Crypto Markets

Crypto Sentiment

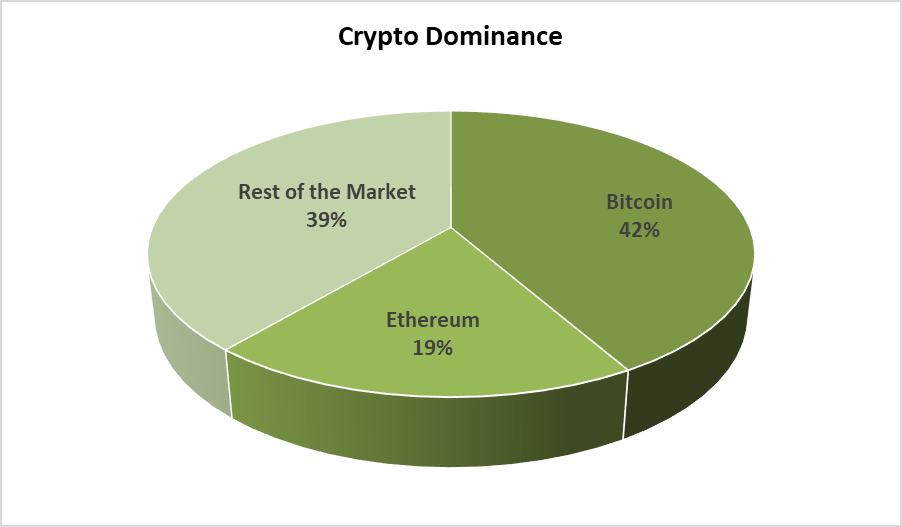

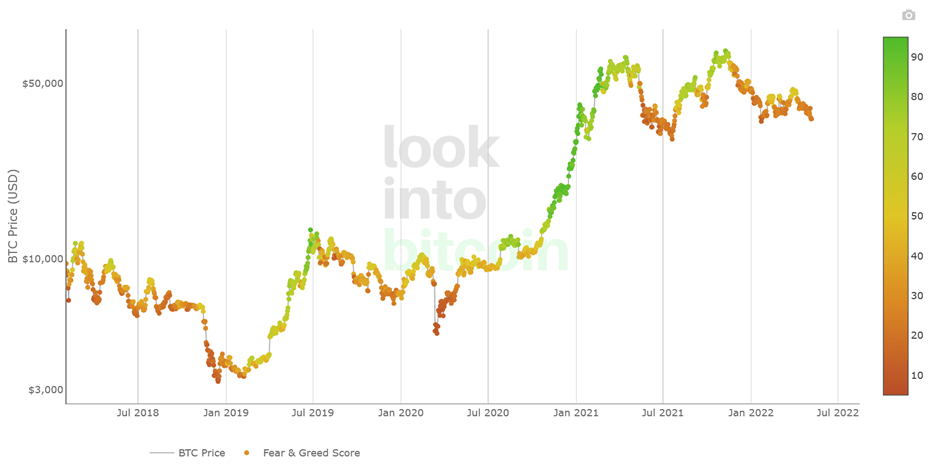

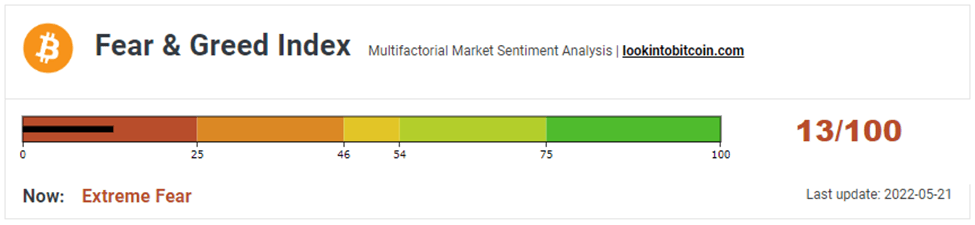

This week the sentiment towards the cryptocurrency markets has slightly improved

but it is still grim. There is fear and blood in the markets. The fear and greed index has

moved up from “9” to “13”.

