Chainlink Overview

Overview:

Chainlink is a decentralized network of nodes that provide data and information from off-blockchain sources to on-blockchain smart contracts via oracles.

The CMP is $24.75 as of 3rd December 2021

.

What is Chainlink?

Chainlink is an Ethereum-based decentralised blockchain oracle network similar to Tellor. The network is designed to make it easier to move tamper-proof data from off-chain sources to smart contracts on the blockchain. Its inventors say that by linking the contract directly to real-world data, events, payments, and other inputs, it may be used to check if the requirements of a smart contract are satisfied in a way that is independent of any of the deal’s stakeholders.

Why Chainlink matters and its problem solving capabilities

Chainlink contributes by offering an innovative decentralised method of authenticating data from oracles and pertinent smart contract output data. ChainLink examines centralised oracle feeds as a single point of failure and proposes a remedy via “middleware” that compromises a decentralised oracle platform. Before data becomes a trigger for a smart contract, ChainLink detects and authenticates it. Individual nodes on Chainlink operate as smart contracts, executing calculations to ensure that the data given into the smart contracts is accurate.

Chainlink follows a paradigm or structure that is quite similar to a blockchain. There is a decentralised network of autonomous oracles that gathers data from diverse sources, aggregates it, and gives a verified, single data point to the smart contract, accelerating its execution and removing any single point of failure.

Fundamentals of Chainlink

Chainlink is a decentralised oracle network made up of data buyers and sellers. Data is requested by purchasers, and it is returned in a secure manner by suppliers.

Buyers choose the data they want, and providers compete to deliver it. When making a bid, providers must commit a stake of LINK tokens, which can be taken away if they misbehave. Once providers have been chosen, it is their responsibility to ensure that the proper responses are added to the chain.

Chainlink aggregates and weights the data given using an oracle reputation system. If everything goes according to plan, providers will be paid, and everyone will be satisfied.

Use cases:-

- Decentralized Finance(DeFi):- When it comes to the crypto sector today, DeFi is now at the top of the list. Intriguingly, 2020 has been called the Year of DeFi, since the sphere saw a 1000 percent gain in TVL in just the third quarter of the year. The DeFi industry is recognised for providing a wide range of services, including lending, hedging, and loan collateralization.

- Stablecoins:- These are cryptocurrency tokens that are linked to valued assets. These things might include fiat monies such as the US dollar, precious metals, and even cryptocurrency. These tokens, as the name indicates, are less prone to volatility than other types of cryptocurrency.

- Bonds:- They have existed since the beginning of decentralised technology. Traditional bond contracts are being phased out in favour of automated smart contracts powered by oracle systems such as Chainlink. They also give useful information like as interest rates, fiat payments, debt scores, and so on.

Tokenomics

The LINK token is utilised as both a payment and a labour token. LINK is used to compensate Chainlink node operators for delivering oracle services as a payment token. Node operators can stake LINK as collateral to provide oracle services as a work token.

The LINK token sale began on September 19, 2017, with a hard ceiling of $32 million. LINK was offered at $0.09 per token during the pre-sale, with a 20% bonus depending on when the investor bought. Following that, LINK was sold at $0.11 per token in a public sale. Both sales totaled 350 million LINK LINK LINK LINK LINK LINK LINK LINK LINK LINK LINK LINK LINK Initially, 1 billion LINK tokens were distributed.

Competition Analysis

Chainlink vs Band Protocol

To request external data, Dapp’s smart contracts interface with Link’s Oracle. The Dapp accepts ETH as payment, which is subsequently converted to the LINK token. This conversion is required so that the Oracle may utilise the LINK token to pay its nodes (employees/workers) for retrieving external data. This is the bottleneck: translating from ETH to LINK during peak network traffic is too expensive/slow for a Dapp that relies on real-time data to execute its smart contract.

Furthermore, the nodes are OFF CHAIN (An off-chain transaction is the movement of value outside of the block chain). Working outside of the block chain is wasteful since it necessitates two transactions to communicate the external data that the Dapp requires.

Dapp’s smart contracts communicate with Band’s Oracle to request external data. The Dapp pays with ETH that is then converted to the BAND token. This conversion happens on Band’s COSMOS infrastructure. COSMOS eliminates the dependence of the ETH blockchain which is subject to network congestion and high gas fees. In addition, Band’s Oracle communicates with its network nodes that live ON CHAIN which means that information can be seamlessly relayed and does not need two transactions to occur like Chain Link.

Team, Media & Community strength

Sergey is the founder and CEO of Chainlink, a prominent blockchain middleware startup that is utilised by businesses (SWIFT, Google, Oracle) and smart contract teams (Web3 Foundation, Zeppelin, Open Law, Market Protocol, and many others). The strength as of now is 89 members working in chainlink .

They have over 635.7K followers on twitter and 4.6K in telegram

Conclusion

Chainlink is a decentralised oracle network that feeds real-world data to blockchain smart contracts. Smart contracts are pre-specified blockchain agreements that assess data and execute automatically when specific circumstances are satisfied. LINK tokens are the digital asset tokens that are used to pay for network services.

Pros

- Allows secure interaction between smart contracts and off-chain data.

- Potential to allow smart contracts that mimic current financial agreements

- Financial reward for feeding reliable data securely into Chainlink

- Partnerships with big companies like SWIFT and Google Cloud

Cons

- Questions as to whether LINK tokens are actually necessary for project

- Systems can work with a single oracle, allowing for data manipulation

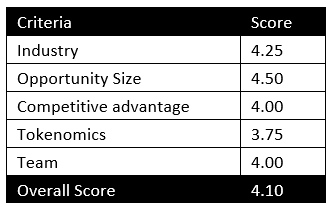

MintingM rating for Chainlink: 4.10/5

Important links and sources

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today