WEEKLY MARKET REPORT

NASDAQ – Global leading Tech Index

The NASDAQ Index corrected around 2% and closed at 25,192 in the last week. The critical support is expected at 25,000 levels and next resistance is expected around 26,000 levels.

Pepsico & Regeneron pharma were the strongest stocks for the week, rising around 4% and 3% respectively.

The NASDAQ Index is expected to bounce back this week

CRYPTO

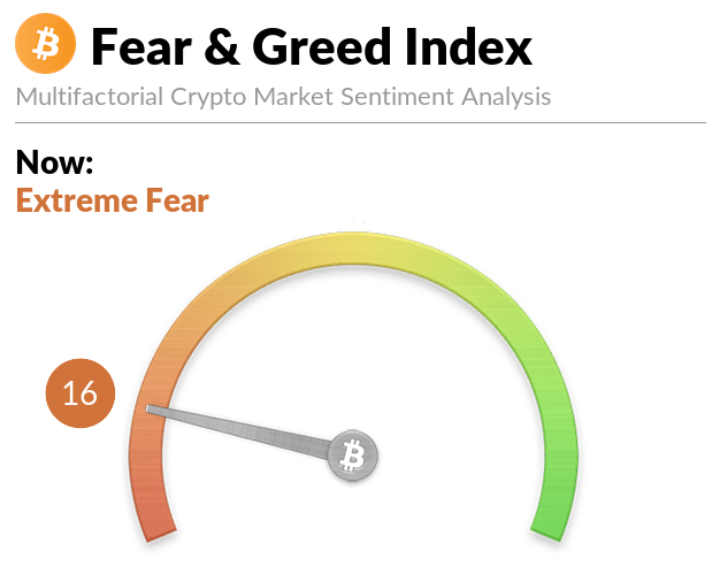

What is the general sentiment for Crypto?

The sentiment towards the cryptocurrency market remained in the FEAR zone. Compared to last week, the Fear & Greed Index decreased to “16” from the previous level of “20”

CVDD-TOP CAP PRICE CHART INDICATOR

Bitcoin is expected to continue its upward movement. As per the Terminal price model, Bitcoin’s cycle top price prediction is around $290,000

Bitcoin chart

$BTC corrected around 2.5% and closed at 88K in the last week. The immediate support is expected at $80K and resistance is expected at $100K. Bitcoin is expected to bounce back as it trades at the lower end of the regression channel.

ETH/USDT

$ETH remained flat and closed at $3.1k in the last week. An immediate support is expected around $2800 and resistance is expected around $3500 levels. ETH is expected to bounce back this week

Strong momentum tokens to watch for – CHZ & AAVE

NIFTY

The Nifty50 Index corrected by 0.5% and closed at 26,046 in the last week. An immediate support is expected around 25,650 and resistance is expected around 26,700 levels. Nifty is expected to gain this week

Sector expected to perform in the coming week – Metals & Financials

PICK OF THE WEEK – HINDCOPPER

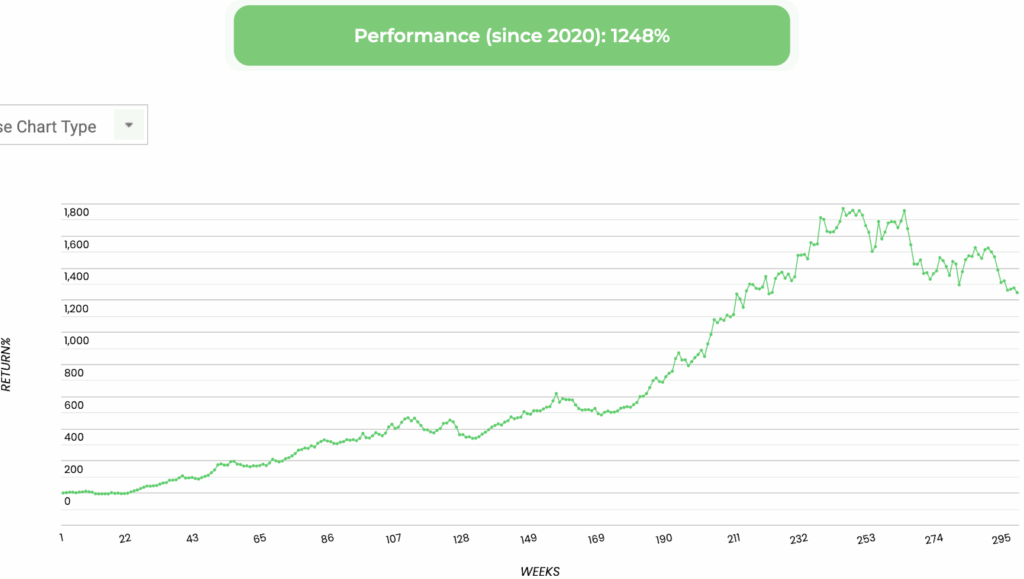

MINTALPHAA – AI Based Stock Portfolio

MintAlphaa: Where Cutting-Edge AI Meets Superior Returns. Unlock the potential of the market with our high-performing AI portfolios and advanced investment strategies.

Automate your stock investments today with MINTALPHAA

Listen to our founder speaking about crypto investments on the Spotify podcast with financial express.