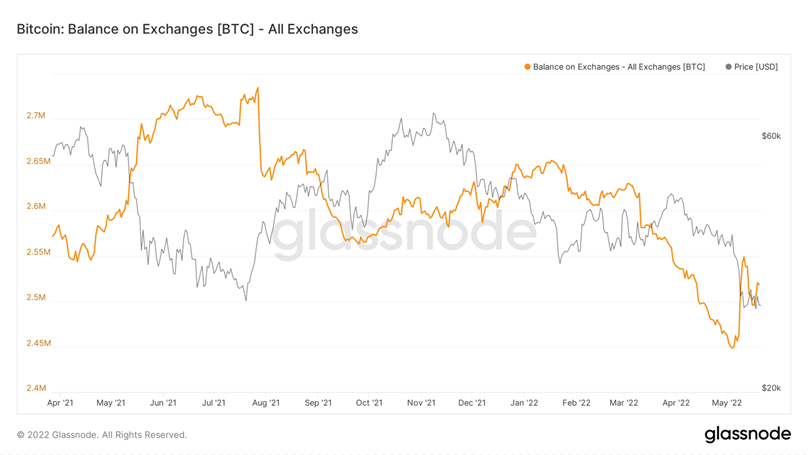

May ‘21 to Aug ’21 was also a time of extreme fear and BTC was bought off exchanges

(Chart mentioned below). And by the start of September, the prices eventually reacted

to the accumulation.

One can say that we are going through the same phase of extreme fear and

accumulation.

