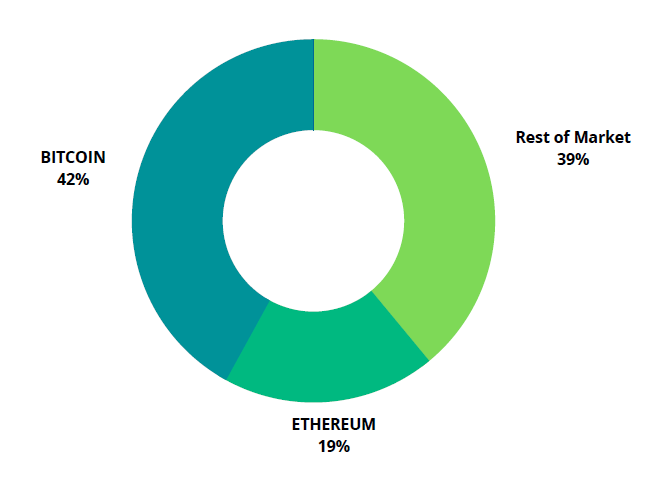

Crypto Market Dominance

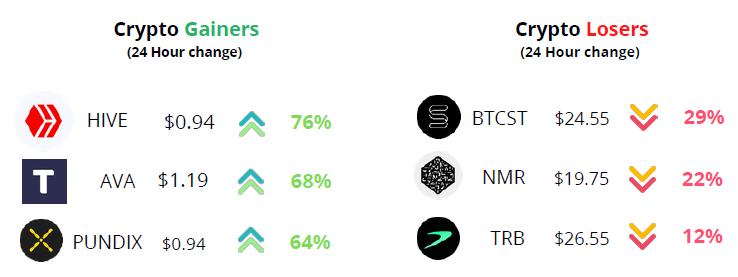

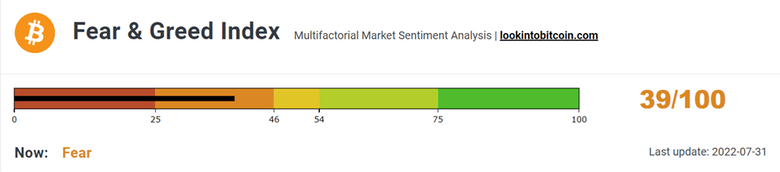

Crypto Sentiment

The sentiment towards the cryptocurrency market is slowly exiting the fear zone and

has improved from last week’s 31 to “39” this week.

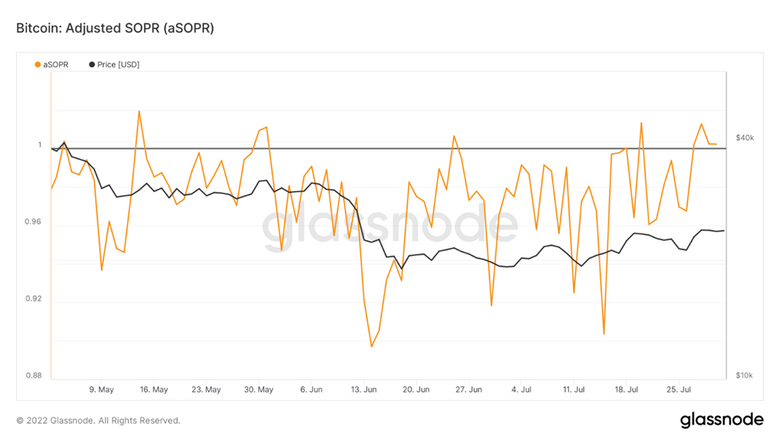

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The Adjusted SOPR filters out transactions that are younger than 1 hour, thus,

clearing out noise from the metric.

The aSOPR for this week has edged above “1”, which indicates that the coins are being

sold at their purchase price. For trend reversal the metric should stay and oscillate

above the level of 1.

Who is buying: Whales or Retail Investors?

