Crypto Markets

Crypto Sentiment

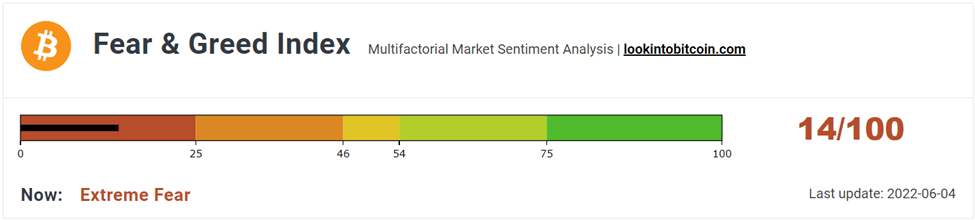

This week the sentiment towards the cryptocurrency markets has not changed much

from last week. The fear and greed index has remained in the “extreme fear” at 14.

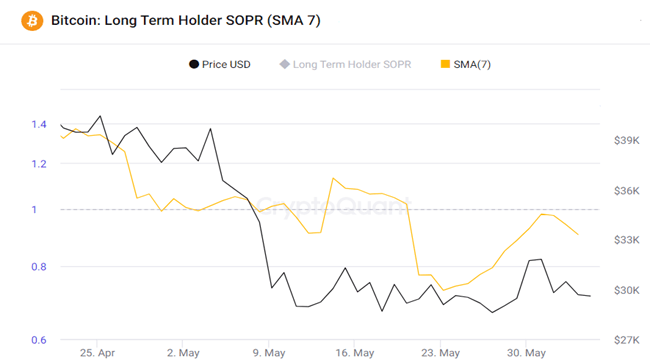

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen’s terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The Adjusted SOPR filters out transactions that are younger than 1 hour, thus,

clearing out noise from the metric.

Long Term Holder SOPR (LTH-SOPR) filters out coins that are younger than 155 days.

Generally, coins that are lived more than 155 days are less likely to be spent on chain.

From the graph below, it can be seen that LTH-SOPR has fallen below 1, indicating that

investors are selling at a loss. The price of $30K where we see LTH-SOPR>1 acts as a

major resistance as most of the investors have booked profit at this price.

Demand for Cryptocurrency

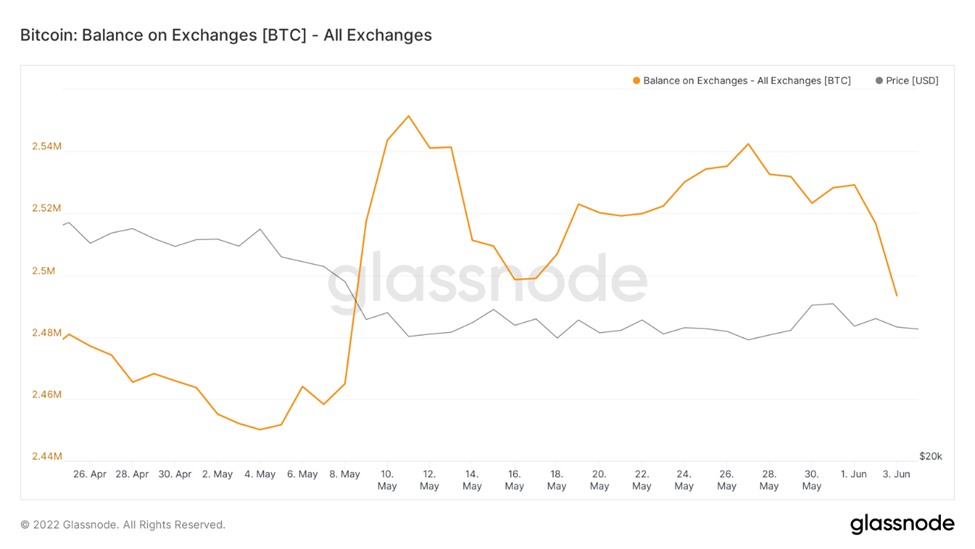

The BTC balance on exchanges has been on a downtrend since the early weeks of May

while the addresses with a balance more than 1 BTC is on an uptrend since the early weeks

of May. A decrease in the exchange BTC balance indicates investors have been moving

their BTC from exchanges to wallets

And an increase in the number of addresses with balance greater than 1 BTC confirm s

this hypothesis. This indicates an accumulation phase which can eventually lead to

supply shock and thus, reversal of the bear market.

