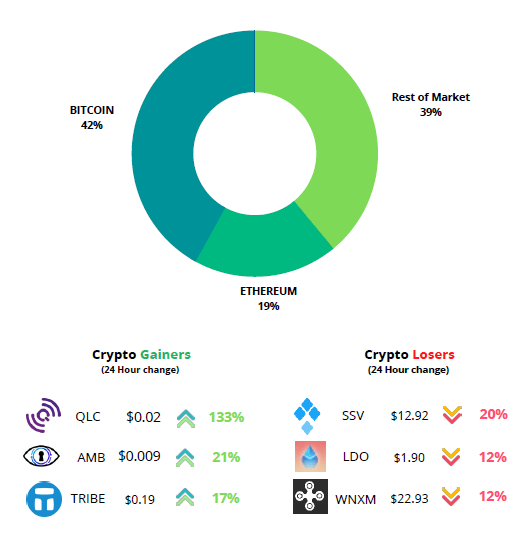

Crypto Market Dominance

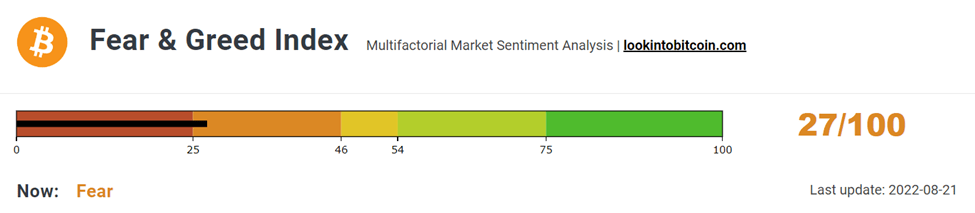

Crypto Sentiment

The sentiment towards the cryptocurrency market plummeted into the “extreme fear”

zone falling from 46 last week to “27” this week.

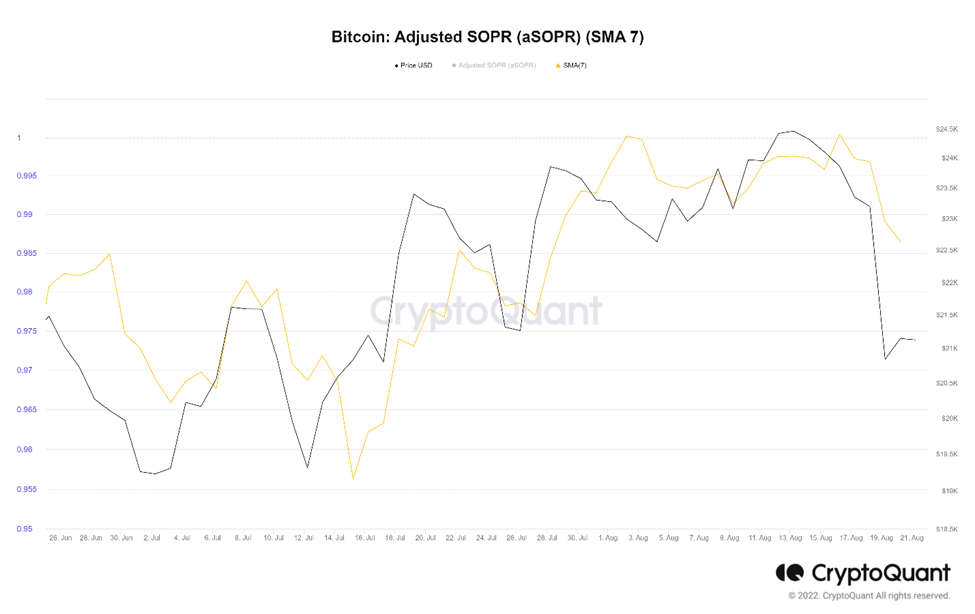

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The Adjusted SOPR filters out transactions that are younger than 1 hour, thus,

clearing out noise from the metric.

The aSOPR for this week is at 0.98 which indicates that the coins are being sold close to

their purchase price. For a trend reversal to take place, the metric should stay and

oscillate above 1.

Are we out of the Bear Market ?

The number of active addresses is directly proportional to the number of active users.

It is important to note that the number of active addresses doesn’t give the exact

number of active users as a user might have more than one address.

During a bull market, the number of active addresses increases tremendously and a

sharp fall is experienced as prices begin to fall showing weaker hands leaving the

market. Historically, we have seen the metric starts oscillating within a range after the

fall in the bear market and increases sharply as the market prepares to move out of

the bear phase. In the current market, the metric is moving sideways showing that the

market is sustained by the HODLers. We might see massive price movement once the

metrics start making higher highs.

