Research summary:

Compound Finance is a Defi protocol (live and operating) that allows anyone to earn interest on their money without any aspect of KYC. We will focus on how the project works, what value it adds, and review its pros and cons.

The CMP is $115 as of 18th March 2022

What is DeFi?

All of the traditional financial services are centralized (controlled by a single authority or managed in one place) in nature. The Risks and problems that come with centralized financial services are Fraud, Mismanagement of funds, Theft, and restrictions to use your own money. DeFi stands for Decentralized Finance (DeFi is a category of Dapps. Dapps are decentralized applications that are launched on networks such as Ethereum). It is a financial service with no central authority. It eliminates these problems by allowing people to have complete custody and control of their money and to get more returns, by eliminating the 3rd party.

There are various categories of DeFi

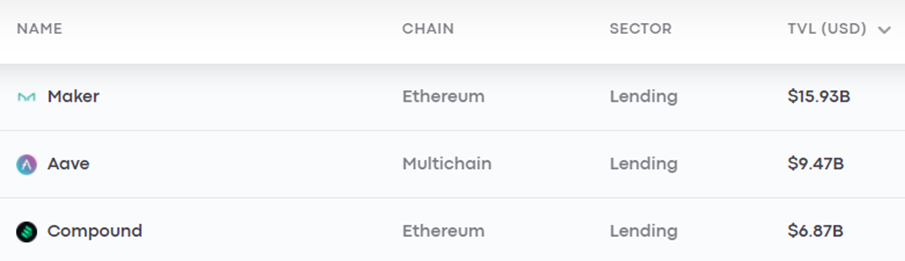

- Money Market: Such applications enable users to borrow assets against collateral and earn interest. Maker, Aave, and Compoundare the top DeFi applications in this category.

- Decentralized exchange: These kinds of applications give users the ability to swap one crypto for another. Uniswap and Sushiswapare the top DeFi applications in this category.

- Derivatives: A derivative contract derives its value from an underlying asset. With the help of smart contracts, DeFi projects like Synthetix allow people to get exposure to a wide variety of assets.

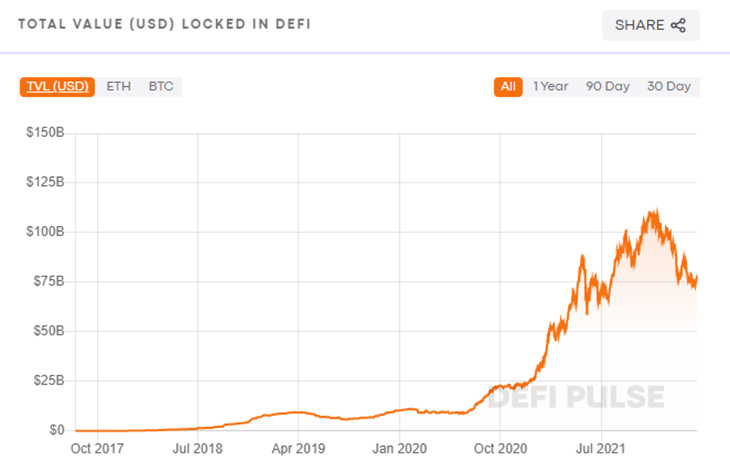

The DeFi space has seen explosive growth over the past year. The graph below indicates that 77.11 billion dollars are currently involved in the DeFi space.

What is Compound Finance?

Compound Finance is a decentralized borrowing and lending platform which algorithmically sets the interest rates based on supply and demand. It takes over the bank’s primary role of being the intermediary of borrowing and lending money. It completely saves the banks margins and gives it to the borrower and the lender. There is no lengthy process of conducting KYC, no need to travel to any location and it is completely accessible. All you need to do is create a Web 3 wallet to get started. This eliminates all the risks that are associated with bank and it also gives investors the opportunity to earn passive income on their cryptocurrency.

The primary goal of Compound Finance is to create a decentralized system for the frictionless borrowing of Ethereum tokens (ERC-20 tokens) without the flaws of existing approaches, enabling proper money markets to function, and creating a safe positive-yield approach to storing assets. The total value locked (TVL) with Compound is $6.8 billion and has a Mcap-TVL ratio of 0.109.

It is currently ranked at #89 (based on Mcap) in the cryptocurrency market. There is a maximum supply of 10 million COMP tokens out of which 6.6 million COMP tokens are in circulation. COMP is currently listed on Binance, Coinbase, and FTX.

How does Compound Finance work?

In Compound Finance, you can borrow and lend money in a decentralized manner. There isn’t anyone any requirement to fix the specification of a loan or meet anyone. This is possible with something referred to as a liquidity pool.

A liquidity pool can be viewed as a bowl of money, lenders can deposit money in the bowl for a certain interest rate (reward) while the borrowers can borrow money from the bowl for a certain interest rate (fee). The bowl in the case of compound finance would be a smart contract and not a bank. The rates are also dynamic and change based on the demand and supply of an asset.