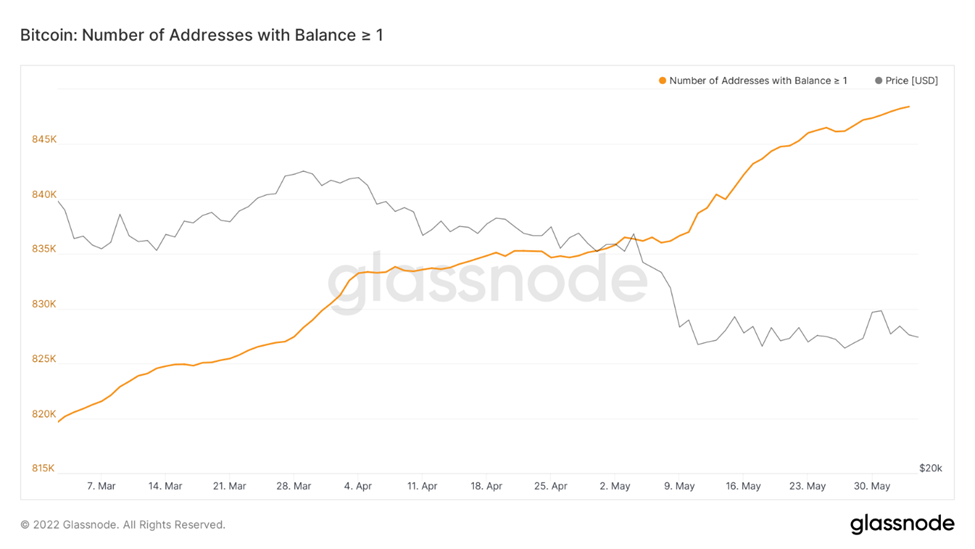

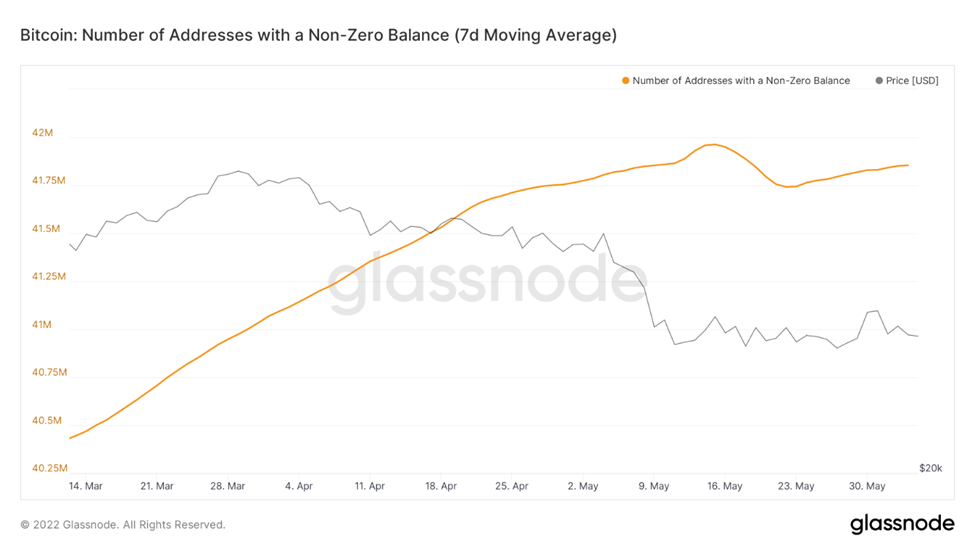

During the recent Luna crash we could see that there was fear sell leading to a sharp

decrease in the number of addresses with non-zero balance. These addresses could

have possibly sold their holdings completely or have their holdings sent to the

exchanges increasing the probability of sell-off during volatility. The addresses with

non-zero balance increased soon after, indicating that either new investors are joining

the market or the same investors who had earlier sold their BTC, have started

accumulating.

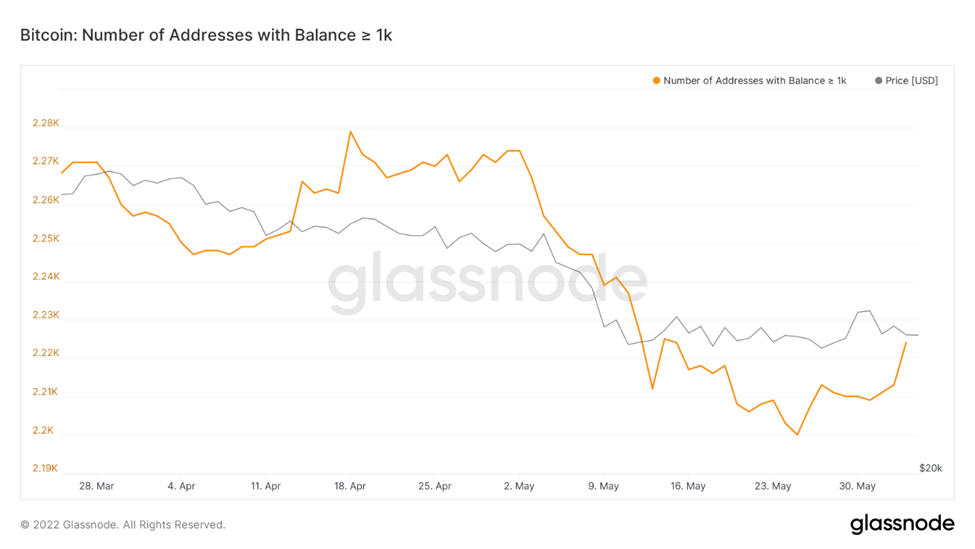

Is the Smart money buying?