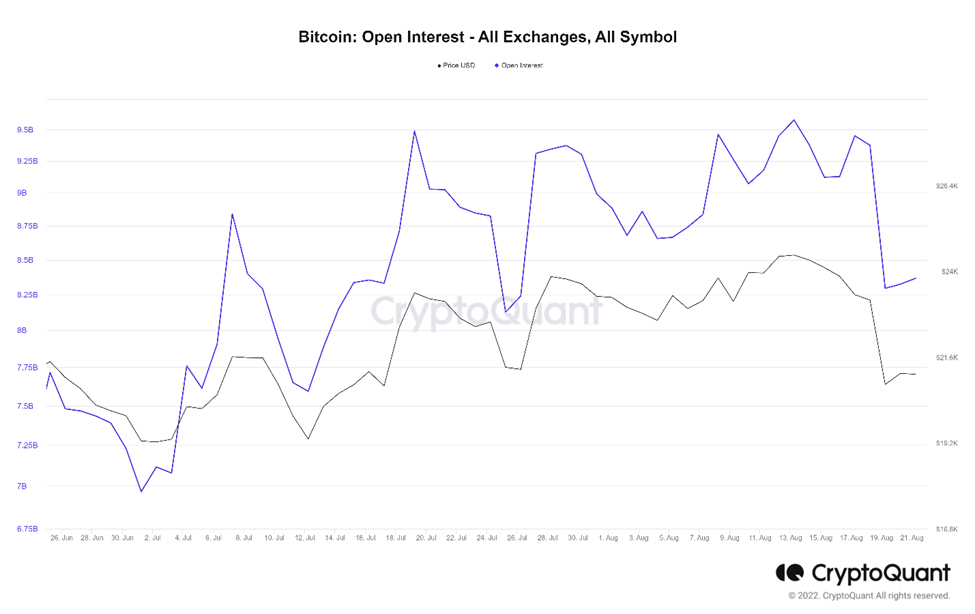

Open Interest (OI) is defined as the number of open positions which includes both long

and short positions. An increase in OI means more contracts are being opened which

indicates more liquidity, volatility, and attention coming into the derivative market

whereas decrease in OI indicates less number of future contract or positions which

might trigger short/long squeeze.

Bitcoin prices have fallen by more than 15% in the last week, leading to a decrease in

open interest by 1.3 billion.

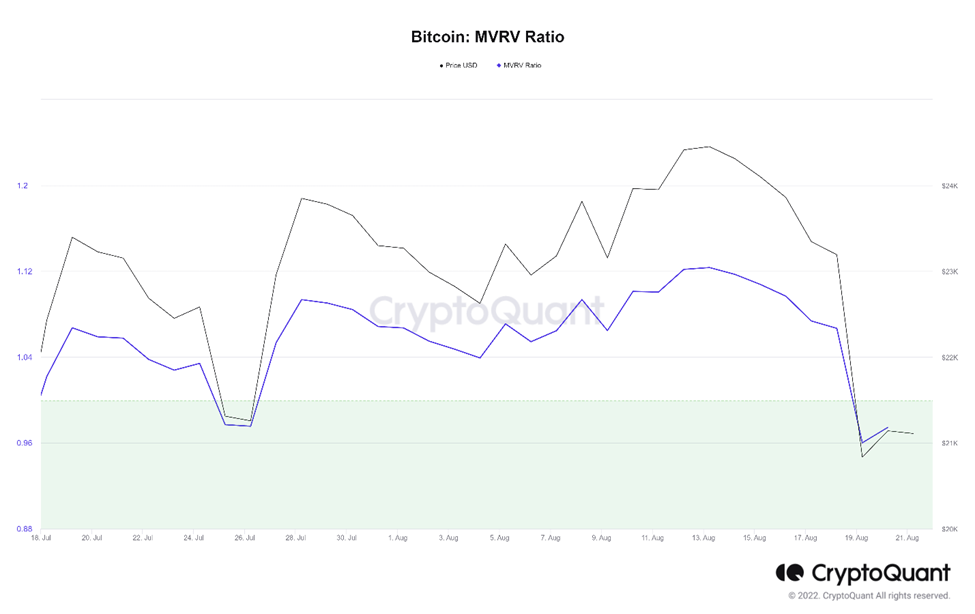

MVRV ratio is equal to the market capital divided by realized capital of Bitcoin. Realized

capital unlike market capital does not use the current market price, but rather uses the

prices each Bitcoin when they last moved.

