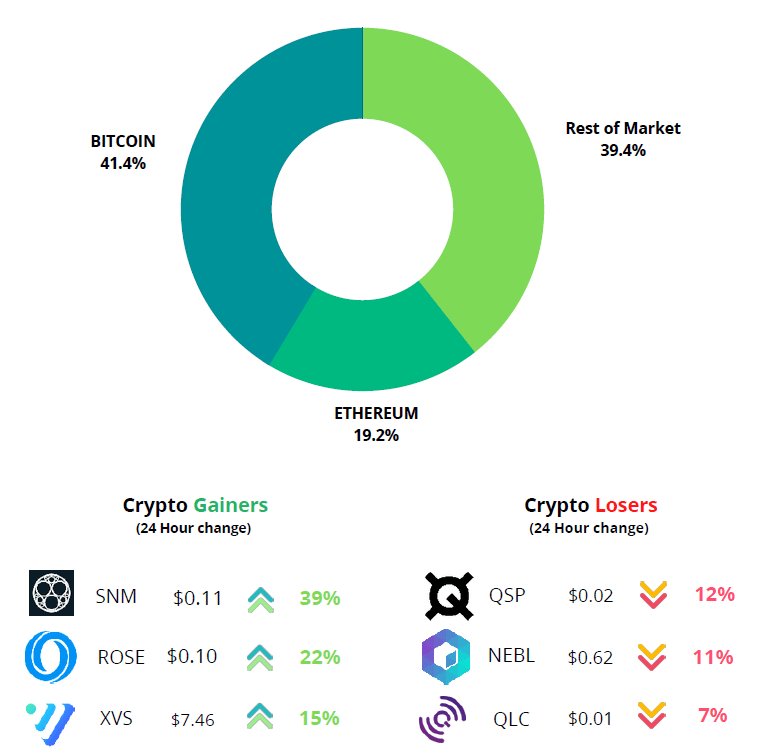

Crypto Market Dominance

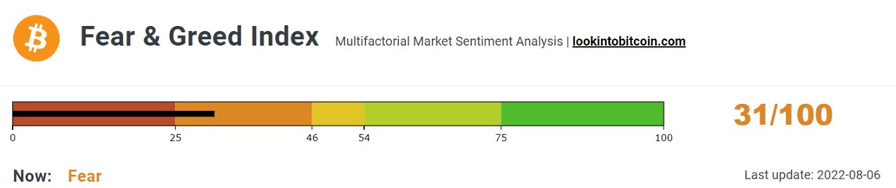

Crypto Sentiment

The sentiment towards the cryptocurrency market continues to remain in the fear

zone and compared to last week’s, the Index has dropped from 39 to “31”.

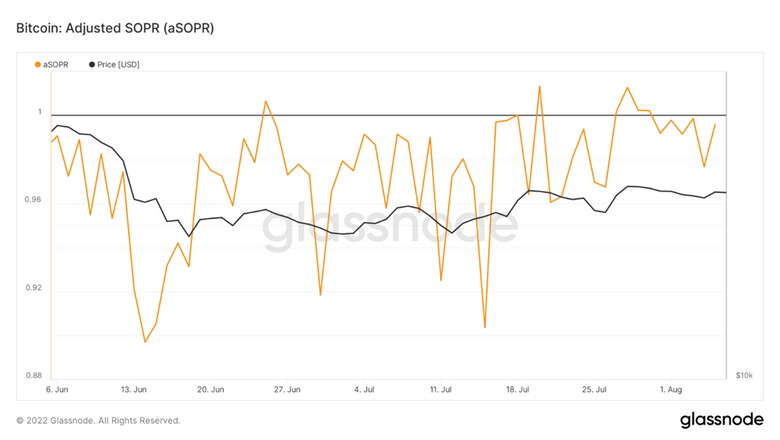

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The Adjusted SOPR filters out transactions that are younger than 1 hour, thus,

clearing out noise from the metric.

The aSOPR for this week is at 0.99 which means that the coins are being sold close to

their purchase price. For a trend reversal, the metric should stay and oscillate above 1.

The metric has currently failed to oscillate above 1 and hence, doesn’t confirm to a

trend reversal.

