Uniswap Report – 11th February 2022

Overview:

Uniswap is a popular decentralized cryptocurrency exchange and a crucial part of the DeFi protocol that operates on the Ethereum blockchain.

The CMP of UNI on 11th February is $11.60

What is DeFi?

Traditional financial services are all centralized (administered by a single authority or handled in a single location). Fraud, mismanagement of cash, theft, and limits on using your own money are some of the risks and issues associated with centralized financial services. DeFi is an acronym for Decentralized Finance (DeFi is a kind of Dapp). Decentralized applications (Dapps) are decentralized applications that are published on networks such as Ethereum). It is a financial service that does not have a centralized authority. It solves these issues by allowing users to have total custody and management of their money and to earn higher returns by removing the third party.

Decentralized exchange: These programs allow users to exchange one cryptocurrency for another. The top DeFi applications in this category are Uniswap and Sushiswap.

What is Uniswap?

Uniswap is a cryptocurrency exchange that operates on a decentralized network. Through the use of smart contracts, the protocol enables automatic transactions between cryptocurrency tokens on the Ethereum blockchain.

Instead of depending on a single central server, a decentralized network design spreads workloads over several workstations.

It is currently #24 (based on Mcap) in the cryptocurrency market. Uniswap’s native token “UNI” has a max supply of 1 billion UNIs and currently has 631.307 million UNIs (63%) in circulation. It is currently listed on all the major exchanges.

Curve Finance and Balancer are among Uniswap’s main competitors.

How Uniswap add value?

In a centralized crypto exchange, the third party that manages the exchange retains the majority of authority over your account. In contrast, with a decentralized exchange, you retain complete control over the account.

This is also another important reason why decentralized exchanges are gaining popularity. However, it is equally to blame for the increased complexity of such systems.

Decentralized exchanges provide more security than centralized exchanges. Hackers pose a significant danger while dealing with centralized crypto exchanges. They can hack the third party that utilizes private keys to access all of the users’ cash, and you may lose your whole investment.

Several similar occurrences have occurred in the past, and centralized exchanges work hard to make themselves safer for their clients. A decentralized exchange eliminates the possibility of hacking and losing cash as a result of such operations.

Centralized exchanges are simpler to govern than decentralized exchanges. Centralized platforms require licenses and must follow the regulations of their region’s local regulatory authority.

Decentralized exchanges, unlike centralized exchanges, do not have regulation since it is extremely difficult to do so due to its distributed blockchain. This implies that even if a government outlaws cryptocurrency exchanges, decentralized exchanges can continue to function in certain areas.

Because different users place specific orders based on market patterns, centralized bitcoin exchanges have higher liquidity. As a result, if an asset is in high demand, multiple users would buy or sell it accordingly. It also features market makers that add liquidity to the marketplace.

Because order matching takes time, decentralized systems do not have as much liquidity as centralized platforms. Another significant factor is their lack of popularity.

The Uniswap app is incredibly user-friendly, so learning how to use it doesn’t take long. It’s simple to link a crypto wallet, exchange one cryptocurrency for another, or deposit your cryptocurrency in a liquidity pool.

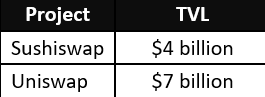

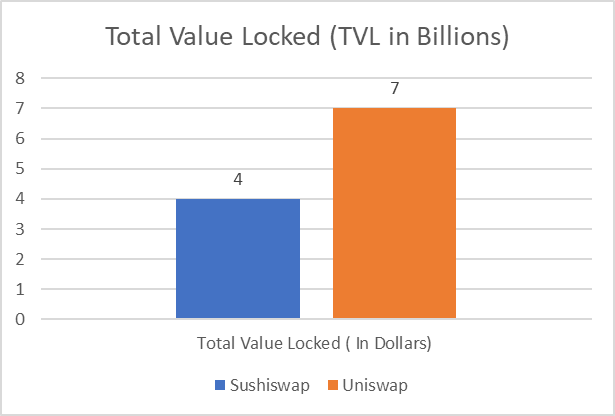

This is where Uniswap’s size comes into play. In terms of total value locked (TVL) – the amount of crypto money in its liquidity pools – it is one of the largest decentralized exchanges. You should have no trouble trading crypto or earning interest as a liquidity provider on Uniswap.