We will consider wallet addresses with more than 1000 Bitcoin as institutional

investors who are closely monitoring the asset class. The recent LUNA fiasco saw the

no. of addresses holding 1000 plus BTC’s, drop slightly. However, the number jumped

up soon after.

What could play out?

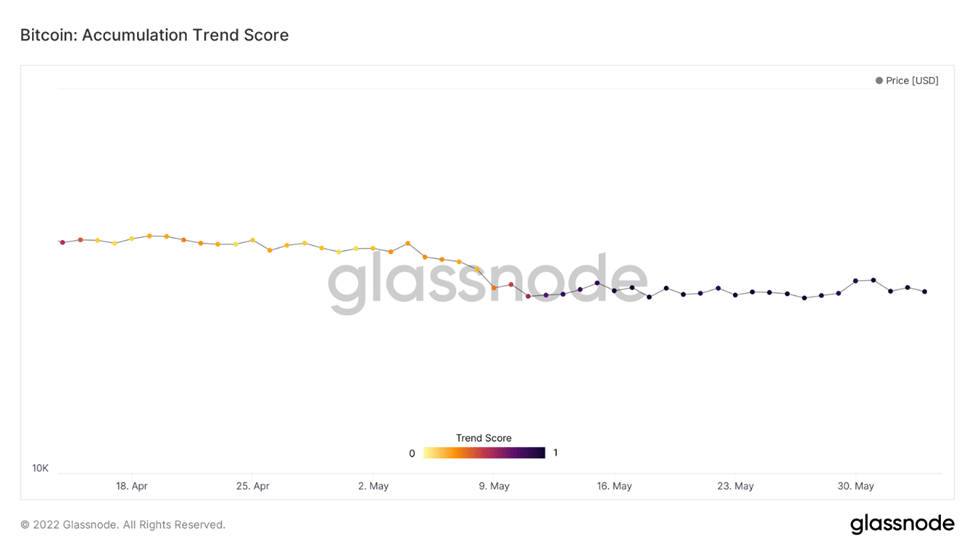

Accumulation trend score is an indicator that reflects the relative size of entities that

are actively accumulating coins on-chain in terms of their BTC holdings. Trend score

closer to 1 indicates that on aggregate, larger entities are accumulating, and a value

closer to 0 indicates they are distributing or not accumulating. Trend score shifting

closer to 1 also confirms our hypothesis of investors accumulating.

Overall Market Performance

DOW JONES

Dow Jones Industrial Average dropped marginally by 1% in the last week. The daily

chart for Dow Jones is moving within a descending channel pattern. The next

resistance is expected at 35,500.

GOLD FUTURES

Gold Futures remained neutral throughout the past week. The 4-hourly trend has

formed an ascending triangle pattern. The next resistance for Gold Futures is

expected at $2,000.

BITCOIN

Bitcoin finally stopped its downward spiral after 9 weeks. The 4-hourly trend for BTC

traversing within an ascending channel pattern. The next resistance for BTC is

expected at $40,000 and an immediate support is expected at $24,000.

ETHEREUM

Ethereum against BTC dropped by over 2% over the week. The daily trend for ETH

against BTC has formed a descending channel pattern. An immediate support is

expected at 0.055

Highlights of the week

The founder of Shiba Inu, Ryoshi has deleted all his previous

tweets. He had deactivated his account around the same

time last year on May 30, 2021. Ryoshi had last tweeted in

May 2021 and has mostly stayed away from posting. A year

later, the founder has come back only to delete all his posts

The world’s largest crypto exchange has gained regulatory

approval in Italy as it continues its expansion to new regions.

The approval allows the company to offer crypto products to

customers in Italy, as well as open offices and expand its

team in the country.

Ripple, one of the most popular blockchain companies, is

preparing to open a new office in Bangalore. Bangalore is

often called the “Silicon Valley of India”, hence it is of no

surprise that the company chose this location for its office.

Our Pick of the Week

Avalanche (AVAX)

We expect a gain of 10% from the Buy Price of 24.79 USDT and

outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today