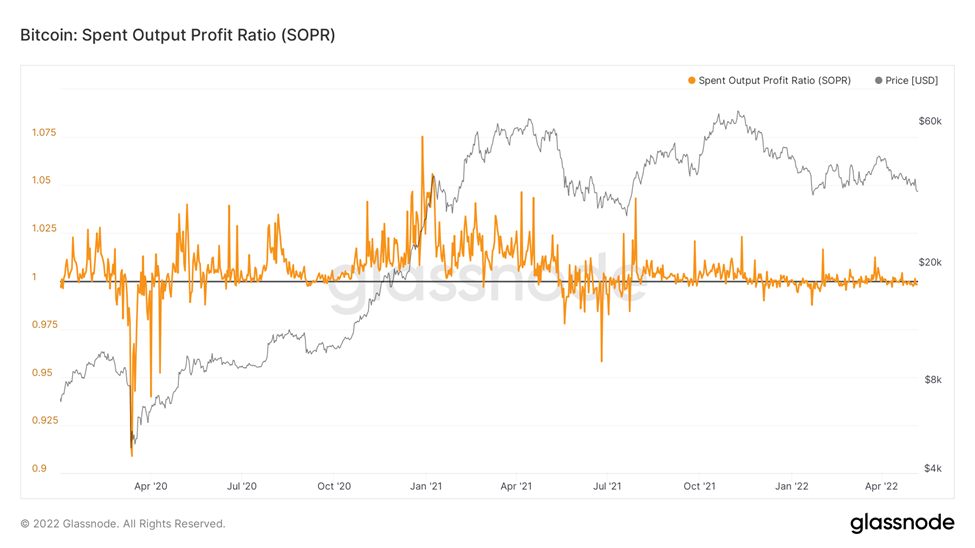

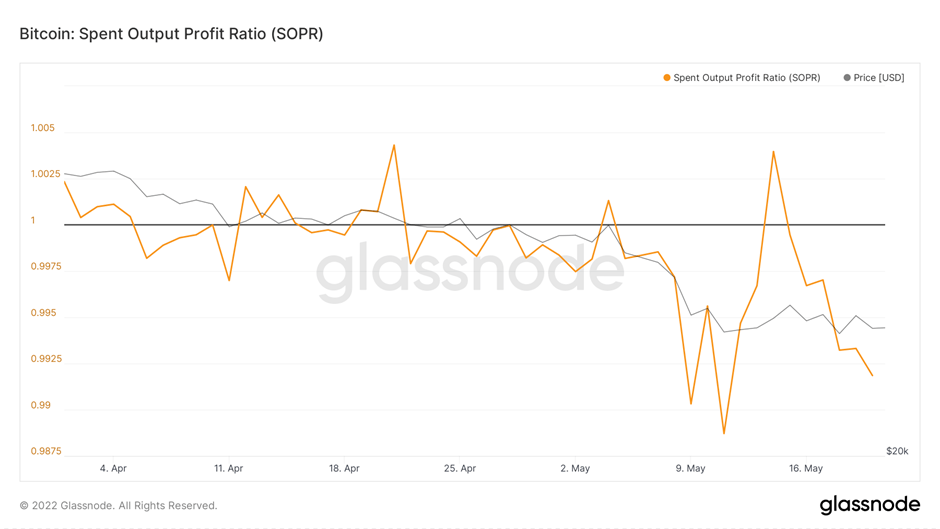

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

SOPR value had broken below 1 last week and it has been plummeting. This indicates

that Bitcoins are being sold at a loss. This is a classic panic seller behavior and it is

being quietly sold to the accumulators. Eventually, the panic sellers will run out of BTC

to sell or will calm down.

