Crypto Markets

Crypto Sentiment

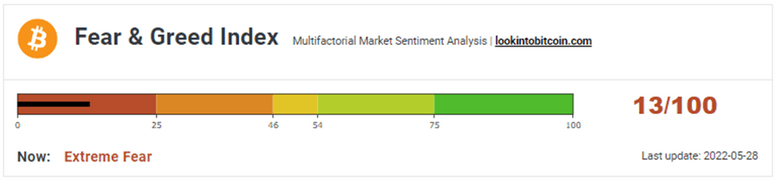

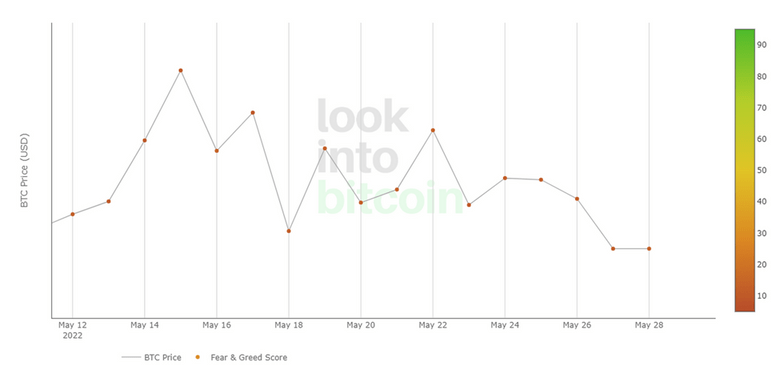

This week the sentiment towards the cryptocurrency markets has not improved or

deteriorated. The fear and greed index has remained at “13”.

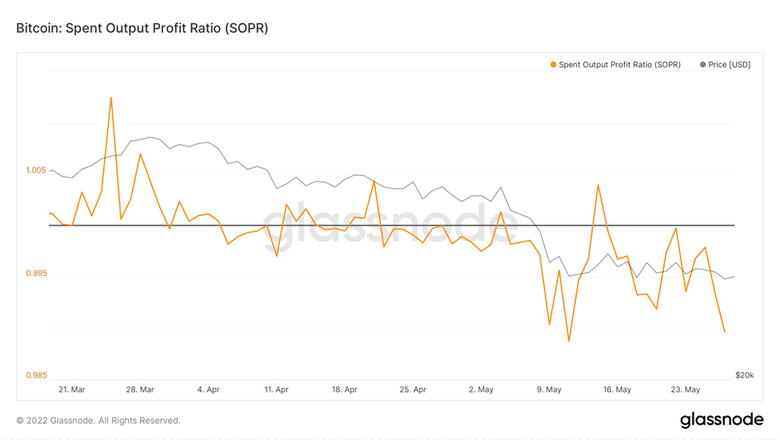

SOPR value had broken the value of 1 and has continued its downward trend. This

indicates that Bitcoin is still being sold at a loss. This is a classic panic selling behavior

and it is being quietly sold to the accumulators. Eventually the panic sellers will run out

of BTC to sell or may calm down.

Demand for Cryptocurrency

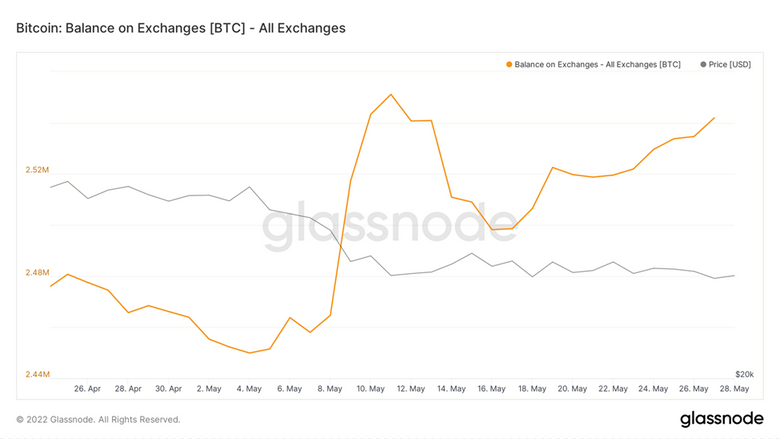

The poor price action could be attributed to the balance on exchanges. This onchain

has risen over the past week and is almost close to its local high. This however still

represents a small inflow in the relatively large outflow that has occurred since the

start of the year.

