Overview:

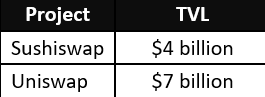

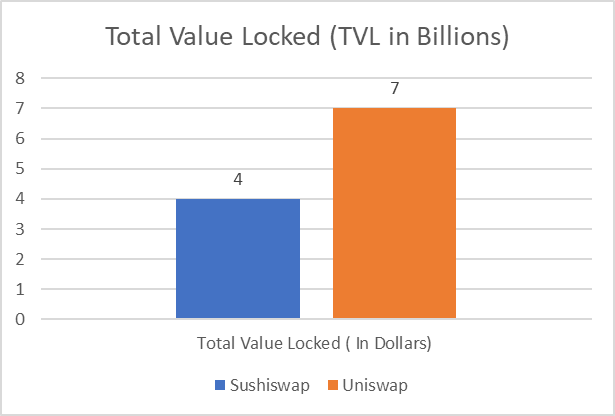

Terra protocol is a decentralized, open-source public blockchain designed for algorithmic stablecoins (More on stablecoins below). These stablecoins can be used on any decentralized applications especially DeFi applications on the Tera blockchain. It currently has 25.9 billion in TVL. It is creating an important element necessary for the success of the DeFi ecosystem.

The CMP of LUNA (Tera’s native token) on 11th March is $97.19

What is Stablecoin?

In the stock market, it is a common strategy to convert your stocks to cash or fiat currency during times of uncertainty. This option gives the investor flexibility and he can potentially buy back in at cheaper rates.

The cryptocurrency markets are known for their volatility as it operates 24/7, throughout the year and there weren’t safe haven coins which allowed investors to take a step back and spectate the market during extreme volatility. Fiat currency was an option, but converting back to fiat currency would be expensive and the lack of banking support for crypto in several parts of the world would compound the difficulty. This led to the creation of stablecoins, a new class of cryptocurrency. Stablecoins by definition were supposed to be stable in the world of volatility and their value were pegged or directly linked to the value of a stable coin (All the popular stablecoins are pegged to the USD).

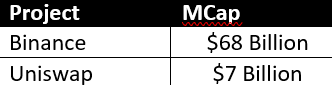

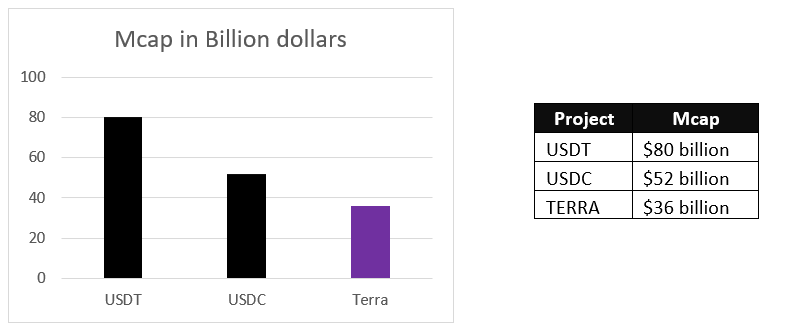

Tether’s USDT is the most popular stablecoin and it is pegged to the USD. Tether is an organization that takes collateral and mints USDT, so theoretically the USDT is backed 1:1 by an actual USD. As of the time of writing this report, Tether has a market capital of $80 billion and is 3rd largest cryptocurrency.

Circle’s USDC is the 2nd most popular stablecoin and it is also pegged to the USD. Circle also is extremely similar to Tether. It is an organization that takes collateral and mints USDC, so theoretically the USDC is backed by an actual USD. As of the time of writing this report, USDC has a market capital of $52 billion and is the 5th largest cryptocurrency.

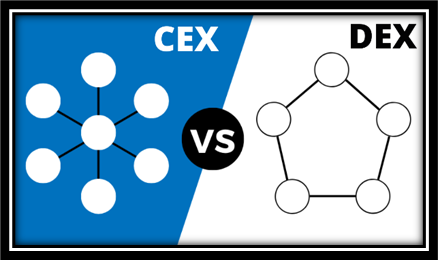

Together USDT and USDC represent $132 billion in the cryptocurrency space and unlike most of the cryptocurrency projects, both these players are completely centralized private companies.

Besides being a safe haven, the stablecoins became “Cash” in the cryptocurrency space. So, the utilities increased significantly, especially in the DeFi ecosystem.

What is Terra?

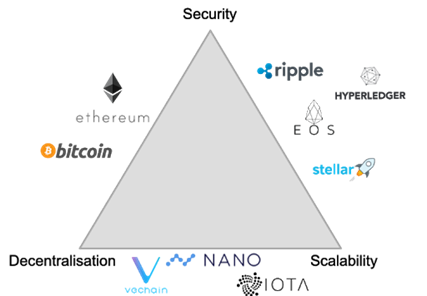

In the world of centralized stablecoins, Terra brings a better solution. The Terra protocol creates algorithmic stablecoins that consistently track the price of any fiat currency. It is a decentralized, smart contract compatible proof of stake blockchain. The Terra mainnet was launched in April 2019 and was built via the cosmos SDK. They have an excellent leadership team and the project has raised funds from multiple partners.

