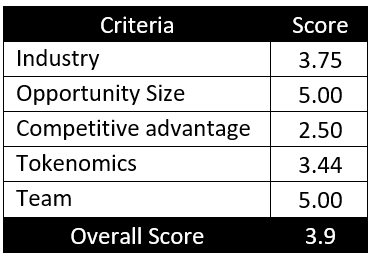

Research summary:

Serum is a decentralized exchange (DEX) based on the Solana blockchain. It is part of the DeFi ecosystem and is one the 1st Dapps in the Solana blockchain, we will focus on how the project works, what value it adds, and review its pros and cons.

The CMP is $9.61, as of 17th September 2021

What is DeFi?

All of the traditional financial services are centralized (controlled by a single authority or managed in one place) in nature. The Risks and problems that come with centralized financial (CeFi) services are Fraud, Mismanagement of funds, Theft, and restrictions to use your own money. DeFi stands for Decentralized Finance (DeFi is a category of Dapps. Dapps are decentralized applications that are launched on networks such as Ethereum). It is a financial service with no central authority. It eliminates these problems by allowing people to have complete custody and control of their money and to get more returns, by eliminating the 3rd party.

There are various categories of DeFi

- Money Market: Such applications enable users to borrow assets against collateral and earn interest. Maker, Aave, and Compoundare the top DeFi applications in this category.

- Decentralized exchange: These kinds of applications give users the ability to swap one crypto for another. Uniswap and Sushiswapare the top DeFi applications in this category.

- Derivatives: A derivative contract derives its value from an underlying asset. With the help of smart contracts, DeFi projects like Synthetix allow people to get exposure to a wide variety of assets.

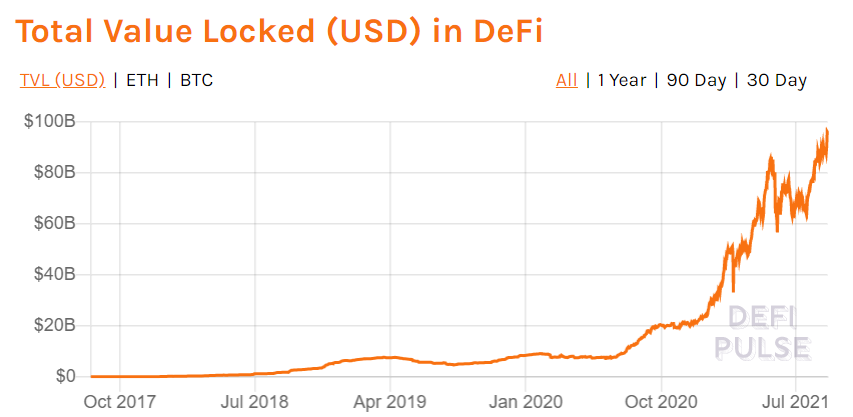

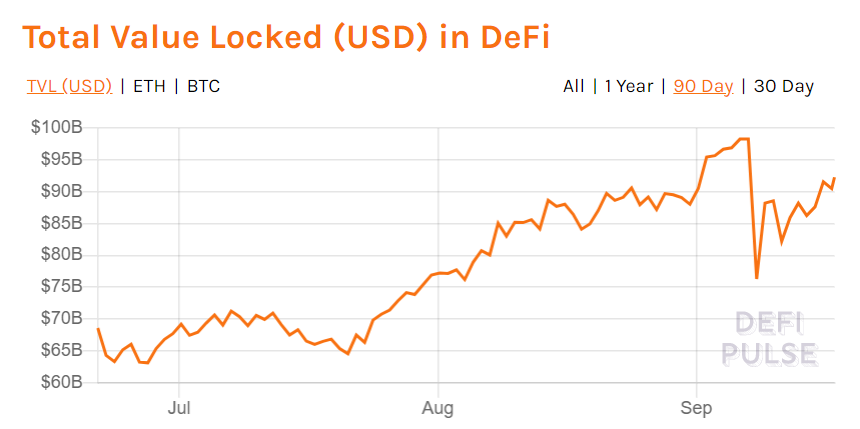

The DeFi space has seen explosive growth over the past year. The graph below indicates that 95.96 billion dollars are currently involved in the DeFi space.