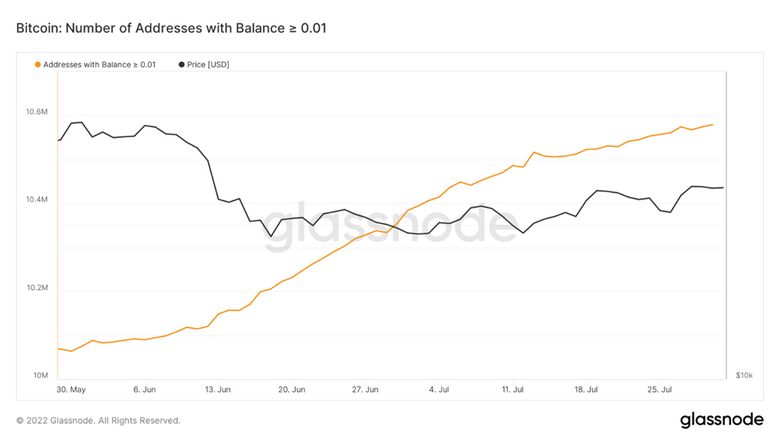

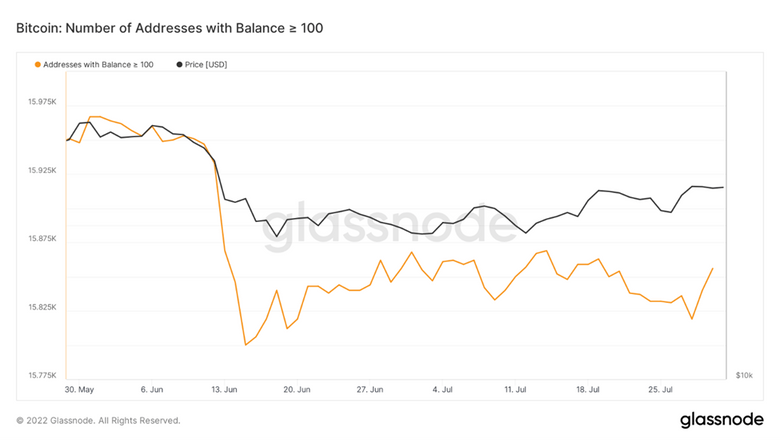

The number of addresses with at least 0.01 Bitcoin has continued its uptrend and

surpassed last week’s value. Meanwhile, the number of addresses with at least 100

BTC has increased slightly compared to last week’s data.

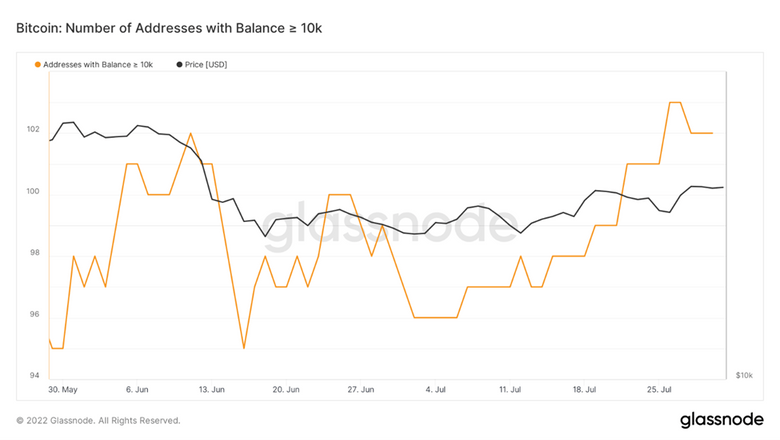

The number of addresses holding at least 10,000 BTC has increased by 5% in the last

month. This shows that the whales or large investors have been adding during the

bear phase and the recent price movement is due to strong hands buying.

Are we out of the Bear Market ?

