Mirror Protocol Report – 17th December 2021

Overview:

Mirror Protocol is a DeFi protocol for creating synthetic assets known as Mirrored Assets, or mAssets, based on the Terra blockchain. mAssets are digital assets that replicate the price behaviour of traditional and digital financial assets, allowing traders to trade without the need of intermediaries and acquire price exposure without having to own the underlying assets.

The CMP of MIR on 17Th December is $2.24

What is terra blockchain?

Terra is an open-source blockchain payment network for algorithmic stablecoins, which are digital currencies that track the value of other assets. Terra stablecoins may be spent, saved, traded, or exchanged instantaneously on the Terra blockchain.

What is DeFi?

Decentralized finance, or DeFi, is a mechanism for making financial goods available on a decentralized blockchain network that is open to the public. As a result, instead of going via intermediaries like banks or brokerages, anybody may utilise them. Unlike a bank or brokerage account, DeFi does not require a government-issued ID, Social Security number, or proof of address.

What is a Synthetic Asset?

Similar to traditional financial derivatives, which derive their value from other underlying assets like commodities, currencies, precious metals, stocks, or bonds, synthetic assets aim to achieve the same objectives without the necessity of holding the actual asset itself.

For example, let’s say that there is a cricket fantasy league app, where you can buy players and have them on your team. When the player (Let’s say Dhoni) performs well in the real world, the very same player in the game will also play well. In this example, you have a synthetic asset (The player) without actually owning the real player in your team.

Very popular synthetic assets that every crypto investor is familiar with are stable coins. USDC behaves like a USD but is not a USD.

What is Mirror Protocol?

Mirror Protocol (MIR) is an Ethereum token that administers the Mirror Protocol, a system that “allows the creation of fungible assets that mirror the price of real-world goods.” By minting “synthetic” reproductions of the real thing, the idea hopes to enable 24/7 equities trading. MIR tokens can be used to propose and vote on significant protocol modifications.

Why Mirror Protocol matters and its problem – solving capabilities

The creators of the Mirror Protocol have set out to solve a number of issues. The project’s primary purpose is to hasten the integration of conventional assets into the blockchain industry. Anyone may participate in the market since Synthetics provide exposure to these assets.

Millions of individuals throughout the world are now unable to access vital financial resources owing to their geography, status, or other restrictions. Traditional financial assets like stocks, bonds, and derivatives are extremely difficult for people outside of America and Europe to invest in. Furthermore, there are several additional charges involved with these transactions, adding to the challenges faced by many investors. The Mirror Protocol offers a more inclusive market option.

Fundamentals of Mirror Protocol

Mirror Protocol is used to construct synthetic assets that are modelled after real-world and real-time asset values in traditional financial markets. Anyone from anywhere in the globe may establish mAssets, lowering the entry barrier to trading stocks, commodities, and other assets.

Mirror Protocol is also utilized to bring liquidity to the synthetic asset market, and the project’s developers hope to expand the network’s capabilities to include earning a dividend for holding stocks, dynamic ETFs, and margin trading.

Use cases:-

- Minting:- MIR tokens were added as a new collateral option for minting mAssets in Mirror Protocol V2. Other new features in this version include support for pre-IPO assets, a “Mint/Short” LP Token, and solutions for governance issues. If a result, as the number of users on the platform grows, so will the demand for MIR. The MirrorToken (MIR) is minted by the protocol and distributed as a reward to reinforce behaviour that secures the ecosystem. With it, Mirror ensures liquid mAsset markets by rewarding MIR to users who stake LP Tokens obtained through providing liquidity.

- Governance:- Active stakeholders and liquidity providers are actively engaged in the process of discussing and voting for protocol upgrades.

- Liquidity Incentives:- MIR is distributed as a reward to users who provide mAsset liquidity to AMM. There is a fixed fee called the LP commission of 0.30% which serves as a reward for liquidity providers for Mirror-related pools on Terraswap.