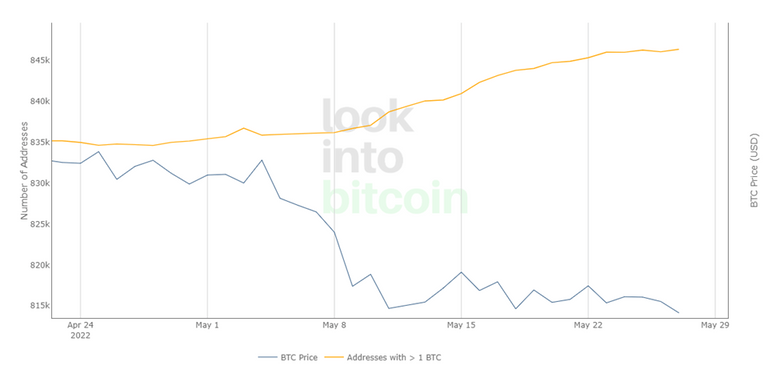

The overall buying behavior however seems to be strong, as the number of addresses

with at least 1 BTC is still on the uptrend and has been hitting new all-time highs.

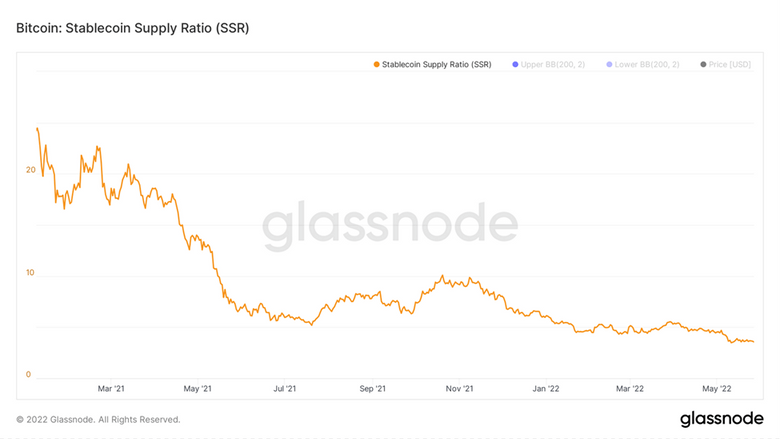

Although the balance on exchanges has started to rise, the buying power of the

stablecoins in the entire cryptocurrency space is also increasing.

The SSR is currently at an all-time low which in laymen’s terms indicates that

approximately 28% of all Bitcoins can be bought from the markets. We can also infer

that money waiting in the sidelines and ready to be deployed in the markets. Once this

money is deployed the buying pressure is likely to move the price towards the upside.

Is the Smart money buying?

