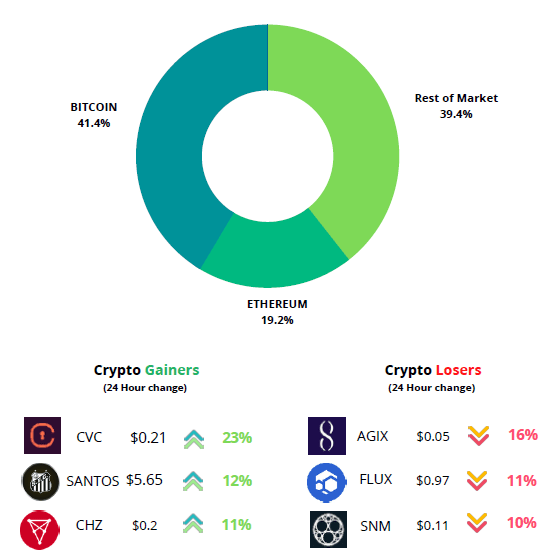

Crypto Market Dominance

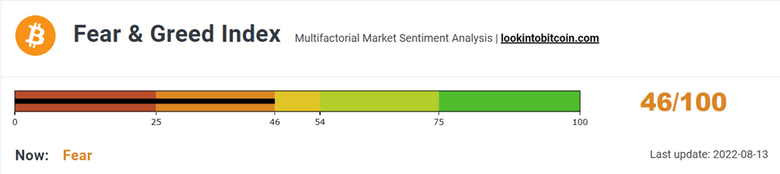

Crypto Sentiment

The sentiment towards the cryptocurrency market has entered back into the “neutral

zone” after nearly four and half months and currently is at “46”.

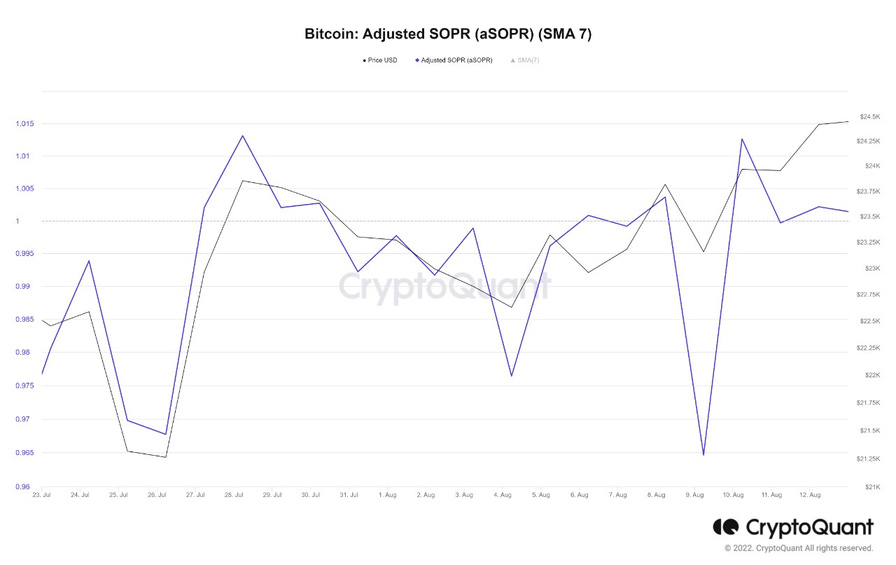

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The Adjusted SOPR filters out transactions that are younger than 1 hour, thus,

clearing out noise from the metric.

The aSOPR for this week stands at 1.0 which means that the coins are being sold at

their purchase price. For a trend reversal the metric should stay and oscillate above 1.

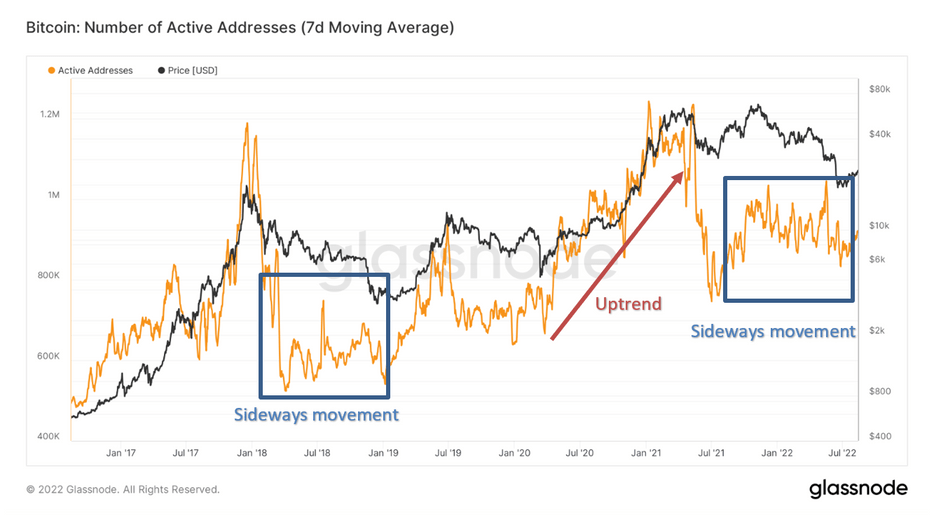

Are we out of the Bear Market ?

