Research summary:

This research report is focused on “SwissBorg”. We will focus on how the project works, what value it adds, and review its pros and cons.

The CMP is $0.598 as of 9th July 2021.

What is SwissBorg?

SwissBorg is a wealth management mobile application that allows for a smooth transition from 16 different fiat currencies to select cryptocurrencies. SwissBorg gives investors an option to make their crypto make money for them. SwissBorg gives investors the option to grow their money using crypto.

The organization has 420,000 verified users, with a total user asset value of $1.17 billion, and is currently ranked at #95 (as per Mcap) in the crypto market.

There is a maximum supply of 1 billion CHSB tokens out of which approximately 70% is in circulation. CHSB is currently listed on HitBTC, Kucoin, and Uniswap.

What value does SwissBorg bring to the table?

SwissBorg allows investors to invest and earn and boasts the following features:

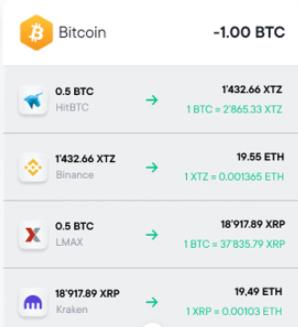

Liquidity Aggregator: SwissBorg has a smart engine that finds the best prices and liquidity from exchanges such as Binance, HitBTC, LMAX, and Kraken. For example, if you want to buy 5 BTC through SwissBorg, you receive a detailed report of the location of each portion of BTC along with prices.

Additionally, transaction fees are disclosed in advance, increasing transparency.

Asset & Portfolio Analysis: SwissBorg currently supports 19 cryptos including popular coins such as BTC, ETH, and USDC – the only stablecoin which is approximately 1 to 1 USD. It provides a summarized short-term analysis of each token.

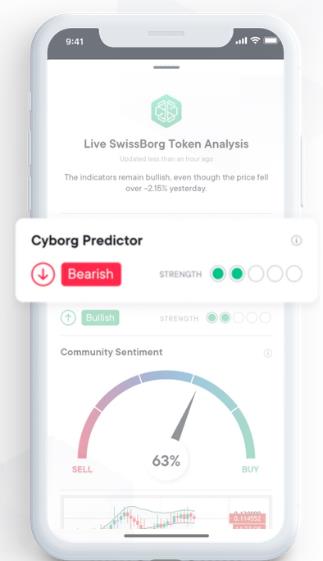

Cyborg Predictor: SwissBorg’s machine learning algorithm predicts asset moves over the next 24 hours.

SwissBorg Predictor: This brings together the most popular technical analysis indicators to indicate price trends.

Community Sentiment: This indicator focuses on public sentiment towards the token. This is derived from the buying and selling on the SwissBorg application.

Support & Resistance: This metric displays the support and the resistance levels of the token.

Yield Aggregator: SwissBorg has a delightful feature that puts your crypto to work and functions like a fixed deposit. You need to lock in your crypto, which in turn generates interest.

This is possible due to yield farming. Yield farming is the practice of staking, providing liquidity on exchanges, and lending crypto assets through DeFi protocols in order to generate high returns or rewards.

Yield farming is a risky activity, and if the underlying smart contract hasn’t been stress tested or is exploited then there is always a potential for a disaster. Billionaire Mark Cuban lost money on IRON Finance (A Defi Protocol) which returned a 4 million % APY (annual percentage yield). And then suddenly the price of IRON Finance went from $60 to nothing.

To tackle this, SwissBorg began a Safety Net Program where they set aside a percentage of the returns to limit risk. SwissBorg has funded this program with a starting capital of € 1’000’000.00.

What is it’s tokenomics & the utility of the token?

CHSB is the native token to SwissBorg. The token is deflationary in nature. 20% of the revenue from the SwissBorg ecosystem is used to buy back and burn CHSB tokens. This creates scarcity and value. The buyback and burn occur only when the price falls. The burn of tokens is also carried out in a transparent manner.

CHSB has 1 main utility i.e premium benefits which can be unlocked by the use of tokens. Staking a few tokens unlock benefits. If you stake 2000 CHSB you get access to community premium account (in picture in purple) and if you stake 50,000 CHSB you get access to the genesis premium account (green).

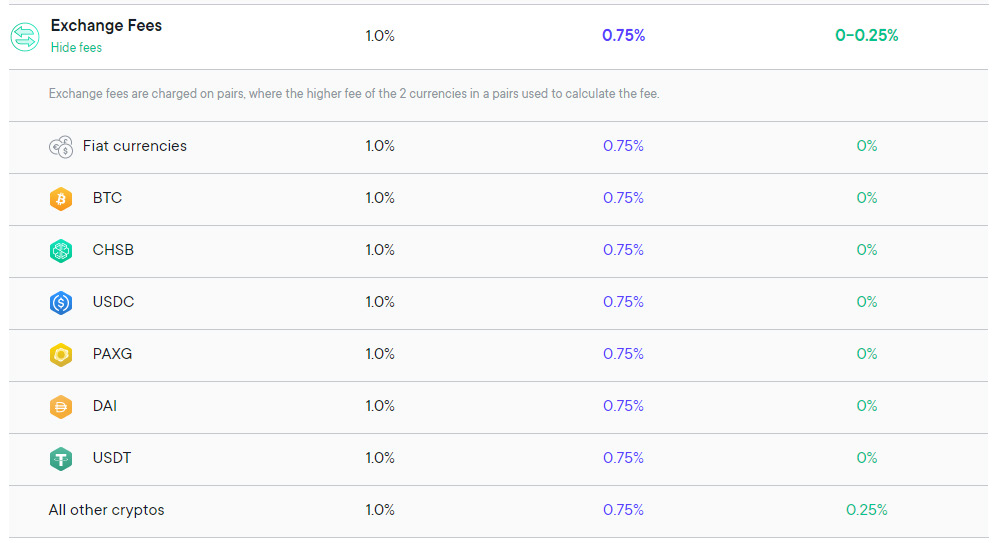

Lower fees: Fees are waived for investors irrespective of the quantity bought leading to savings. The table on the left indicates the fees structure based on different amounts of tokens staked.