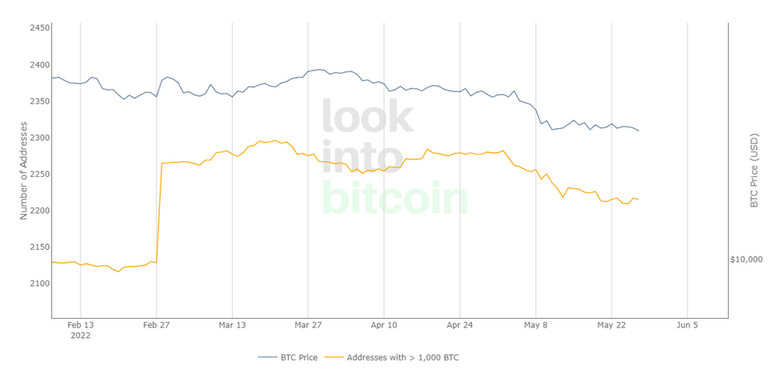

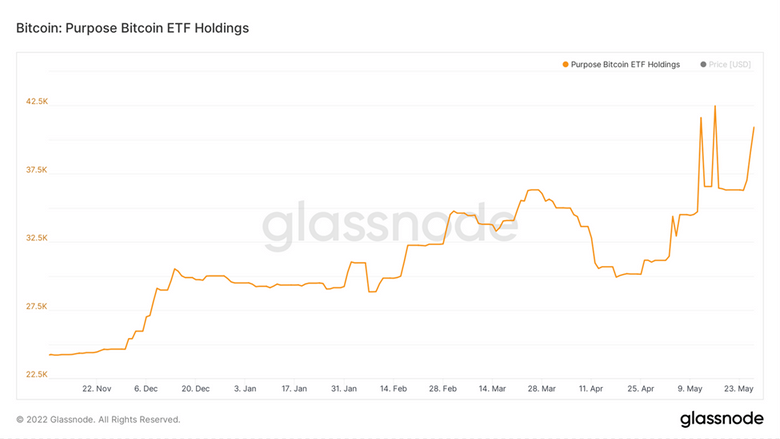

We will consider wallet addresses with more than 1000 Bitcoins. Based on the below

chart we can clearly spot accounts with more than 1000 BTCs are increasing &

decreasing at the same pace. This data point has started to stabilize, however one of

the biggest Bitcoin Spot ETFs has just increased its holdings significantly.

What could play out ?

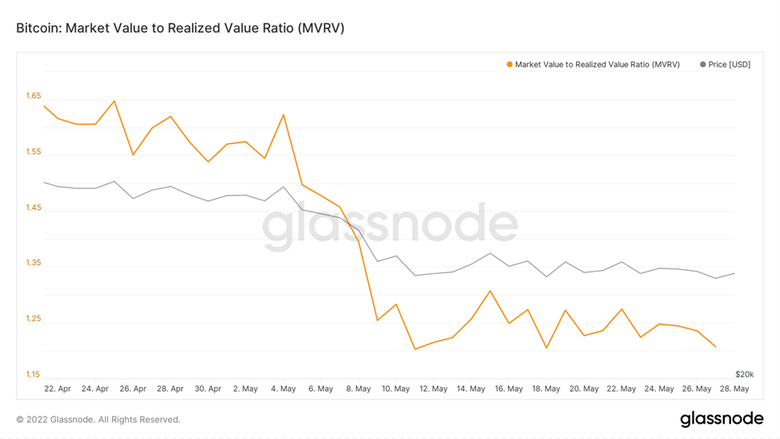

The MVRV ratio is equal to the market capital divided by realized capital of Bitcoin.

Realized capital unlike market capital does not use the current market price, but rather

uses the prices each Bitcoin when it last moved.

The current MVRV ratio has fallen to 1.20 and is trending towards to the downside.

This likely indicates that the Crypto Market is extremely close to the bottom.

Overall Market Performance

DOW JONES

Dow Jones Industrial Average surged by 6.3% in the last week. The 4-hourly chart for

Dow Jones has bounced of its support level. The next resistance is expected at 35,500.

GOLD FUTURES

Gold Futures gained marginally over the past week. The weekly trend continues to

traverse within the triangle pattern bottom making higher lows. The next resistance

for Gold Futures is expected at $2,000.

BITCOIN

Bitcoin closed lower for the 9th week in a row. The daily trend for BTC moving within a

descending triangle pattern. The next resistance for BTC is expected at $40,000 and an

immediate support is expected at $24,000.

ETHEREUM

Ethereum against BTC fell by nearly 9% over the week. The daily trend for ETH against

BTC has broken below the channel pattern and dropped below its previous support.

An immediate support is expected at 0.055

Highlights of the week

Gafisa, one of Brazil’s major real estate developers, has

announced it will now accept Bitcoin as payment for

apartment purchases, making it yet another publicly traded

firm to adopt the digital asset.

The Central African Republic (CAR), the world’s second country to legalize bitcoin after El Salvador, intends to build a bitcoin tax-free area to attract cryptocurrency firms and fans. There is a possibility that the Central African Republic could be a major cryptocurrency hub.

In an ‘Ask me Anything’ session, there was a question asked

to CZ ” If Binance goes bankrupt, are users’ wallets safe?”

This might be a fear for almost all the users but Binance said

that it would reimburse the users before the shareholders if

the exchange goes bankrupt.

Our Pick of the Week

Tron (TRX)

We expect a gain of 10% from the Buy Price of 0.081 USDT and

outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today