Research summary:

This research report is focused on “Request Network”. We will focus on how the project works, what value it adds, and review its pros and cons. The CMP is $0.2 as of the 15th of October.

What is Request Network?

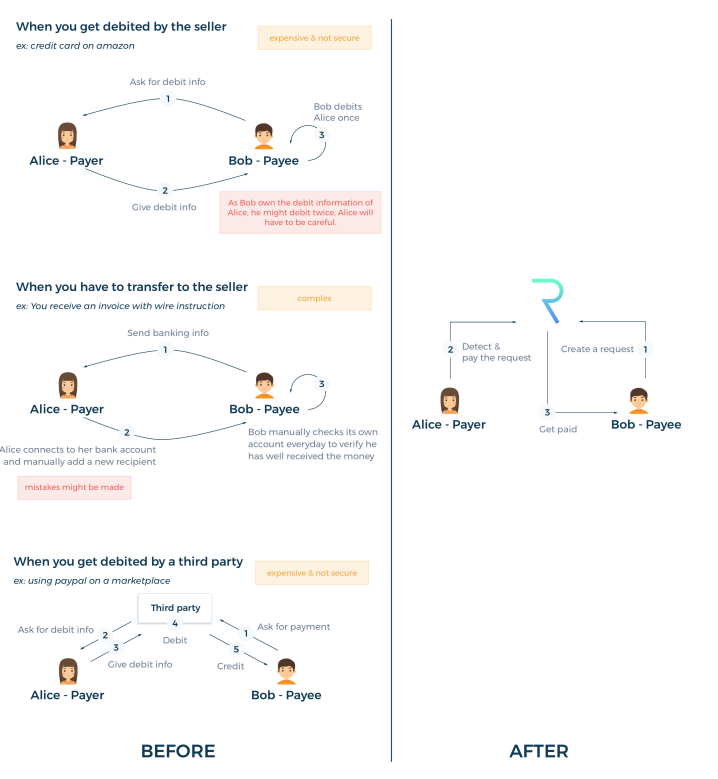

Request is a decentralized network that allows anyone to request a payment (a Request Invoice) for which the recipient can pay in a secure way. All of the information is stored in a decentralized authentic ledger. This makes the payments cheaper, easier, and more secure.

Request supports Ethereum, Celo, Polygon, Fantom, and Near payment networks and there are more than 750 companies that use Request.

It is currently ranked at #277 (based on Mcap) in the cryptocurrency market. There is a maximum supply of 0.99 billion REQ tokens out of which 0.99 billion REQ tokens are in circulation (It is fully diluted). STX is currently listed on Binance and Binance.

How does Request work?

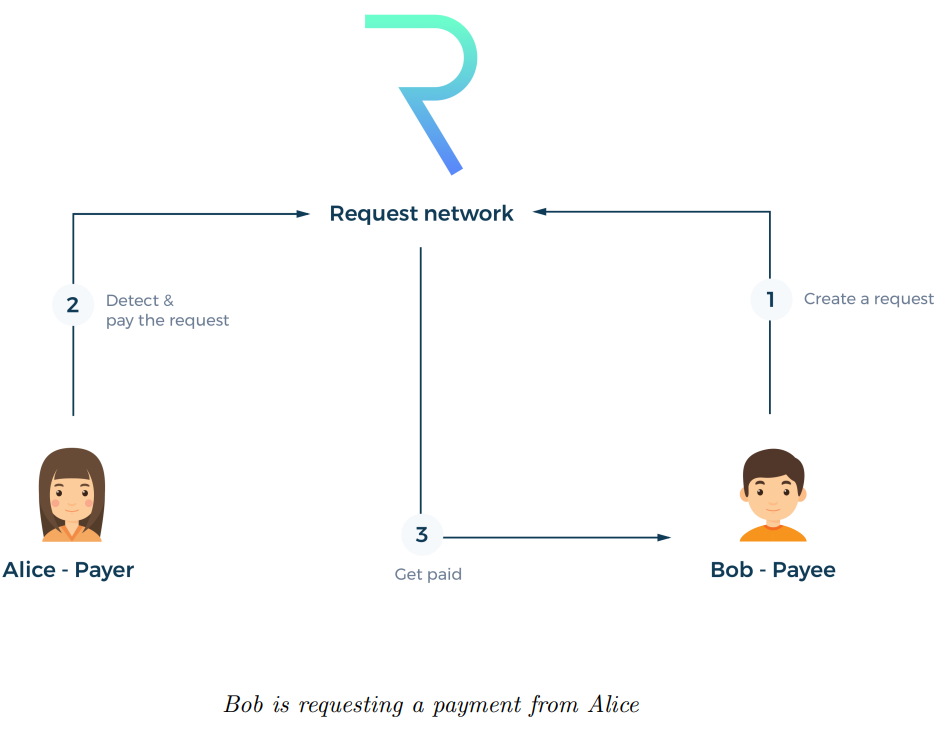

Request is a decentralized network that allows anyone to simply create, share or fulfill a request for payment. When a Request is created, the trade laws that are applicable to its specific case are taken into account, and taxes are applied.