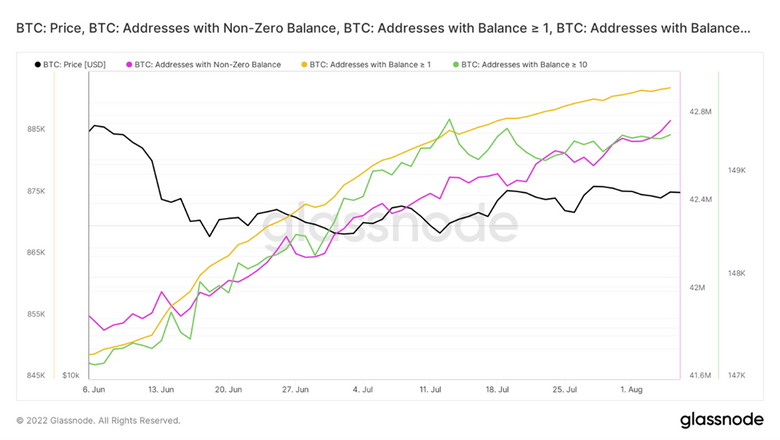

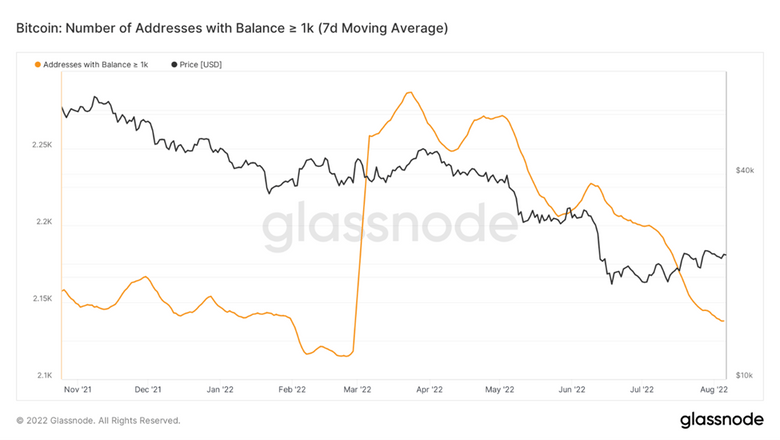

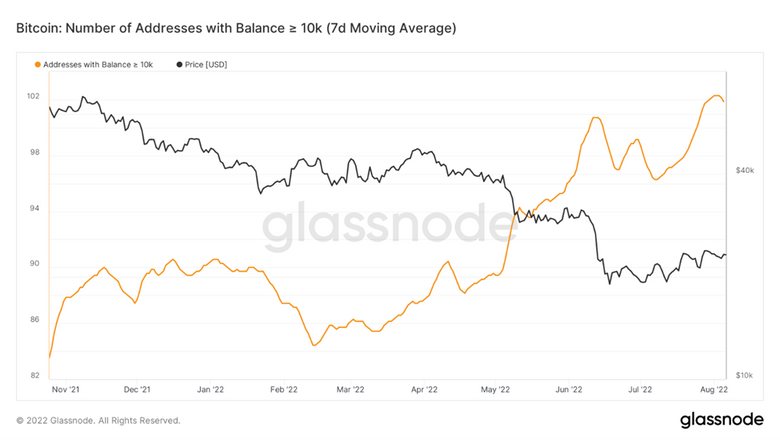

Who is buying: Whales or Retail Investors?

The number of addresses with non-zero balance is at an all time high of 42.7 million.

Similar trend can be seen in the number of addresses holding at least 1 and 10 BTC.

The point to ponder here is, who are selling BTC to these investors?

The number of addresses holding at least 1000 Bitcoins have decreased by 149

addresses since the year peak in Mar 2022. This indicates that these investors have

been distributing their coins.

Even though we have seen addresses holding at least 1000 coins have decreased,

An increase in the number of addresses holding at least 10,000 BTC is a positive sign and

gives strength to the price movement.

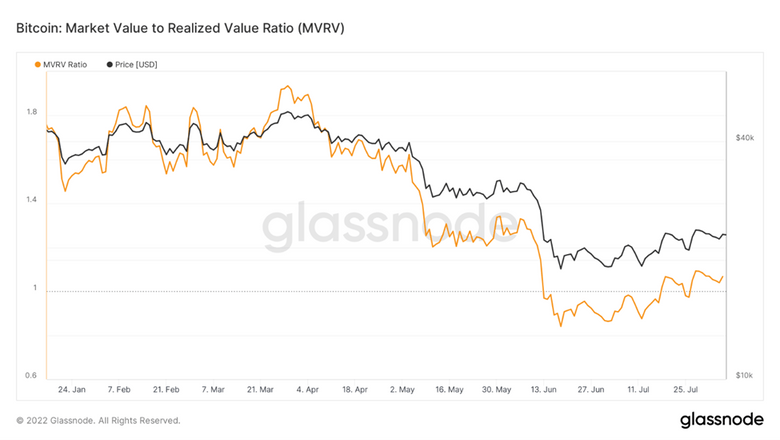

Are we out of the Bear Market?