As per the above-mentioned image, you can borrow and lend 10+ ERC-20 tokens, the top tokens are Ethereum, USDC and DAI.

When a lender supplies an asset (Lets take BAT tokens for this example), he receives something referred to as a “cTokens” (cBAT) which will increase in value as the interest is accrued while a borrower has to provide collateral in cTokens to borrow from the pool. To make sure that the value of the collateral does not drop significantly (due to the volatility) compared to the loan amount, the protocol overcollateralizes.

The motivation from the lender’s point of view is to earn passive income while borrowers can the protocol to increase their leverage on their position. Let’s say that the investor is confident that BAT is about to surge, so he can borrow money and keep BAT as collateral. He will then buy more BAT with the borrowed money. So, when BAT surges, the borrowed BAT’s new value minus the principal and interest would be the profit.

What is the utility of the COMP?

COMP is an ERC-20 native token to Compound Finance’s ecosystem. It represents a core element in Compound Finance’s ecosystem and is essentially a governance token. The token holders can put forth proposals and can also vote on proposals. These proposals can be used to shape the future of the protocol.

Competition analysis. When it comes to Lending platforms in the Defi space, Compound Finance is the 6th largest Dapp based on total value locked (TVL) and is the 3rd largest Dapp in the lending category space.

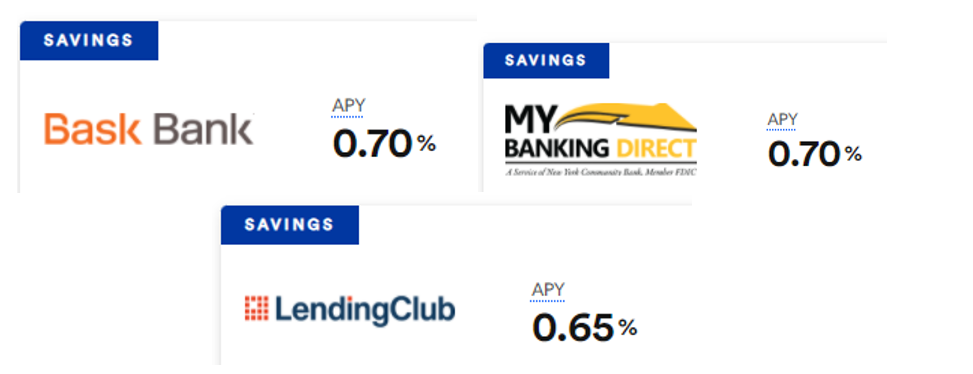

Although it is within the top 3 lending applications, there is a huge potential towards the upside based on the competition. Besides its crypto peers, the traditional banks are also a competition. It has an amazing edge over the banks in developed nations. 0.7% found at US savings account is always beaten by the 4.58% on Aave tokens on compound finance.

Team, Media, and community strength.

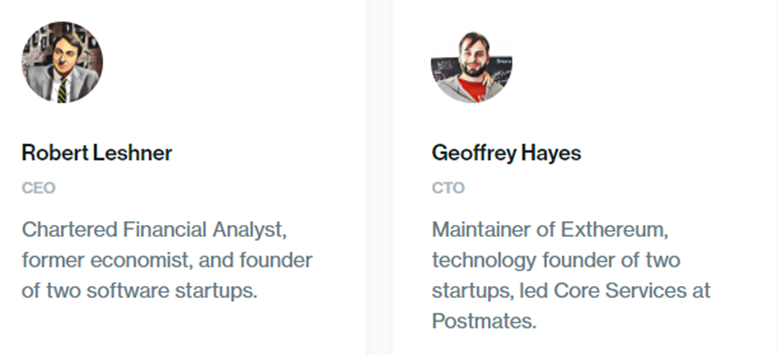

The leadership team has strong experience in the field of Finance & Technology and has created multiple companies in the past. Compound Finance has great community strength, but they are only visible on Twitter and Medium. They have 222k Twitter followers and their media presence is not very impressive.

Conclusion

Pros: Compound Financeis the 6th largest Dapp and the 3rd largest Lending protocol in the DEFI space. It has huge market potential as it is trying to take over the primary role of the banks which is a multibillion-dollar industry. It is a simple to use Dapp, which is a key aspect to mass adoption. The team has expertise in Finance, Technology and Business.

Cons: Technology can be exploited and this applies to DeFi applications such as Compound Finance. During an update, the protocol gave away approximately $90 million dollars to its users. This does not mean that the traditional banks have not done something similar (Fat finger error or an AI going berserk when it meets an undefined condition). The other major problem is usability, given that it is based on the Ethereum network, the gas fees make the network extremely expensive to use, making it obsolete.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today