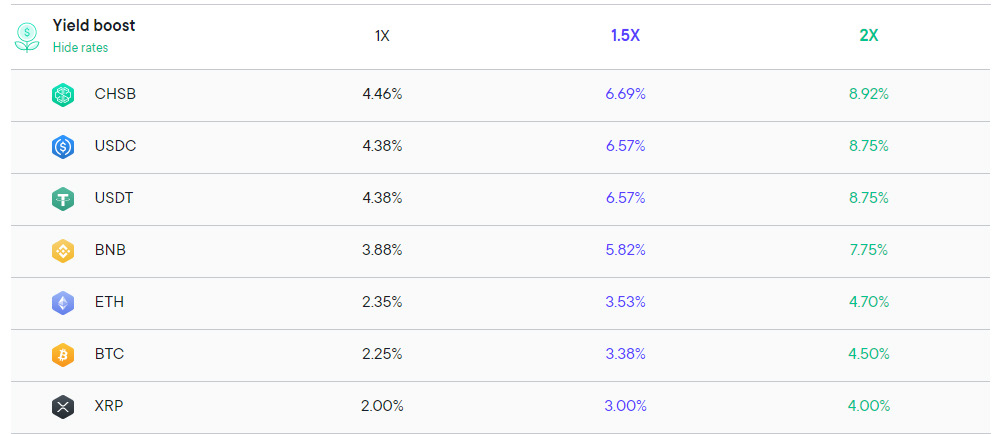

Yield Boost: If you stake 2000 CHSB, you get 1.5x the yield when compared to a normal account, and if you stake 50,000 CHSB you get a 2x more adding value to the CHSB token holder.

Who are SwissBorg’s competitors?

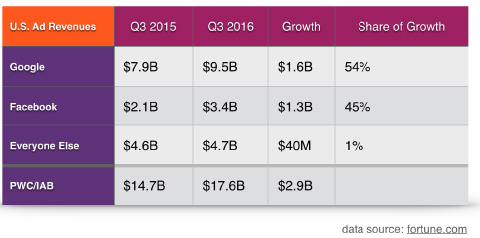

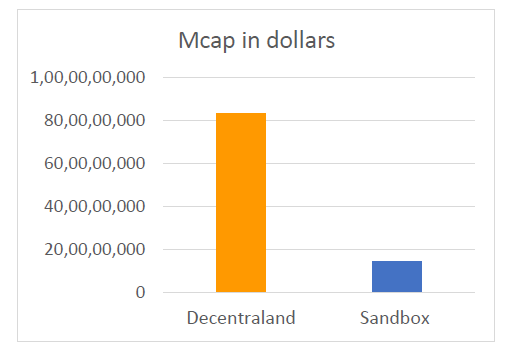

SwissBorg is a one-of-a-kind project. Based on its offerings, cryptocurrency exchanges are its main competitors. Let’s draw a comparison with Coinbase which has been listed on the Stock market.

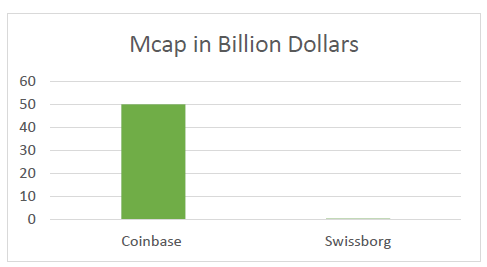

| Project | Mcap in Dollars |

|---|---|

| Coinbase | 50 billion |

| SwissBorg | 0.5 billion |

Based on the above chart, there is tremendous potential for SwissBorg.

Team, media, and community strength

The SwissBorg project is the brainchild of founders Anthony Lesoismer and Cyrus Fazel. The leadership team has vast experience in the fields of finance and technology and currently leads a team of 100+ across the world.

Although SwissBorg may lack media presence, they do have a YouTube channel where the founder discusses the market and share timely updates.

Their community strength is growing, with over 70,000 Twitter followers & 10,000 telegram followers. They are also backed by reputable YouTube influencers like Boxmining, ThatMartiniGuy, and Ivan on Tech.

Conclusion

Pros:

- SwissBorg provides direct monetary value without any major costs. It saves money by avoiding price slippage and provides complete transparency of the cost.

- Yield farming is a very complicated affair and requires time and effort to avoid scams and be watchful of risky protocols. SwissBorg makes yield farming super easy with a safety net.

- CHSB is deflationary and the tokens burn only when the prices start to drop.

- The utility of the token provides direct monetary value to the user in terms of reduced fees and increased yield on earnings.

Cons:

- The number of coins listed on SwissBorg is quite limited.

- The utility of the tokens kicks in if you hold at least 2000 CHSB.

- Swissborg does not have a web version. It is only available on the AppStore and the PlayStore.

MintingM rating for SwissBorg is 3.9/5

| Criteria | Score |

|---|---|

| Industry | 3.5 |

| Opportunity Size | 5 |

| Competitive advantage | 3 |

| Tokenomics | 4.75 |

| Team | 3.33 |

| Overall Score | 3.9 |

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today