MVRV ratio is equal to the market capital divided by realized capital of Bitcoin. Realized

capital unlike market capital does not use the current market price, but rather uses the

prices each Bitcoin when they last moved.

Currently, the metric stands at 1.06. In the previous bear markets, we have seen that

the metric falls below 1 and oscillates below 1 for few days or months which mark the

bottom of the bear market. As the metric moves above 1, the trend reverses. Since, the

metric is above 1 and has started making higher lows, we can say that the market has

started moving out of the bear phase.

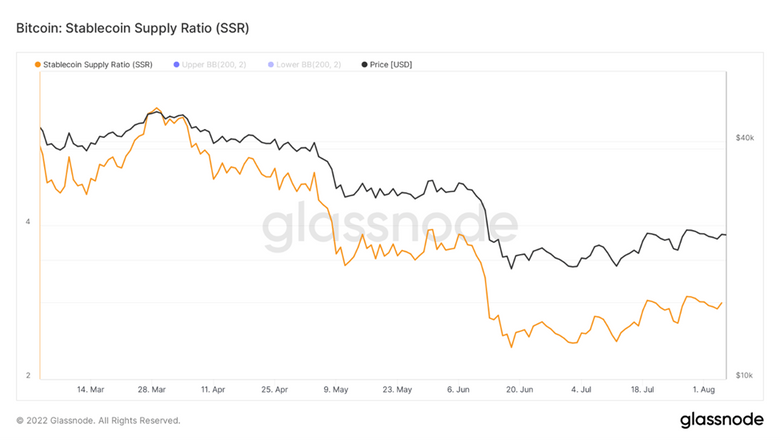

Stablecoin Supply Ratio (SSR) is the ratio of market cap of BTC divided by the market

cap of all stablecoins.

- Low SSR value indicates high Stablecoin Supply compared to that of BTC market

cap indicating potential buying pressure and possible price rise. - High SSR value indicates low Stablecoin supply compared to the market cap of BTC

indicating potential selling pressure and possible price fall.

Currently, SSR is near its bottom and has started making an upward movement which

means market has started moving away from its bottom.

Overall Market Performance

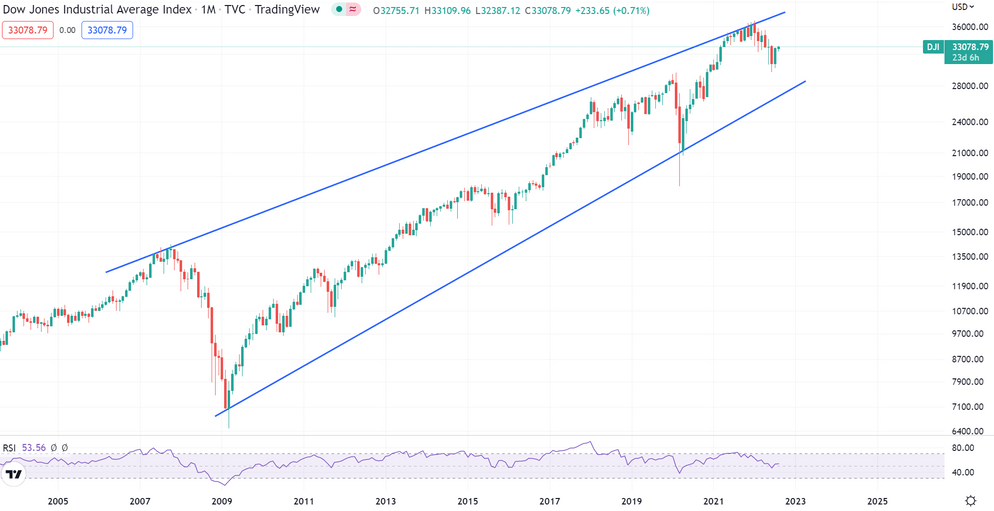

DOW JONES

Dow Jones Industrial Average remained fairly flat in the last week closing in green for

the 5th consecutive week. The monthly trend for Dow Jones is traversing within an

ascending triangle pattern. An immediate resistance is expected at 33,300 level.