Currently, the metric stands at 1.12. In the previous bear markets, we have seen that

the metric falls below 1 and oscillates below 1 for few days or months which mark the

bottom of the bear market. As the metric moves above 1, the trend reverses. Since, the

metric is above 1 and has started making higher lows, we can say that the market has

started moving out of the bear phase.

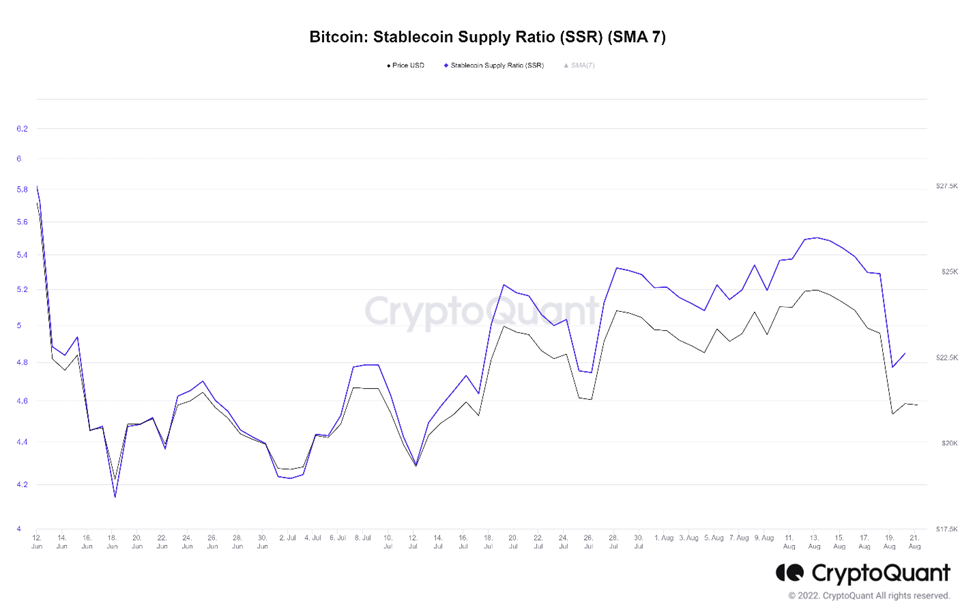

Stablecoin Supply Ratio (SSR) is the ratio of market cap of BTC divided by the market

cap of all stablecoins.

Low SSR value indicates high Stablecoin Supply compared to that of BTC market

cap indicating potential buying pressure and possible price rise.

High SSR value indicates low Stablecoin supply compared to the market cap of BTC

indicating potential selling pressure and possible price fall

After SSR made its bottom in June, the metric had been making an upward movement

for the past 2 years. The recent price drop has led to the drop in the metric from 5.5 to

4.7

Overall Market Performance

DOW JONES

Dow Jones Industrial Average was fairly flat throughout the last week closing in red for

after six weeks. The daily trend for Dow Jones broke above the megaphone pattern

and is retesting the upper trendline. The next resistance is expected at 34,700 level.

GOLD FUTURES

Gold Futures dipped by nearly 1% level last week. The daily trend for Gold is moving

withing the descending triangle pattern, bouncing of the upper trendline. The next

resistance for Gold is expected at $1,840 and next support is expected at $1,680

BITCOIN

Bitcoin dropped by over 11% in the past week as the Dollar index strengthened. The

daily trend for BTC is moving within an ascending channel pattern making higher highs.

The next resistance is expected at $32.3K and key support is expected at $19K.

ETHEREUM

Ethereum against BTC weakened during the week, falling by 5.5%. The weekly trend for

ETH-BTC is moving within an ascending triangle pattern. The next resistance is expected

at 0.088.

Highlights of the week

Binance obtains in-principle approval to operate in

Kazakhstan. The Astana Financial Services Authority, or AFSA,

an independent financial regulator in Kazakhstan, has taken

a step towards licensing major cryptocurrency exchange

Binance to operate in the country.

Ripple has announced that foreign exchange company

Travelex will utilize RippleNet’s ODL(On-demand Liquidity) to

facilitate cross-border payments between enterprises by

utilizing Ripple’s XRP token.

Shima Capital fund has raised $200 million & is set to deploy

between $500,000 and $2 million in pre-seed funding for

crypto- and blockchain-focused companies at the intersection

of consumer products, decentralized infrastructure and

futuristic blockchain technology.

Our Pick of the Week

Manchester City Fan Token (CITY)

We expect a gain of 10% from the Buy Price of 6.888 USDT and

outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today