FTX Report – 4th February 2021

Overview:

FTX is a centralized cryptocurrency derivatives exchange. It offers a web platform and mobile app where you can buy, sell, and trade crypto.

The CMP of FTT on 4th February is $43.71

What is FTX?

FTX is a cryptocurrency derivatives exchange designed for trading by traders launched in May 2019. FTX provides cutting-edge products like as futures, options, volatility products, and leveraged tokens. They work hard to provide a platform that is both sophisticated enough for professional trading businesses and simple enough for first-time consumers.

The term derivative refers to a type of financial contract whose value is dependent on an underlying asset, group of assets, or benchmark. A derivative is set between two or more parties that can trade on an exchange or over-the-counter (OTC).

It is currently #27 (based on Mcap) in the cryptocurrency market. FTX token’s native token “FTT” has a max supply of 352 million FTTs and currently has 138.148 million FTTs (39%) in circulation. It is currently listed on all the major exchanges.

Binance, Coinbase, Bibox, Coinbase Pro, and OKEx are among FTX Exchange’s main competitors.

How does FTX bring value to the table?

Alameda Research, a crypto trading thought leader and the leading liquidity provider in the secondary markets, is behind FTX. Many of the following aspects are dependent on Alameda’s skill, making them difficult for someone else to imitate.

- Live Product:- Unlike many other exchanges and companies that are raising funds through token sales, their exchange is already operational.

- Liquidity from Day 1:- FTX is quite liquid. It already has greater liquidity than any other cryptocurrency futures market; only the BitMEX BTC perpetual futures are more liquid than their FTX counterpart. This is really difficult to recreate. No new exchanges will be able to do so, and those that have been operational for 5 years have only done so for a single contract.

- Domain Expertise: – FTX is created by people who are intimately familiar with the products. Everything from collateral to maintenance margins to liquidation processes to product listing has been completely redesigned from the bottom up by one of the products’ most avid users.

- Pioneering New Products: – They are the first to launch USDT futures and leveraged tokens. These items are in high demand, and anticipate that they will become quite popular.

- Fast Development Cycle:- FTX can reap the benefits of Alameda’s tech staff, which is a skilled, battle-tested company that has built complicated crypto trading systems under time constraints. This implies that their development cycle is substantially shorter than others’, allowing them to release numerous big features every day.

- Strong Partnerships:- They are now working with USDC and TUSD. Because Alameda is a vital element of the secondary markets, they have strong ties with leading exchanges, trading firms, OTC desks, and so forth, with whom they will collaborate.

Additional value-added:-

- Clawback Prevention: – A clawback is a contractual provision whereby money already paid to an employee must be returned to an employer or benefactor, sometimes with a penalty. Socialized losses have taken a large amount of consumer cash on various derivatives exchanges. By employing a three-tiered liquidation model, FTX considerably minimizes the possibility of clawbacks occurring.

- Centralized Collateral Pool + Universal Stablecoin Settlement: – Collateral on existing futures markets is dispersed over several tokens and margin wallets. This makes it harder for traders to rebalance and avoid liquidating holdings. FTX derivatives are stablecoin-settled and require only one global margin wallet to address these difficulties.

- Leveraged Tokens: – These tokens enable traders to enter short or leveraged trades without needing to use margin. A trader who wishes to 3x short Bitcoin, for example, may simply purchase a 3x short Bitcoin leveraged token on FTX. Leveraged coins are ERC-20 compliant and may be traded on any spot exchange.

- USDT Futures: – USDT futures are game changers; many major crypto enterprises sorely need a mechanism to hedge USDT deltas given the currency’s past volatility, and USDT futures will provide that.

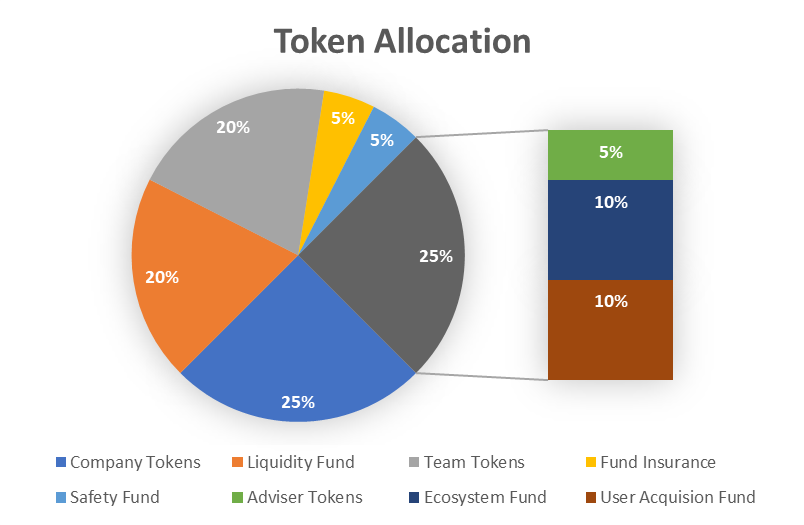

Tokenomics

FTT is the native cryptocurrency token of the crypto derivatives trading platform FTX that launched on May 8, 2019. The market cap of the native token is approximately $6.1 billion, placing it among the top 30 cryptocurrencies by market cap in the world. It has a max supply of 352 million FTTs and currently has 138.148 million FTTs (39%) in circulation. One-third of all FTX market fees are used to buy FTT off the open market and permanently remove it from circulation. This feature renders FTT deflationary for a token with a fixed supply cap. FTT has ample volume on any other exchanges it increasing the likelihood that the price is not being manipulated by FTX.

