem solving capabilities

KAVA, in particular, decentralises network administration by allowing anybody who owns and stakes the coin to vote on its software regulations and rules.

The KAVA coin is used to reward users who mint USDX and plays an important part in the Kava network’s administration.

Users who own and stake KAVA can vote to modify certain programme characteristics. These factors include, but are not limited to, the assets accepted as collateral by the protocol, the needed collateralization ratio, and the costs paid by borrowers.

Kava users may also delegate KAVA to the validators that administer the blockchain and compete for newly minted KAVA, awarding votes to them in exchange for a share of the stability fees paid by users shutting CDPs.

KAVA coins, like many other cryptocurrencies, have a finite supply, which means that according to the software’s regulations, there will only ever be 100 million KAVA.

Fundamentals of Kava

The functionality of smart contracts employed by the Kava lending protocol to support a peer-to-peer lending system is dependent on the protocol’s functioning. Users can lock their cash in smart contracts, which results in the creation of new USDX tokens that can be used as collateral for a loan. The next phase in this process is automated, and it involves creating a specific smart contract that binds the value of USDX to the value of the US dollar, therefore reducing volatility in the cryptocurrency market. A collateralized debt position is what it’s termed. Users can build CDPs by depositing bitcoin into smart contracts using linked digital wallets. The Kava system will immediately lock the monies in a smart contract whenever they are deposited. The

system then creates new USDX stable coins depending on the amounts deposited, allowing users to take out a USDX loan.

Users must clear their loan and pay a lending charge to cancel the CDP and receive the collateralized crypto. When the user cancels the CDP, the initial collateral is returned to the same wallet, and the borrowed USDX is burned, or destroyed, by the Kava system. The system also uses a collateralization ratio to shield the protocol against volatility and guarantee that USDX is over-collateralized to prevent the collateral from depreciating in value.

Use cases:-

- Chainlink Price Oracle:-

The oracle client will ask the Binance v3 API for pricing information about that asset at the crontab frequency selected. If Binance goes down, CoinGecko will take over. It will submit a postprice transaction to the blockchain along with a period when that price should be deemed expired if the price satisfies the posting criteria (default is 0.5 percent change from the previous posted price). At the conclusion of each block, the asset’s current price is determined by the median price of all oracles.

- Sentinel:-

Sentinel is built to run several copies at the same time. This redundancy should make it able to have a tx validated swiftly and reliably amid volatile market conditions.

It’s crucial to make sure there aren’t any race conditions between the copies. Two bots, for example, might opt to remove debt and send in tx. If both txs are confirmed, the debt will be repaid twice as much.

- Auction Bot:-

The auction client will poll the kava blockchain for active auctions at the crontab frequency set. It will bid on auctions that fulfil the conditions using the provided parameters. The client uses the Binance v3 exchange API to get the current spot price of the collateral asset in order to calculate margin. If Binance is unavailable, CoinGecko is utilised as a fallback.

Tokenomics

Competition Analysis

Team, Media & Community strength

Brian Kerr is the CEO of Kava and one of its co-founders. He founded Fnatic Gear, the first firm to make Esports gear and apparel developed by Esports players for Esports fans, after graduating from San Francisco State University with a Bachelor’s degree in Business Administration.

Conclusion

Kava is an intriguing DeFi project, but I’m not sure we need another MakerDAO-style initiative. On the other hand, having access to a collateralized debt position platform that can use any crypto asset is advantageous.

Pros

- Support for cross-chain assets is generous.

- USDX stablecoins are produced and donated to a Hard protocol, providing a yield-earning alternative.

- Masternodes and staking options are available, as well as high payouts for the top 100 validators.

Cons

- Has a Kava Safety Committee that has the ability to break the chain. This raises concerns about the decentralization of the system.

- The top validators have a disproportionate amount of kava voting power (15-10-2021). For further information, see the coin distribution chart above.

- The annual inflation rate is 20%.

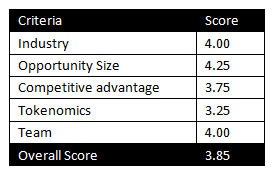

MintingM rating for KAVA Protocol: 3.85/5