The number of active addresses is directly proportional to the number of active users.

It is important to note that the number of active addresses doesn’t give the exact

number of active users as a user might have more than one address.

During a bull market, the number of active addresses increases tremendously and a

sharp fall is experienced as prices begin to fall showing weaker hands leaving the

market. Historically, we have seen the metric starts oscillating within a range after the

fall in the bear market and increases sharply as the market prepares to move out of

the bear phase. In the current market, the metric is moving sideways showing that the

market is sustained by the HODLers. We might see massive price movement once the

metrics start making higher highs.

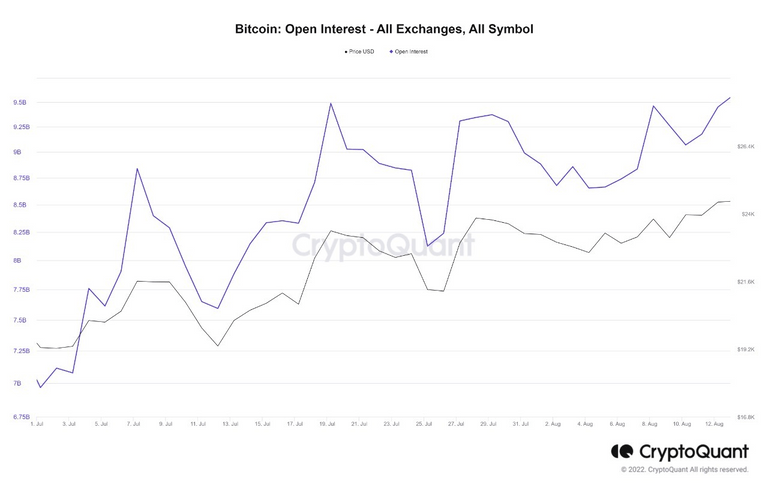

Open Interest (OI) is defined as the number of open positions which includes both long

and short positions. An increase in OI means more contracts are being opened which

indicates more liquidity, volatility, and attention coming into the derivative market

whereas decrease in OI indicates less number of future contract or positions which

might trigger short/long squeeze.

OI has started showing increasing trend since July and has increased by 70% since the

last month. The increasing trend supports current price movement of Bitcoin price.

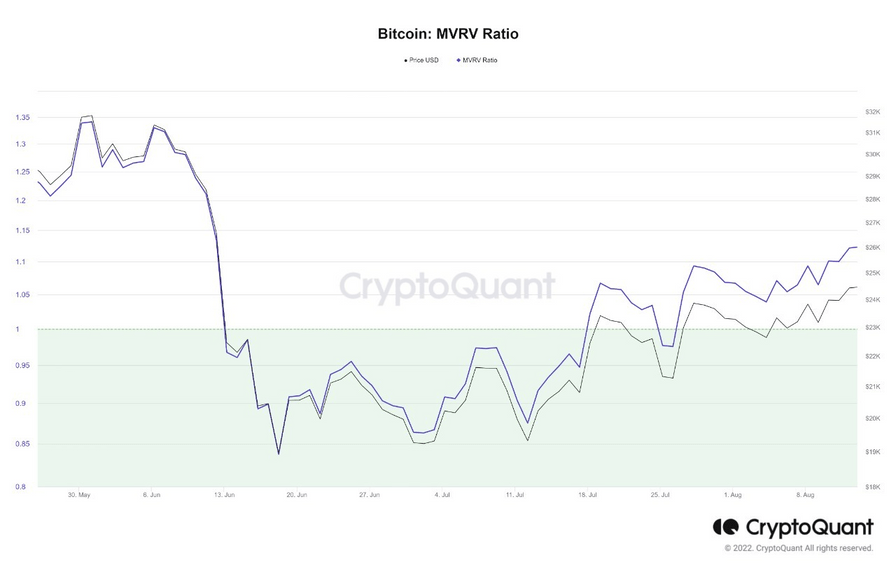

MVRV ratio is equal to the market capital divided by realized capital of Bitcoin. Realized

capital unlike market capital does not use the current market price, but rather uses the

prices each Bitcoin when they last moved.

Currently, the metric stands at 1.12. In the previous bear markets, we have seen that

the metric falls below 1 and oscillates below 1 for few days or months which mark the

bottom of the bear market. As the metric moves above 1, the trend reverses. Since, the

metric is above 1 and has started making higher lows, we can say that the market has

started moving out of the bear phase.