Data as of 17th September 2021 and from https://DeFipulse.com/

What is a Solana?

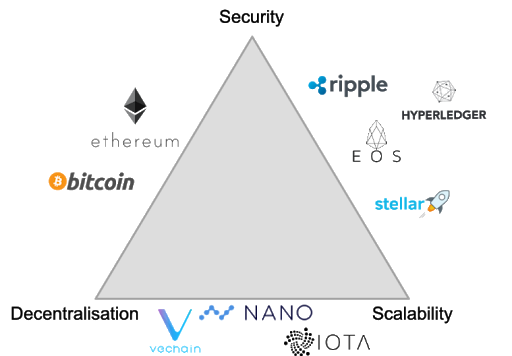

Solana blockchain is a 4th generation blockchain and is a competitor to the Ethereum blockchain. It has claimed to solve the “blockchain trilemma”, a term coined by Vitalik Buterin. He proposed that when a blockchain is being built, it is forced to sacrifice one out of the three aspects of the blockchain.

The three aspects are Security, Decentralisation, and scalability. Solana has claimed to solved the trilemma with the help of “Proof of History” & has achieved amazing statistics. When it comes to Transactions per second and average transaction fees, Solana beats Ethereum by a long stretch.

What is Serum?

Serum is a protocol for decentralised exchanges that brings the best of CeFi and DeFi through its on-chain orderbook design. In the world of ever-growing DeFi applications, amongst all the expensive and slow Dapps, Serum brings unprecedented speed and low transaction costs to decentralized finance

The total value locked (TVL) with Serum is $ 457 million. It is currently ranked at #132 (based on Mcap) in the cryptocurrency market. There is a Max supply of 10 billion SNX tokens out of which 50 million SNX tokens are in circulation. SNX is currently listed on Binance, FTX, and Bithumb.

What problem does Serum solve?

Although there are several advantages to Decentralized exchanges such as

- No KYC requirement

- You can avoid exchange hacks and scams

- There is no restriction to the tokens that are traded

Speed and cost: Most of the decentralized exchanges in the current state are also very slow and are very expensive. There have been times when the transaction cost has surpassed the entire value of the transaction & there have been times when some of my Uniswap transactions have taken days to process. This is one of the reasons people flock to centralized exchanges.

Orderbooks: Most of the Decentralized exchanges use the AMM system rather than the orderbooks system.There are lots of disadvantages to AMM. You can’t provide liquidity unless you provide both sides; you can’t choose to only provide at a particular price; you can’t provide at a price other than the current market price, and you can’t choose the size to provide there without providing way more behind it. There’s a solution to this–it’s what the rest of finance does. But DeFi doesn’t have orderbooks, by and large, because the ETH network is too slow and expensive to support them. Matching bids and offers with each other involve a bunch of operations.

Cross-chain support: Currently there is a problem in the cross-chain DeFi space which is trust. It relies on those arbitrators, to be honest.

What does Serum bring to the table?

Most of the above problems are solved by Serum and do it with the help of the Solana blockchain. Each transaction is executed at a fast pace at a small cost. As it has the power to process 65,000 transactions per second, it can employ the orderbook system, which most of the centralized exchanges use. When it comes to cross-chain swaps, Serum uses smart contracts with built-in economic incentives to allow users to swap assets across different blockchains in a trustless manner (e.g., Ethereum for Bitcoin). This is done by requiring both parties involved in the swap to put down some amount of collateral to execute a swap. If the swap isn’t executed on time, the victim can raise a dispute and the Smart contract will determine if the dispute is valid. The staked crypto will be deducted accordingly.

What is the utility of the SRM?