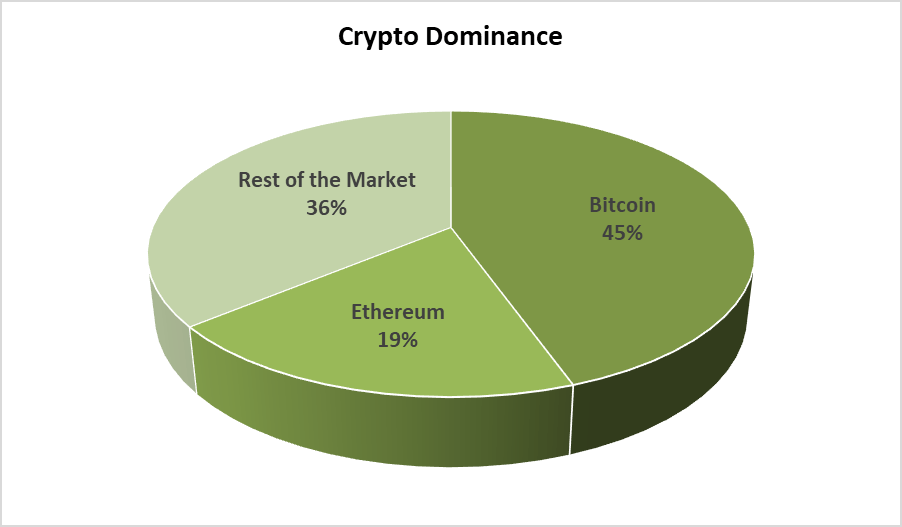

Demand for Cryptocurrency

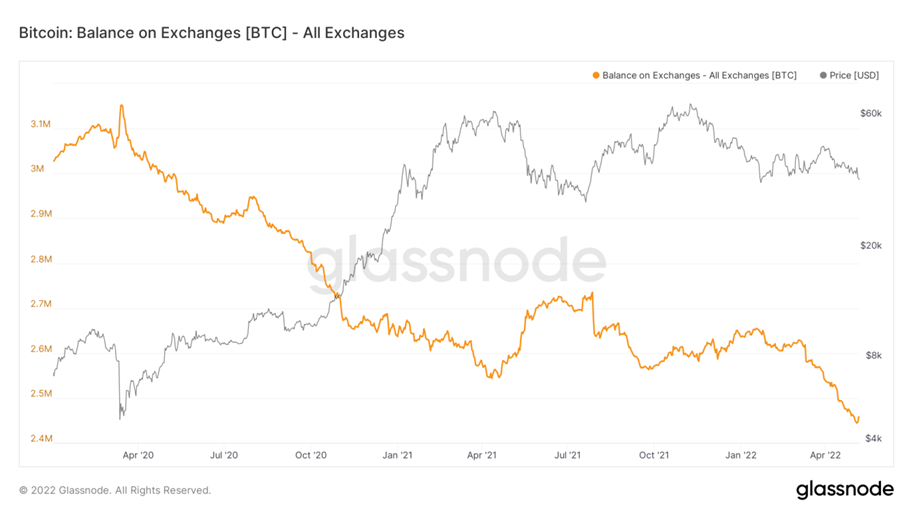

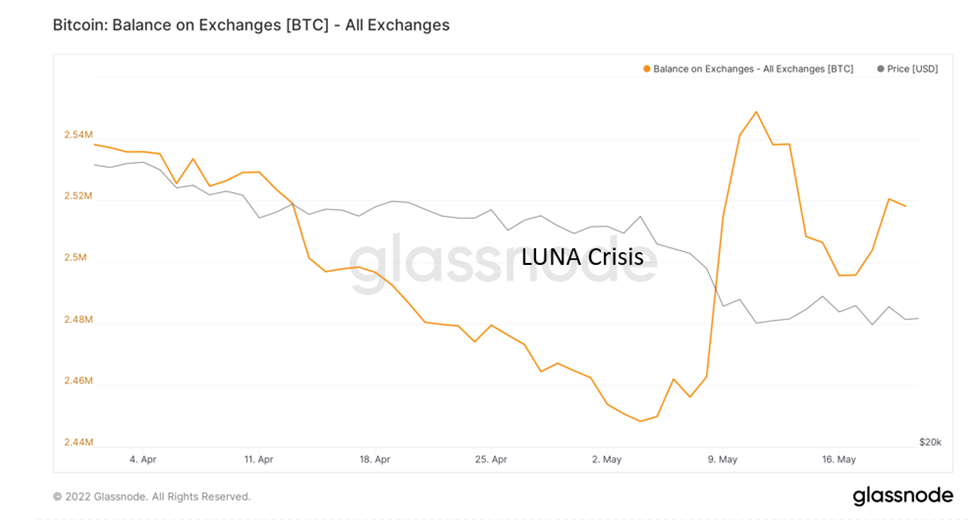

As mentioned in the prior report, we had assumed that the balance on exchanges had

increased because of the Luna crisis and we were proved right when LUNA came out

and announced the same. As the dust has cleared the decline in balance on

exchanges has begun and it is likely that we continue this pattern of buying.