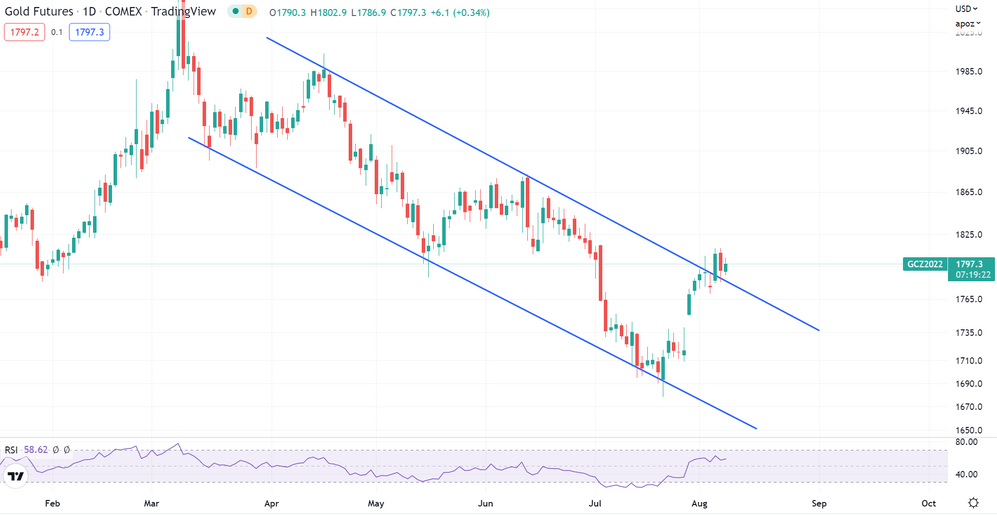

GOLD FUTURES

Gold edged above the $1,800 level last week, closing in green for the 3rd consecutive

week. The daily trend for Gold broken out of the descending channel pattern. The next

resistance is expected at $1,840

BITCOIN

Bitcoin remained fairly steady throughout last week. The daily trend for BTC is moving

within a descending channel pattern but has been on an uptrend in the recent days..

The next resistance is expected at $32.3K and key support is expected at $19K.

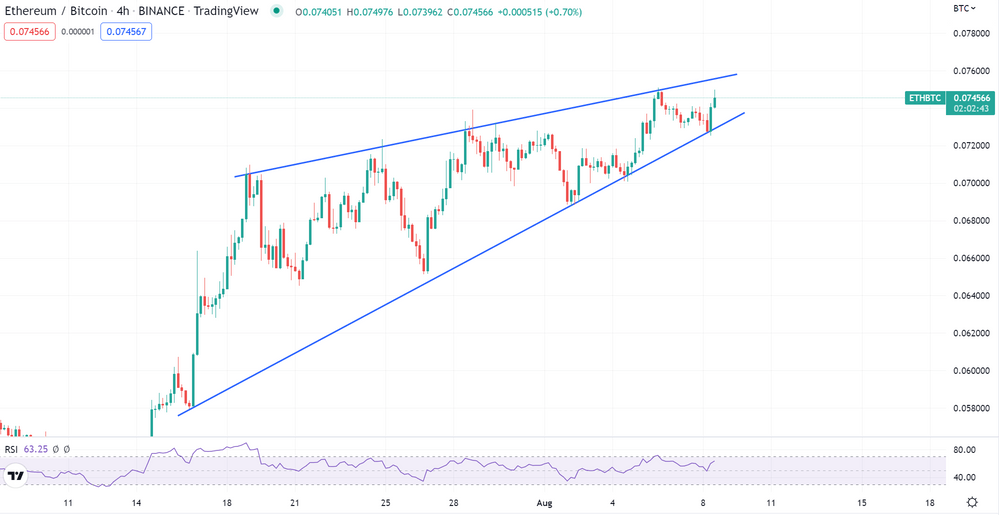

ETHEREUM

Ethereum against BTC closed positive for the 5th successive week. The 4-hourly trend

for ETH-BTC is moving within a classic triangle pattern, making higher lows. The next

resistance is expected at 0.076 and an immediate support is expected at 0.046

Highlights of the week

Tiffany & Co has announced the launch of an NFT collection,

exclusive to Cryptopunk holders. The collection has a supply

of only 250 and are priced at 30 ETH each ($50K USD).

RAKBANK announced an agreement with Kraken that will

allow UAE residents to trade digital assets using a local

Emirati bank account and dirhams.

Starbucks is looking for digital collectibles to better engage

customers and is planning to launch its Web3-based rewards

the program next month.

Our Pick of the Week

Loopring (LRC)

We expect a gain of 10% from the Buy Price of 0.4458 USDT and

outperform BTC in the coming week

Target Achieved

Chiliz (CHZ)

CHZ umped by 25% in just a day and achieved our predicted target of

10%, outperforming Bitcoin which gained only 5% in the same period

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today