How Uniswap works:-

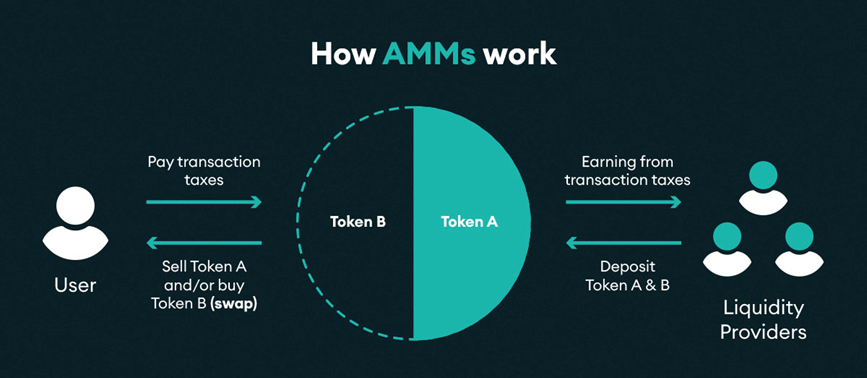

Holding assets for a longer period of time may make it more difficult to sell them. Uniswap’s decentralized exchange’s liquidity pools eliminate market order differences between sellers and buyers. Liquidity pools in the DEX protocol might aid in the development of a vast collection of assets for trading, which would then aid in the resolution of any market liquidity difficulties. Most importantly, for increased operation, the world’s largest DEX incorporates a unique Automated Market Maker or AMM algorithm.

The Automated Market Maker, or AMM technology, is the driving factor behind the Uniswap DEX protocol. It is essentially a smart contract that is used to manage liquidity pools and provide tokens that are used to facilitate transactions. The AMM algorithm aids in determining the effective price of a token based on the interaction between token supply and demand in liquidity pools.

As an automated liquidity protocol, the AMM smart contract provides incentives for people on the exchange to take on the role of liquidity providers. Basically, the users on Uniswap pool their money for creating a fund that they can use for trades on the platform. It is important to note that each listed token has its respective liquidity pool where users can contribute. The AMM protocol helps in determining the price of the tokens for trading according to a mathematical equation.