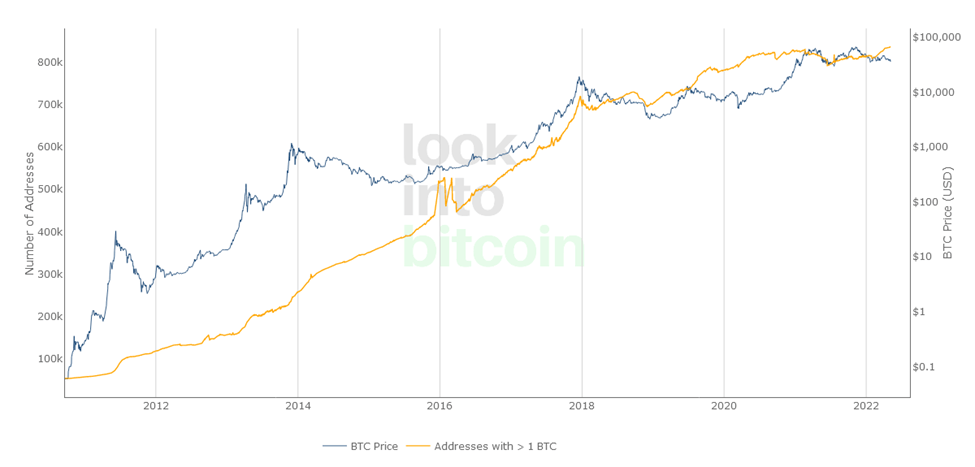

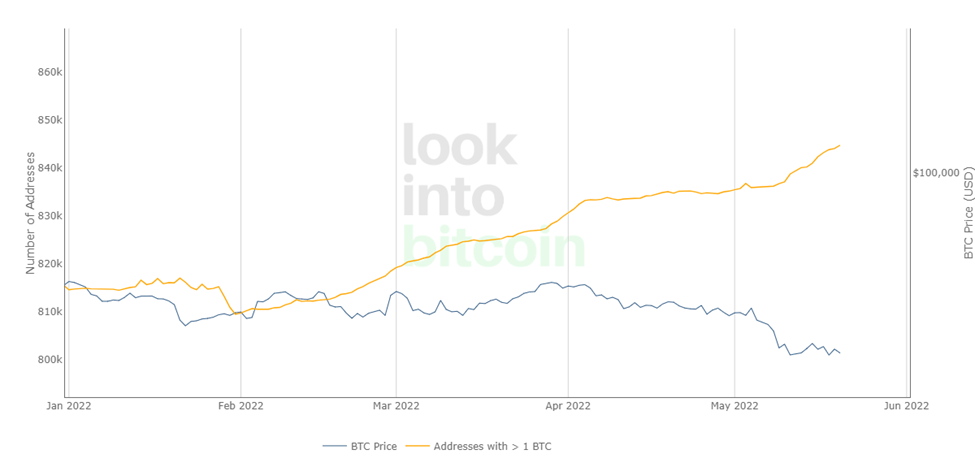

The overall buying behavior also seems to be strong, as the number of addresses with

at least 1 BTC is still on the uptrend and has hit an all-time high record.

When it comes to new users coming into the crypto space, we will look into the google

trends. The interest is gauged based on the range of 1 to 100

Going by the above chart, it seems like we have a spike in interest in the

cryptocurrency space. This could be attributed to the overall adoption within the

cryptocurrency space. In the prior runups, price was the factor that pulled in new

investors but this time it could be the rise of adoption that would bring in new people.

Is the Smart money buying?

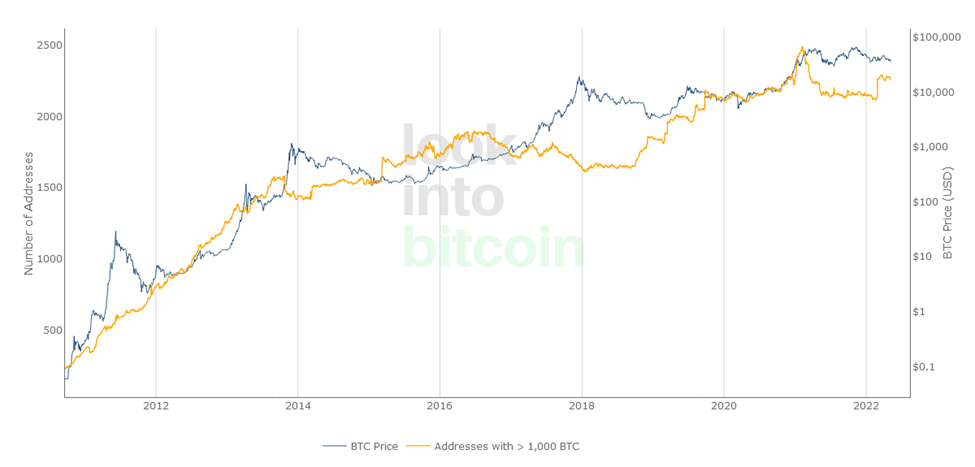

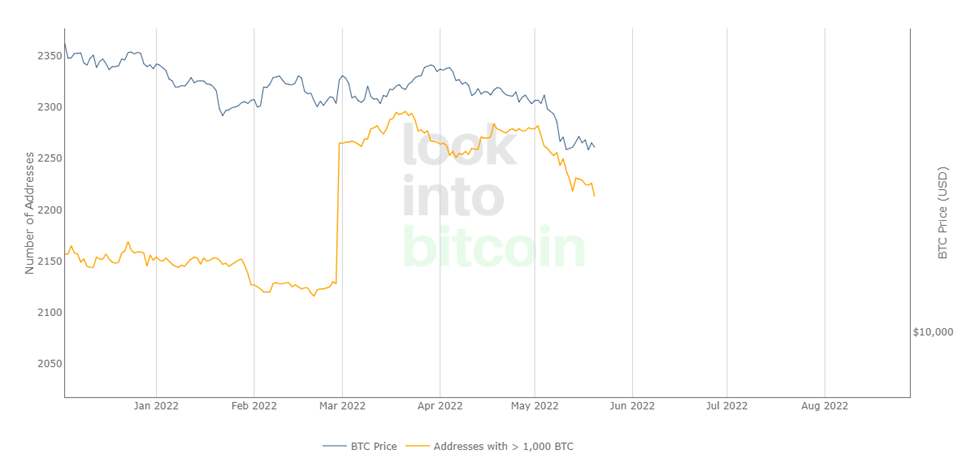

We will consider wallet addresses with more than 1000 Bitcoin as institutional

investors who are closely monitoring the asset class.