It is currently #9 (based on Mcap) in the cryptocurrency market. Terra native token “LUNA” has a maximum supply of 1 billion “LUNAs” and currently has 0.37 billion LUNAs (37%) in circulation. It is currently listed on all the major exchanges.

What problem does Terra solve?

In the current financial ecosystem, sending money from 1 country to another is not an easy task. It is expensive as there are a lot of conversions that occur and there are often limitations when it comes to money transfer. Bitcoin fixes this issue but brings in different issues of its own. The biggest one is that the value of a bitcoin is often volatile and will fluctuate a lot. Stablecoins fixes this issue as it is designed to be stable.

As mentioned above, the top two stablecoin leaders represent $132 billion and both of them are centralized private companies. This is a major issue as both the private companies are under no obligations to disclose the collateral for these stablecoins.

Tether the largest player has management that has been associated with scams in the past while there are a lot of irregularities when it comes to the collateral behind USDT. The official statement has changed multiple times, initially, it mentioned that the USDT was backed 1:1 with a USD and now the language has changed to 1 USDT is backed by tether reserves.

This is an extremely concerning aspect as a stablecoin is supposed to be an integral part of the DeFi ecosystem and the global payment processor ecosystem.

How does Terra solve this problem?

Terra solves both the above-mentioned problems with its algorithmic stablecoins that consistently track the price of any fiat currency.

UST is pegged to the USD while KRT is pegged to the Korean won and so on. So, a user can send USD to a Korean vendor by swapping his UST with the KRT at relatively low fees and with no limitation.

Given that the roots of this project are from Korea, people from Korea are already using this functionality via the “CHAI” application through the Terra blockchain. Based on what the team mentioned, they are already in 18,000 offline stores in Korea. Similar applications are present in other countries as well.

How is UST different from USDT or USDC?

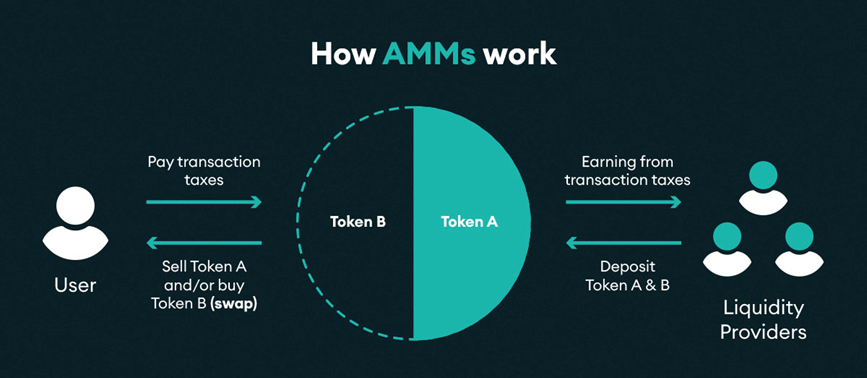

“LUNA”, the native token to the terra blockchain is extremely integral to the Terra ecosystem. LUNA and UST are dependent on each other as you need LUNA to create UST. 1 LUNA is equal to 1 UST and while converting LUNA to UST, some portion of LUNA is burned while the rest goes to the community pool (The money from the community pool is used for making new applications) The stability of the value of UST is assured with the help of arbitrage. Arbitrage is an activity when you buy and sell something that has different prices at two different locations. For example, if bitcoin is trading for $10,000 at Binance and Bitcoin is trading at $15,000 at Coinbase, people will start buying from Binance and sell at Coinbase till the values meet on both exchanges. The values will equate as more buying happens at Binance; the price will rise while on the other hand, the price at Coinbase will fall due to the massive sell-off.

So, when the value of UST goes above $1, people will start burning LUNA (as the intrinsic value of 1 LUNA and 1 UST is the same) and mint more UST. This will lead to the supply of UST increasing and thus the value of UST will fall back to $1. This process works in the opposite manner when the value of UST falls below $1.

Due to this relationship, it is safe to say that the value of LUNA rises when there is a demand for UST and the value of UST depends on the adoption of Dapps on the terra blockchain.