When creating a request for payment, the user (Bob) defines to which address the payment request needs to be allocated and what the amount is due. Optionally, the user can define terms and conditions to the payment request, upgrading the simple request for payment into an invoice. After creation the user can share this request for payment/invoice, to make sure it’s paid by the other party (Alice). All these steps are documented and stored on the Request network, allowing everyone involved to easily keep track of their invoices, receipts and payments for (personal) accounting purposes.

They simplify the entire process, which results in cheaper, easier, and more secure payments, and it allows for a wide range of automation possibilities.

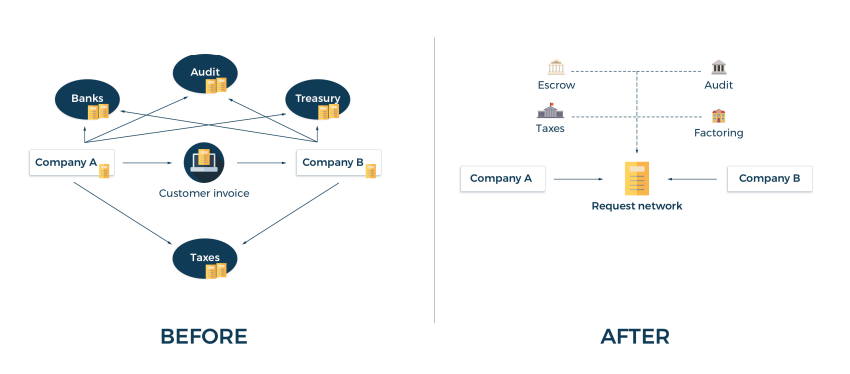

With more than 5 trillion dollars moved everyday via the SWIFT network alone, Request would simplify the current system. A ledger containing all standardized accounting entries can automate real-time accounting, improve auditing, automate factoring, simplify expense reporting, make escrow simple and reliable, and detect and automatically pay taxes.

What is the utility of the REQ?

Given that the cryptocurrency space is blowing up lately, a lot of projects are creating tokens just to ride the hype. So, the question we should ask is “Does Request (in this case) require any tokens? Well, when creating a payment request using Request, an additional fee is required when broadcasting the payment request to the network. Upon broadcasting, this fee is sent to a smart contract called “Burner” on Ethereum, collecting all fees paid to create requests.

By calling a function on the smart contract, these collected ETH fees are periodically swapped into REQ tokens using an on-chain liquidity protocol called Kyber Network. Simultaneous to swapping ETH into REQ, the smart contract transfers the total amount of REQ tokens towards the Ethereum genesis address. This practically reduces this amount of REQ from the total supply, as no one will ever be able to gain access to this address, making it deflationary. The utilities are given below:

Anti-spam: In order to avoid people spamming the network with payment requests, a certain fee is charged in REQ, which is eventually burned.

Governance: Given that Request is a decentralized protocol, the token can be used as a tool for governance by the network participants.

Others: Other major utilities include, staking, discounts to holders and independency. The REQ token allows the Request network to migrate, simultaneously run on multiple blockchains or even run on its own dedicated blockchain, without hurting the core mechanisms of the network. This makes the network independent from both the currency and technical infrastructure provided by others.

Competition analysis.

There are a lot of players in the traditional space, such as Paypal and Venmo and there are a few competitors in the blockchain space as well.

Request network isn’t the market leader but it does have huge potential.

Team, Media, and community strength.

The team behind Request Network has extensive knowledge and experience in the money transfer space. One of the co-founders (Christophe L) was the co-founders of MONEYITS, which was operating in the money transfer space.

Their media presence isn’t strong but they do have a decent community strength. They have 47k Twitter followers and 3k discord members.

Conclusion

Pros: Request Network is working on solving on removing inefficiencies and improving the money transfer space with the help of blockchain. The tokenomics is excellent and the team behind the project is experienced in the industry.

Cons: The money transfer space has a lot of players in both the traditional space and the blockchain space.

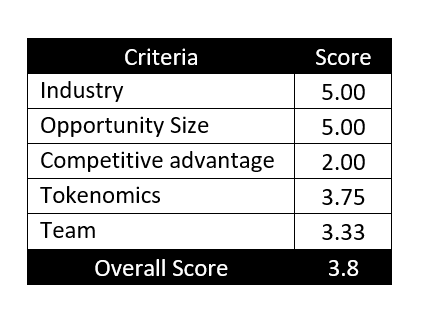

MintingM rating for Request Network is 3.8/5