We can connect the dots with the prior chart on Bitcoins leaving exchanges with the

above data point and can assume that the Luna’s BTC reserves are responsible for the

downtrend on this number. As the number of BTC addresses with at least 1 BTC has

been climbing higher and higher.

Overall Market Performance

DOW JONES

Dow Jones Industrial Average dropped nearly 3% in the last week. The daily chart for

Dow Jones has broken below the descending channel pattern. The next support is

expected at 29,800.

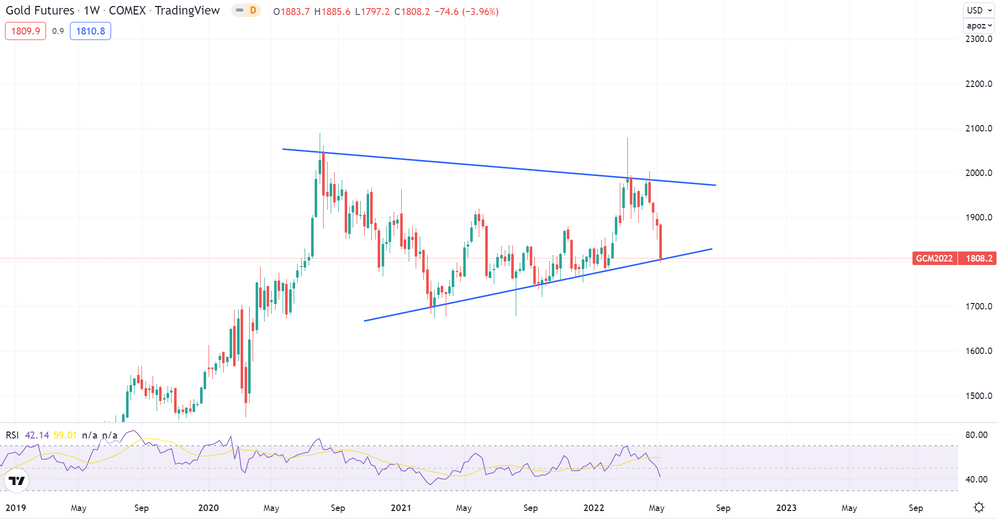

GOLD FUTURES

Gold Futures gained marginally over the past week to edge above $1,800. The weekly

trend bounced off from the triangle pattern bottom. The next support for Gold

Futures is expected at $1,675.

BITCOIN

Bitcoin continued to consolidate around the $30K levels. The weekly trend for BTC has

broken below the channel pattern. The next resistance for BTC is expected at $40,000

and an immediate support is expected at $24,000. The monthly RSI for Bitcoin is at

46.9, the lowest in over 2 years with a support at 43.

ETHEREUM

Ethereum against BTC fell by 2.1% over the week. The weekly trend for ETH against

BTC is moving within a channel pattern. The next resistance is expected at 0.077 and

next support is expected at 0.064

What could play out?