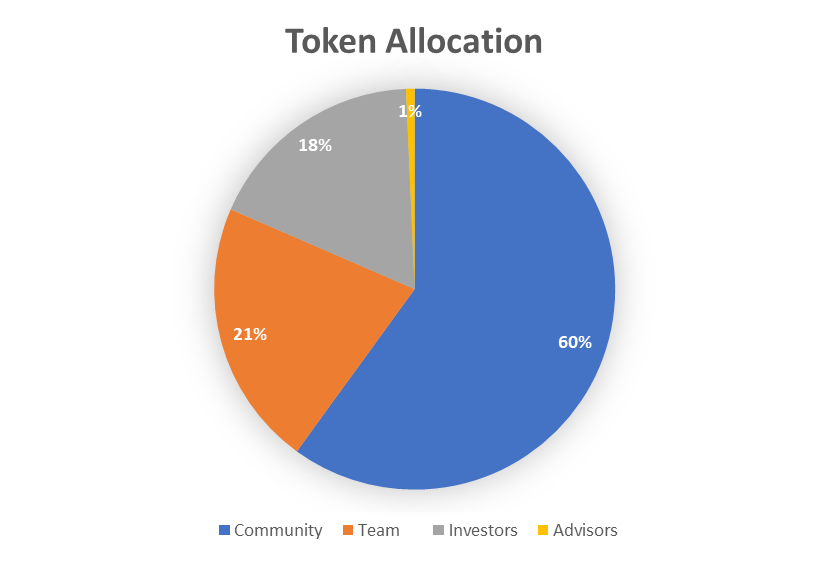

LUNA has a maximum supply of 1 billion and we a burn mechanism in place, the token could become deflationary in the long run. Other token utilities include staking and governance.

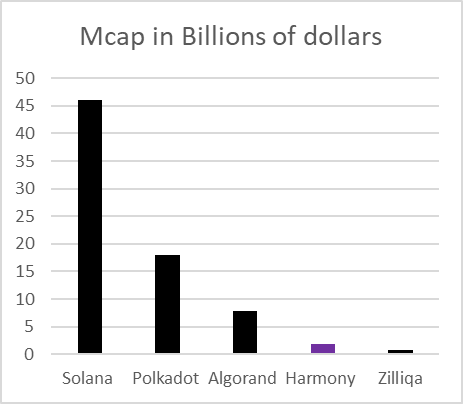

Competition Analysis

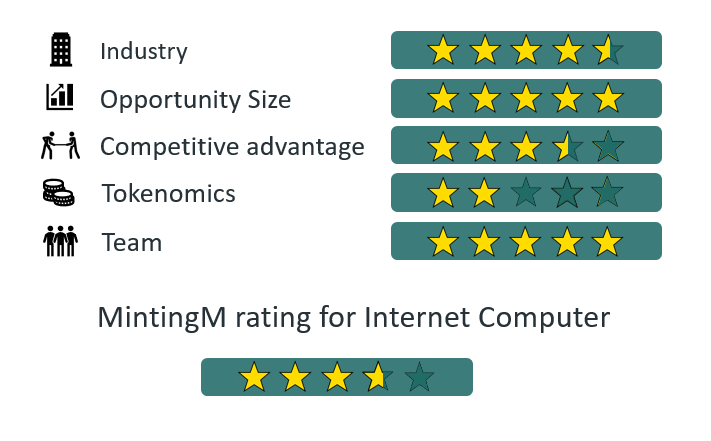

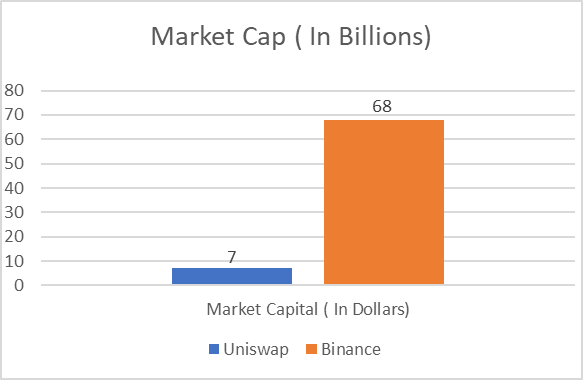

Terra is trying to solve one of the biggest problems in the DeFi space and is going against the top stablecoin issuers. It has an edge over the top two leaders in the space as it is primarily focused on fixing its flaws via its own offering. Another player in the cryptocurrency space would be COTI as they are also moving in the footsteps on Terra.

Team, Media & Community strength

The leadership team behind the project are serial entrepreneurs and ivy leaguers.

Terra’s social media strength is growing rapidly on Twitter and telegram. They have over 350K followers on Twitter and 31k members on telegram. Their media presence is also extremely strong.

Conclusion

Pros:

Terra is aiming to solve one of the biggest problems in the DeFi and stablecoin sector. The token is designed in such a way that if the project grows, the value of the LUNA token will also grow with it.

The adoption is also looking good as the Chai application has over 2 million users. Their community pool dedicated to building new Dapps is filled to the brim with money.

The protocol has multiple strong Dapps such as mirror protocol under its belt and the network is and the transaction fees are extremely cheap.

Cons:

Transparency is a huge problem with Tether and unfortunately, there is a lack of clarity when it comes to the circulating supply of the LUNA tokens, this however can be fixed if the team adds more clarity in this section. Competition is also a major challenge that Terra has to face as there are 2 players who already have a 1st mover advantage. Regulation is another big issue as most of the major economies are planning to bring over CBDC.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today