Tokenomics

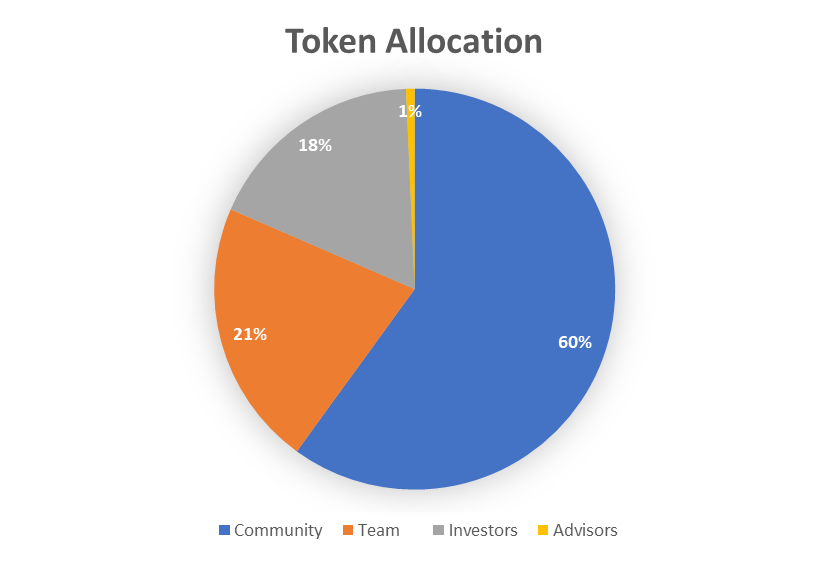

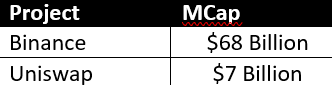

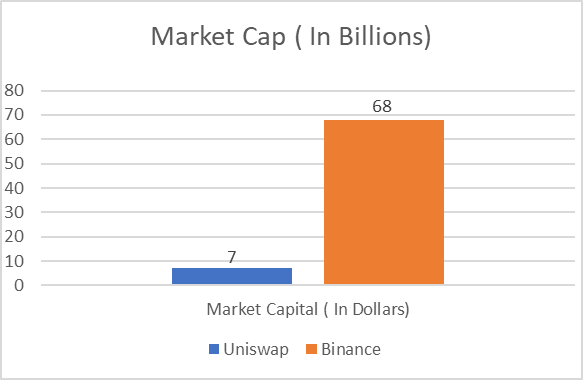

UNI is the native cryptocurrency token of Uniswap as well as a governance token, the term “governance token” refers to the power of token holders to vote on platform modifications and advancements that was launched on November 2, 2018. The market cap of the native token is approximately $7 billion, placing it among the top 30 cryptocurrencies by market cap in the world.

It has a max supply of 1 billion UNIs and currently has 631.307 million UNIs (63%) in circulation. The quantity of UNI tokens will be regularly increased to ensure continuing involvement and contribution to Uniswap at the expense of passive UNI holders due to a constant 2% annual inflation rate.

The principal application of (UNI) is as a governance token. Holders can attach their UNI to an address, thereby delegating voting power. Users have the option of delegating themselves.

Uniswap (UNI) tokens are useful for a variety of organizations and people. It offers an alternative, decentralized payment system free of intermediaries’ involvement, giving you more control over your money.

UNI can also be used for speculation and investment, as well as an alternative to costly and time-consuming overseas transfers.

Competition Analysis

Uniswap vs Sushiswap

There is no liquidity mining scheme on Uniswap. It once awarded shares of UNI tokens as incentives for liquidity providers via liquidity mining. The liquidity mining effort, on the other hand, was short-lived and never fully realized. As a result, after the initial token distribution, users have no other option for obtaining UNI tokens. On the opposite end of the scale, you might find the benefit of liquidity mining. SushiSwap’s active liquidity mining program allows users to earn SUSHI governance tokens by staking their tokens.

Decentralized exchanges provide liquidity pools of crypto token pairings where you may trade crypto for a charge. It is vital to note that the exchange costs may be used to differentiate between Uniswap and SushiSwap.

When looking at Uniswap for swap costs, you will see three unique charge categories. The charge tiers are 0.05 percent, 0.3 percent, and 1%, depending on the risk assumed by liquidity providers in relation to predicted volatility in the pools. SushiSwap, on the other hand, charges a flat 0.3 percent exchange fee on all trading pairs. Liquidity providers earn 0.25 percent of exchange fees, while SUSHI token holders may receive the remaining 0.3 percent.

Total Value Locked (TVL) refers to the total liquidity or total quantity of assets locked in DeFi smart contracts. It can provide users with a clear idea of the worth of a platform. Surprisingly, SushiSwap was able to grab the lead in TVL when it first launched. Uniswap, on the other hand, introduced the UNI token and opposed its opponent in terms of TVL. Uniswap’s TVL was $4 billion in July 2021, whereas its competitor’s TVL was $3.4 billion.

Uniswap vs Binance

The Binance chain is represented by BEP2. However, this implies that the value and performance of UNI are more directly linked to the value and profitability of Ethereum. At the same time, the value and performance of BNB are solely impacted by Binance’s achievements.

The Uniswap flat charge is 0.30 percent. When you make a transaction on Uniswap, you will always be charged a 0.30 percent trading fee, regardless of your trading volume, deal size or other factors. Binance, on the other hand, offers extremely cheap trading costs that begin at 0.10 percent. If your trading volume in the previous 30 days has been greater than 50 BTC and you have at least 50 BNB in your wallet, you can pay a 0.09 percent charge for your trades.