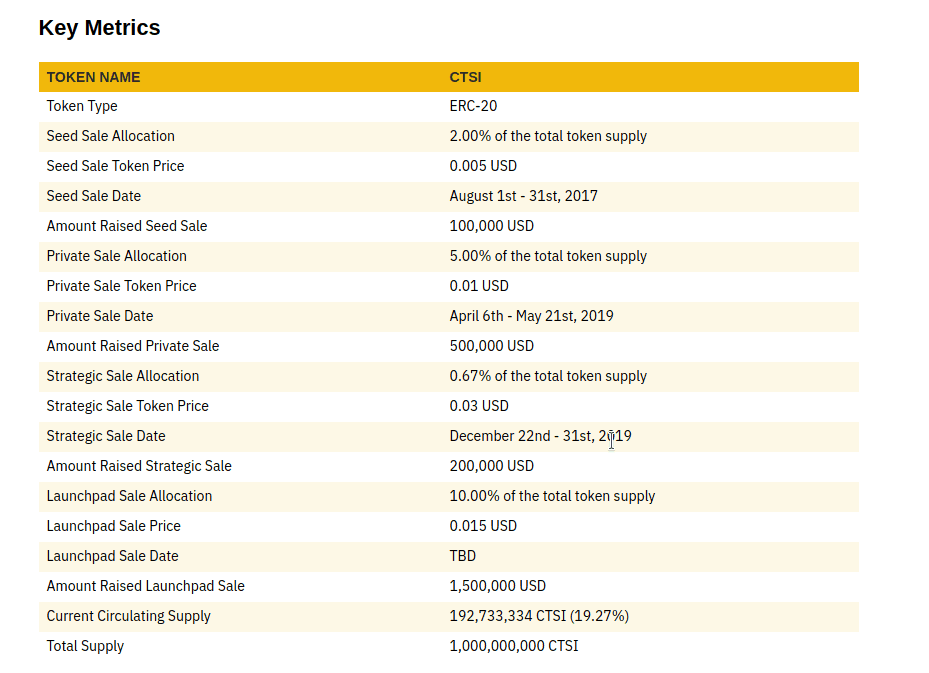

SRM is an ERC-20 token on the Ethereum blockchain and an SPL token on the Solana blockchain. It has a deflationary mechanism inbuilt as all the net fees on Serum go to an SRM burn. Here are some of the major utilities of SRM.

Discount on Fee – Justlikeany other exchange token, holding SRM gives the holder a certain amount of discount on the transactions.

Staking – Staking SRM is required to run a validator node for the Serum DEX.

Competition analysis.

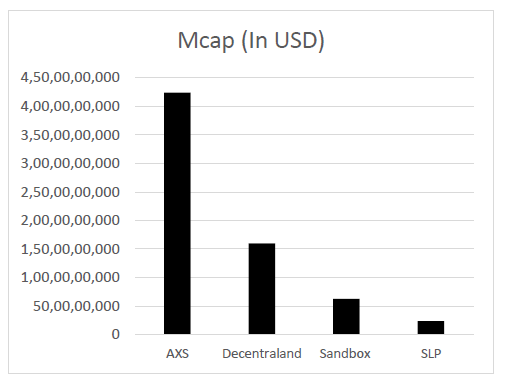

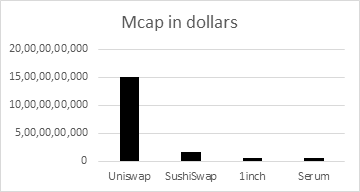

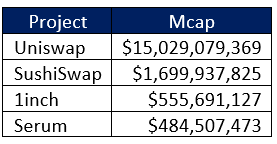

Serum has a long list of competitors in the DEX space and it is just getting started. Uniswap is the top competitor and is more than 10x away from Serum.

Based on the total value locked metric. Serum has just above $450 million while Uniswap has just above 4.9 billion.

Team, Media, and community strength.

Serum has a strong team of advisors, right from Sam Bankman, the founder of FTX exchange to the founders of Compound.

They have a mediocre media presence but they have a strong community strength of 137k Twitter followers and 12k telegram followers.

Conclusion

Pros: Serum has come up with a solution to the existing problems in the DEX space. You don’t have to pay high fees and the wait time is also extremely low. It has the backing of one of the greatest minds in the cryptocurrency space.

Cons: Although the tokenomics are deflationary in nature, the amount of circulating supply is too low.

MintingM rating for Serum is 3.9/5