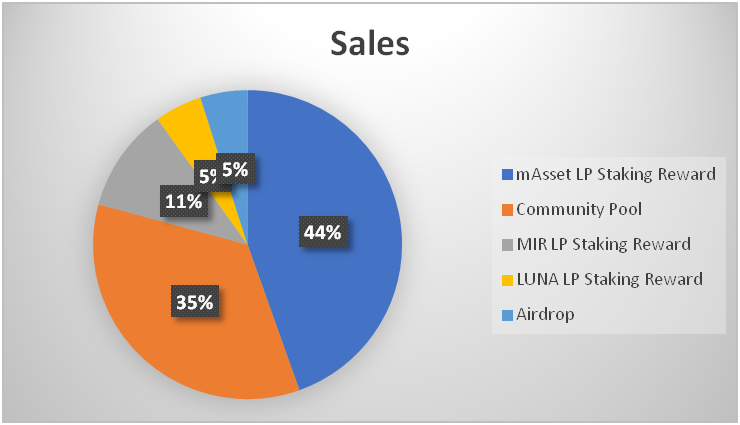

Tokenomics

Mirror Protocol’s native token MIR has a fixed supply asset with only 370,575,000 tokens to be distributed over 4 years. Beyond that, there will be no more new MIR tokens introduced to the supply. In 2021 – Year 1 – Mirror Protocol is set to print a total of 128.1m (183m – 54.9m) $MIR tokens, or 350,728 $MIR tokens in a day assuming emissions follow a linear inflation. In 2022 – Year 2 – it will print an additional 73.2 million $MIR tokens.

Competition Analysis

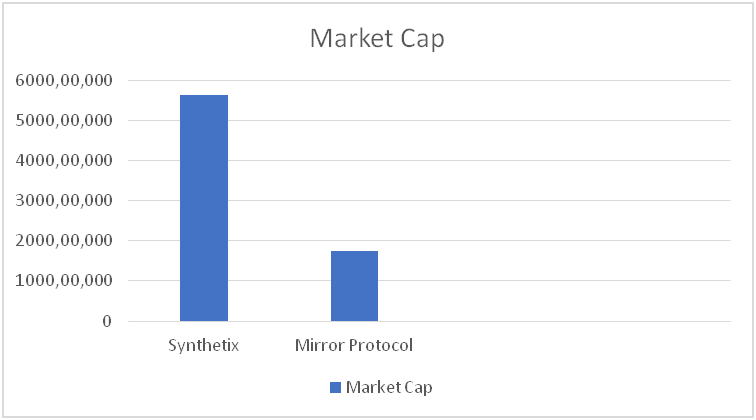

Mirror Protocol and Synthetix

Even while these two protocols work in a similar way, in that one deposits assets to be used as collateral and the other utilises that collateral to mint synthetic assets, there are some differences. There are a few key distinctions between them that contribute to their respective utility and, as a result, worth.

To begin with, they use distinct blockchains. Synthetix is based on Ethereum, whereas Mirror is based on Cosmos and operates on the Terra blockchain. Right away, this has significant ramifications. Because Synthetix is based on Ethereum, gas prices will be a major barrier to broad adoption, at least until it is ported to an L2, which is not now the case. Mirror, on the other side, operates on the Terra environment, which is based on Cosmos and has far lower gas prices.

Team, Media & Community strength

Do Kwon and Daniel Hyunsung Shin are the co-founders of Terraform Labs. Do Kwon is the CEO of the company. Do was a software engineer at Microsoft and Apple and studied Computer Science at Stanford. Prior to founding Terraform Labs, Daniel founded TicketMonster, which is Korea’s leading e-commerce platform.

They have over 82.3K followers on twitter and 14.2K in telegram

Conclusion

Traders in decentralized finance (DeFi) are increasingly interested in synthetic assets, which they think can help break down barriers to the old financial system by allowing traders from all over the globe to obtain exposure to equities and other assets. Mirror Protocol aims to fill this need by offering proxy versions of the major financial assets. Users can mint synthetics by placing collateral and trading them on automated market makers using the protocol. Holders of the protocol’s native Mirror token are in charge of it (MIR).

It’s the first of its kind on the terra blockchain. It was launched between 11th November to 4th December 2020. By May 2021, Mirror protocol grew to be the fifteenth largest DeFi protocol by Total Value locked(TVL), with $118 billion of collateral locked in the protocol. It has a total supply of $370,575,000 with a circulating supply of $77,742,679. With the ongoing developments and upgrades that are taking place within the MIR platform. Mirror Protocol has a great future ahead in this crypto market. Traditional brokerages still cost $10 to enter and exit a position. On Mirror protocol it costs from $0.10 to $1.50, almost 10x cheaper. Even though the founders have adequate experience from the best of the tech companies what they lack is the financial expertise in this particular space. Though this space is complex and complicated it has a lot of potential growth which can lead to replace the traditional market space.

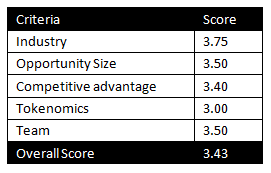

MintingM rating for Mirror Protocol: 3.43/5

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today