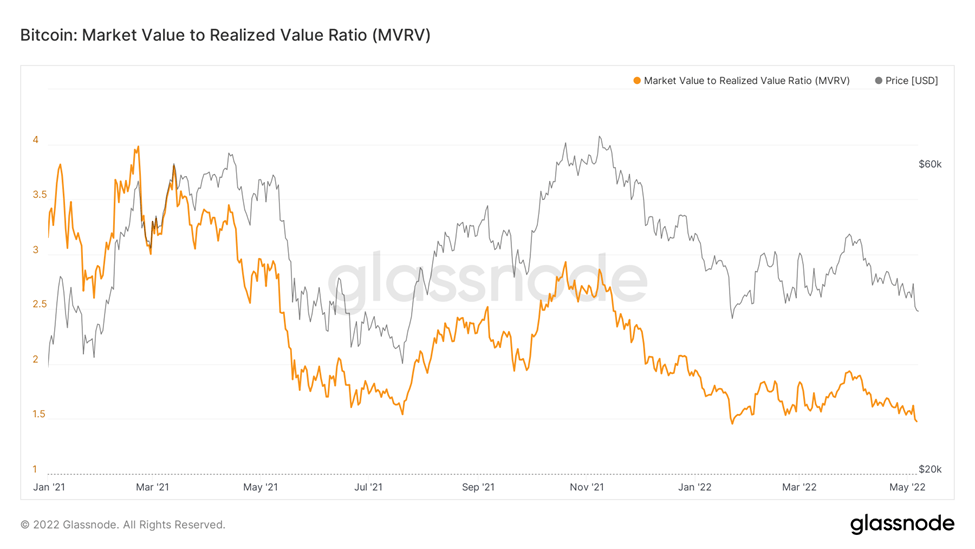

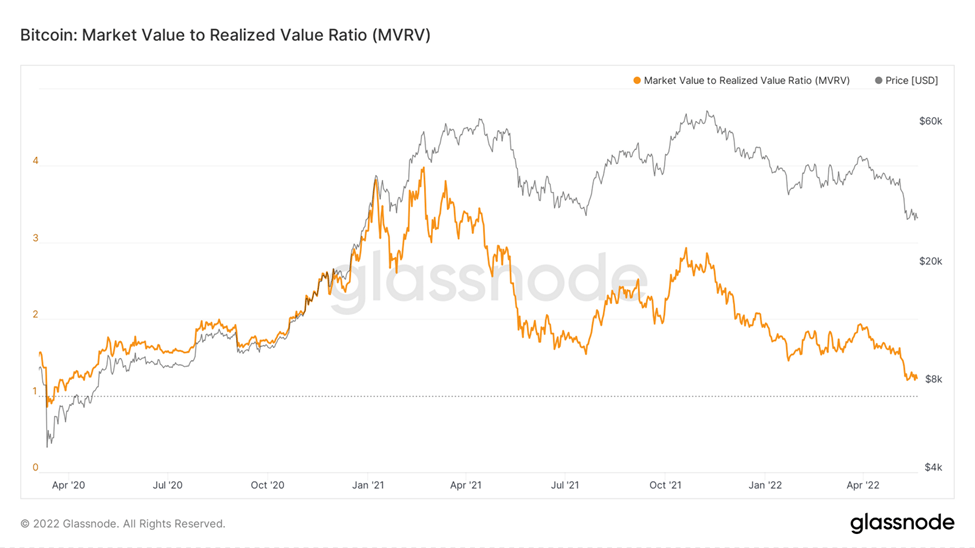

The MVRV ratio is equal to the market capital divided by realized capital of Bitcoin.

Realized capital unlike market capital does not use the current market price, but rather

uses the prices of each Bitcoin when they last moved.

So, for example, if the price of most of the Bitcoin when they last moved was $10,000

and the current price is $60,000. Then the MVRV ratio would stand at 6. This means

that the market is extremely heated and profit booking is likely. On the other hand, if

the of most of the Bitcoin when they last moved were near the market price, then the

CMP can be considered as the bottom.

The current MVRV ratio stands at 1.22 and is trending towards to the downside. We

are now too close to the April 2020 low which marked as a starting point to the 2020

run.

Highlights of the week

South Korea calls Do Kwon to the National Embassy by

Yun Chang-Hyun, a representative from the ruling

party. He apparently expressed concerns about the

behavior of exchanges during the crash.

China is the 2nd largest Bitcoin hash rate provider even

though the Chinese govt had banned all crypto

operations in China in mid of 2021. Some of the miners

are still operational which means that the operations

have gone underground

The Schools and Bitcoin Project in Argentina seeks to

educate high school students on the importance of

Bitcoin starting with 4,000 students across 40 odd

schools

Our Pick of the Week

Kava(KAVA)

We expect a gain of 10% from the Buy Price of 2.77 USDT and

outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today