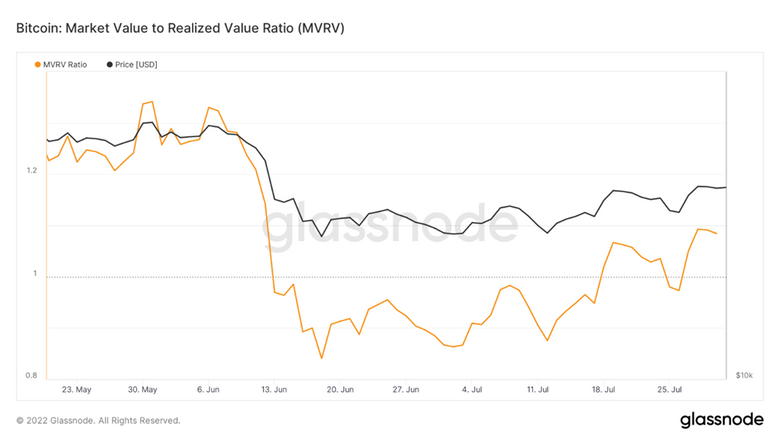

MVRV ratio is equal to the market capital divided by realized capital of Bitcoin. Realized

capital unlike market capital does not use the current market price, but rather uses the

prices each Bitcoin when they last moved.

Currently, the metric stands at 1.08. In the previous bear markets, we have seen that

the metric falls below 1 and oscillates below 1 for few days or months which mark the

bottom of the bear market. As the metric moves above 1, the trend reverses. Since, the

metric is above 1, we can say that the market has started moving out of the bear

phase.

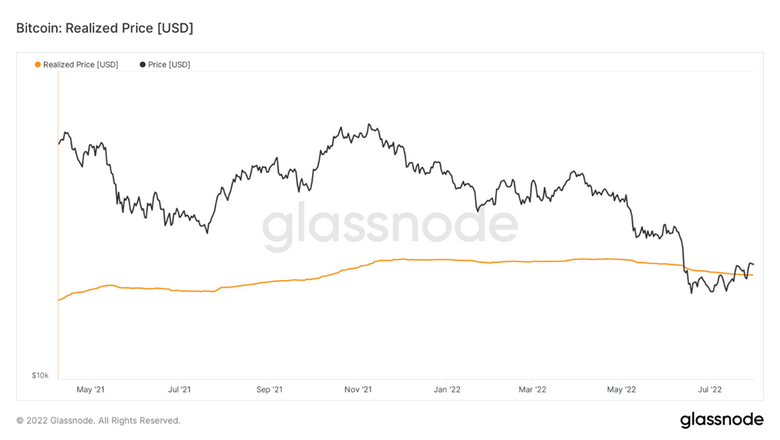

Realized price is the value at which coins were purchased divided by the total number

of coins in circulation. Realized price acts as a psychological support area and in all

bear markets we have noticed that market bottom occurs when realized price is more

than the market price.

The BTC price has moved above the realized price and this might suggest the end of

bear market but $23,213 (realized price before price went below it) acts as a major

support area and the price must sustain above it for the momentum to continue.

Overall Market Performance

DOW JONES

Dow Jones Industrial Average gained by 3% in the last week closing in green for the

fourth consecutive week. The daily trend for Dow Jones has broken above the

descending channel pattern. An immediate resistance is expected at 33,300 level.

GOLD FUTURES

Gold Futures made over a 3% surge over the last week, nearly touching the $1,800

mark. The daily trend for Gold continues to traverse within a descending channel

pattern, moving in an uptrend. The next resistance is expected at $1,840

BITCOIN

Bitcoin crossed the $24,000 level during the past week. The daily trend for BTC is

moving within an ascending channel pattern. The next resistance is expected at $32.3K

and key support is expected at $19K.

ETHEREUM

Ethereum against BTC closed positive for the 4th successive week. The 4-hourly trend

for ETH-BTC has formed an ascending triangle pattern. The next resistance is expected

at 0.076 and an immediate support is expected at 0.046

Highlights of the week

Bitcoin Lightning card is faster than Mastercard in

contactless payment. The card powered by the Bitcoin

Network completed the payment in 3.4 seconds, whereas

the Mastercard took almost double the time

Earlier Tesla had sold 75 percent of its bitcoin (BTC) holding

for a total of $936 million. In the process, the company made

a profit of $64 million in the second quarter of 2022.

Cathie Woods Ark sold 1.4M Coinbase shares worth $75M.

This news comes days after it was reported that the U.S.

Securities and Exchange Commission is investigating the

company for allowing Americans to trade in tokens that

should have been registered as securities.

Our Pick of the Week

Chiliz (CHZ)

We expect a gain of 10% from the Buy Price of 0.1284 USDT and

outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today