Binance is a cryptocurrency exchange that is centralized. As a result, you don’t have to be concerned about the security of your wallet and cryptocurrency. You’re secure as long as you enable 2FA on your Binance account and apply common sense. Binance also features a user fund, known as SAFU, which provides insurance against any breaches and helps users feel safer on Binance. However, when you utilize decentralized exchanges such as Uniswap, you are solely responsible for the security of your cryptocurrency and wallet. If you are confident in the security of your computer and utilize popular and secure wallets such as MetaMask, you are unlikely to have any security issues or cryptocurrency loss.

Binance’s gas fees range from 0.015 percent to 0.10 percent for purchase and trading fees, and 3.5 percent or $10, whichever is greater, for debit card transactions, but the typical gas fees for Uniswap trades range from $100 to $300-400, depending on the network gas fees. If you deal in small quantities, you might consider using centralized exchanges.

Team, Media & Community strength

Hayden Adams is the founder of Uniswap. Adams formerly worked as a researcher at Columbia University Medical Center (June 2012 – October 2014), as a Mechanical Engineering Intern at Vista Wearable Inc. (June 2015 – September 2015), and as an Engineer at Siemens (July 2016 – July 2017). Hayden Adams received his Bachelor of Science in Mechanical Engineering from Stony Brook University in 2016.

Noah Zinsmeister is the head of engineering at Uniswap. In 2016, he received his B.A. in Economics-Mathematics from Columbia. He plummeted deep, far down the bitcoin rabbit hole after a close encounter with a Ph.D. He is currently the Engineering Lead at Uniswap, an Ethereum-based decentralized digital asset exchange, and he also manages web3-react, a framework he invented for creating blockchain apps.

Matteo Leibowitz is Strategy Lead at Uniswap. Formerly Research Analyst of The Block. Founder & Managing Editor of CryptoChat.us. Matteo joined The Block in January 2019 as a Research Analyst. Matteo founded CryptoChat after graduating from Columbia University in 2017, an industry-leading weekly that provides opinion and analysis on the latest events in the blockchain world, with a focus on the developing Ethereum ecosystem.

Uniswap’s social media family is growing rapidly on Twitter and discord. They have over 835.7K followers on Twitter and 87k members in discord in over 4 years. They have had a lot of traction in news articles and is been closely monitored and been compared to major players like Chainlink, AAVE in terms of performance because it has a promising future and a lot of potentials to grow.

Conclusion

Uniswap is the market’s largest decentralized exchange, facilitating over $600 billion in trade volumes on its v2 and v3 platforms this year (over $300 billion on each platform).

It plays a unique role in the field of cryptocurrency trading. The emphasis on decentralization by design has been one of the main factors enabling its growth. The DEX platform facilitates exchanges of digital assets with the certainty of liquidity by utilizing automation and smart contracts.

It was launched on Polygon, an Ethereum-focused scaling platform. More than 72 million Uniswap (UNI) token holders backed the move, and Uniswap is now available on Polygon. In other words, Uniswap users may now swap tokens utilizing the Polygon blockchain using the official Uniswap interface.

By committing their assets to liquidity pools, liquidity providers play a vital role in the Uniswap market. In addition, the platform employs an AMM method to determine the price of assets in a liquidity pool, assuring fair value. As a result, Uniswap DEX is unquestionably one of the best options for crypto trading, particularly with a focus on DeFi.

The Uniswap team has created an excellent protocol that is likely to endure the test of time as one of the most successful DeFi efforts. Competitors, on the other hand, are presenting their case, and this rivalry will ultimately result in better products for everyone to utilize.

It has become a crypto powerhouse in the DeFi area, with a user-friendly UI that appeals to many beginners in the crypto field.

The project’s decentralization and transparent governance via its UNI coin make it a favorite among blockchain enthusiasts who dislike large, centralized cryptocurrency exchanges. Furthermore, its liquidity pools are an appealing venture for investors who wish to generate revenue from cryptocurrencies they currently own without selling them.

Important links and sources

https://research.binance.com11

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today