FTT was created to serve as the platform’s backbone and propel it forward. Originally supplied as a reward for exchange transactions, the FTT token now serves various services within its ecosystem, such as VIP discounts based on the number of coins owned by users or prizes for supplying liquidity through futures contracts trading with their own FTT currency.

One of the most significant advantages of utilizing FTT is acquiring a reduction on trading expenses. Crypto futures not only have a smaller charge, but they also have narrower spreads. The percentage differential might be as high as 60% for active traders on the FTX platform. Traders can also utilize FTT as collateral for future trades.

Competition Analysis

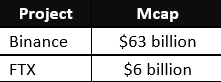

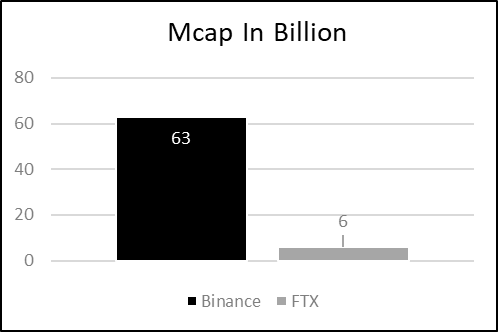

FTX vs Binance

Looking at the sorts of products that both exchanges provide, we can see that they have a lot of similarities in terms of their overall offering. The main distinction is that Binance is more focused on the spot market and has a broader variety of currencies, whilst FTX is primarily focused on the futures market. Both exchanges also feature goods that are exclusive to them, such as Binance Earn, Crypto Loans, P2P market, and so on. FTX, on the other hand, features volatility and prediction markets. Also, both of these exchanges are entering the NFT sector and have recently launched their NFT marketplace.

The web and app interfaces for each of these exchanges are exceptionally clean and user-friendly. The interface may be difficult for a total newcomer to grasp, but a trader with any expertise will readily navigate around the exchange. However, Binance has an advantage here because of its extensive resource collection known as Binance Academy. Binance Academy not only teaches consumers how the exchange works but also how the crypto market operates and what the newest market trends are.

Both exchanges have relatively low costs on their spot trade market, and the rates continue to fall as volume grows; nonetheless, FTX wins here, charging 0.02 percent as a maker fee and 0.07 percent as a taker fee for tier 1 accounts. This is much less than the 0.1 percent maker and taker fee charged by Binance. In fact, even after utilizing the local currency BNB for trading, the customer will have to pay a fee of 0.075 percent, which is still greater than what FTX charges.

Binance being #1 and FTX being #3 in the exchange market FTX has a great deal of potential to grow even bigger than Binance as of now Binance has a weekly visit of 34,051,317 whereas FTX has 4,373,686 and the average liquidity of Binance is 802 while FTX has 685 which is not that far from Binance.

Team, Media & Community strength

Sam Bankman-Fried is the co-founder and CEO of FTX. Sam worked as a trader on Jane Street Capital’s international ETF desk before starting FTX. He traded a wide range of ETFs, futures, currencies, and stocks, as well as designed their automated OTC trading system. He received a physics degree from MIT.

Gary Wang is the co-founder and CTO of FTX. Gary worked as a software developer at Google before launching FTX. He designed systems that aggregate costs over millions of flights, reducing latency and memory use by more than half. He earned a degree in Mathematics with Computer Science from MIT.

Nishad Singh is the Head of Engineering at FTX. Nishad worked as a software engineer at Facebook before joining FTX, where he focused on applied Machine Learning. He earned a bachelor’s degree in Electrical Engineering and Computer Science from the University of California, Berkeley, with the highest distinction.

FTX’s social media family is growing rapidly on Twitter and telegram. They have over 380.4K followers on Twitter and 58k members in telegram in just over 3 years. They have had a lot of traction in news articles and is been closely monitored because it has a promising future and a lot of potentials to grow.

Conclusion

FTX being a trading platform, cryptocurrency users who wish to invest in any major cryptocurrency will ultimately learn about or use the platform. This gives FTT holders a significant edge because they may anticipate the token’s price to increase as more users join the platform and utilize it as a trading platform on a daily basis.

On both its international and US exchanges, FTX maintains strict security requirements. Neither has been the victim of a security event, such as a data leak or hack, to date. FTX requires two-factor authentication (2FA). The Authy or Google Authenticator app is recommended by the exchange, although there are other 2FA choices available as well. You may also need 2FA and a different password for all withdrawals on your account with FTX.

The team comes from leading Wall Street quant funds and tech companies: Jane Street, Optiver, Susquehanna, Facebook, and Google. They are familiar with the traditional secondary market. They have backgrounds in equity derivatives trading; they know both how derivatives are traditionally designed, and what derivatives there is market demand for.

Investing in FTT appears to be a sensible idea when past trends and general price patterns of similar cryptocurrencies are considered. Since early 2021, FTT has returned about 1,000%. Even from the standpoint of the crypto market, this is nothing but astounding.

Because of the unique trading instruments it provides, the FTX exchange has a “first-mover” edge in several crypto worlds with its creative array. Overall, FTX is well worth a look if you’re interested in cryptocurrencies.

Important links and sources

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today