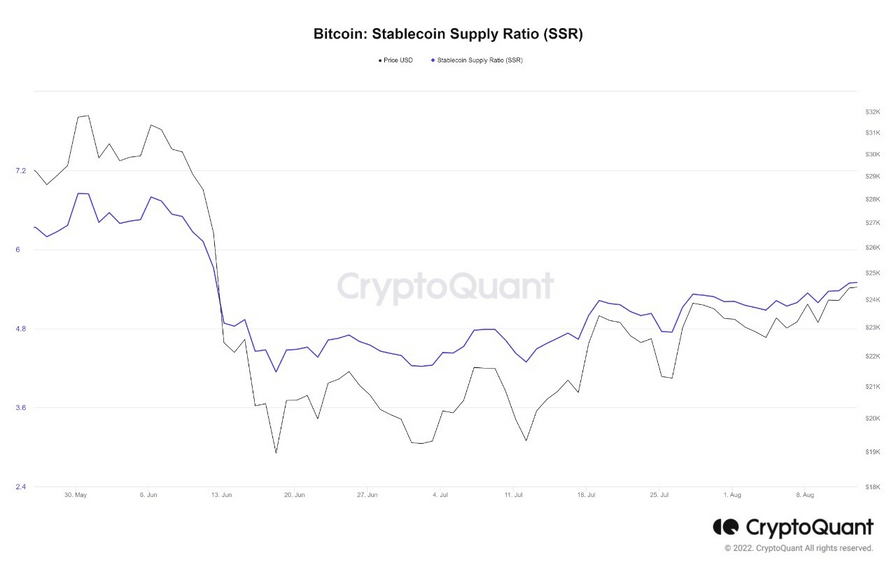

Stablecoin Supply Ratio (SSR) is the ratio of market cap of BTC divided by the market

cap of all stablecoins.

- Low SSR value indicates high Stablecoin Supply compared to that of BTC market

cap indicating potential buying pressure and possible price rise. - High SSR value indicates low Stablecoin supply compared to the market cap of BTC

indicating potential selling pressure and possible price fall.

Currently, SSR is near its bottom and has started making an upward movement which

means market has started moving away from its bottom.

Overall Market Performance

DOW JONES

Dow Jones Industrial Average gained nearly 3% during the past week closing in green

for the 6th straight week. The daily trend for Dow Jones is on the verge of breakout

from the megaphone pattern. The next resistance is expected at 34,700 level.

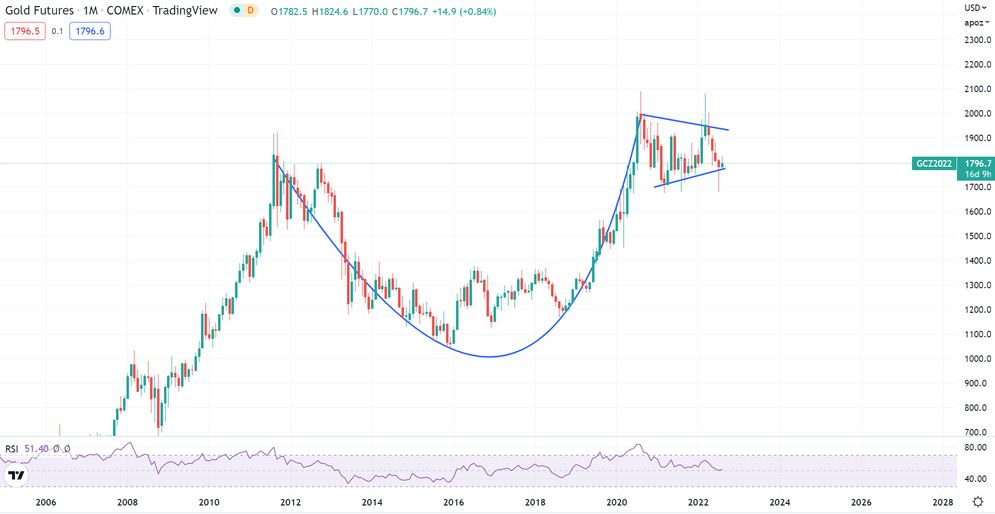

GOLD FUTURES

Gold Futures dipped below the $1,800 level last week, falling by just over 1%. The

monthly trend for Gold has formed a Cup & handle pattern. The next resistance is

expected at $1,840

BITCOIN

Bitcoin gained nearly 5% fin the past week. The 4-hourly trend for BTC is moving within

an ascending channel pattern making higher lows. The next resistance is expected at

$32.3K and key support is expected at $19K.

ETHEREUM

Ethereum against BTC closed positive for the 6th successive week, gaining 9%. The

weekly trend for ETH-BTC is moving within an ascending triangle pattern. The next

resistance is expected at 0.088.

Highlights of the week

Netherlands-based crypto investment firm Maven 11 has

launched its third lending pool on Maple Finance, giving

borrowers access to liquidity amid the bear market

Launch Cart, a rival to Shopify, integrates Lightning and

Bitcoin payments. The platform anticipates that by utilizing

spontaneous payments made through Bitcoin’s Lightning

Network will eliminate issues with fraud.

Nas Daily, the creator tech platform & Invisible college, will

enable $2,000 worth of courses that would cover topics such

as NFT investing, Community Building, Video Editing, and

Crypto fundamentals. Their goal is to become “The largest

web3 learning library on the internet.”

Our Pick of the Week

Gala (GALA)

We expect a gain of 15% from the Buy Price of 0.06930 USDT and

outperform BTC in the coming week

Target Achieved

Loopring (LRC)

LRC jumped by 12% in just a day and achieved our predicted target of

10%, outperforming Bitcoin which gained only 5% in the same period.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today