Crypto Markets

Crypto Sentiment

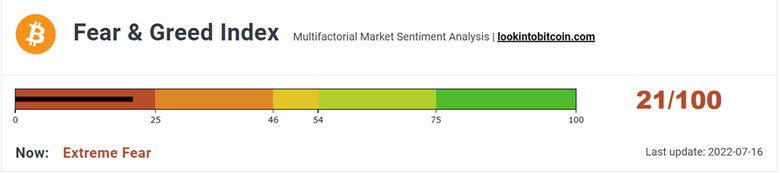

This week the sentiment towards the cryptocurrency markets has not changed

significantly compared to last week’s index. The index currently stands at “21”.

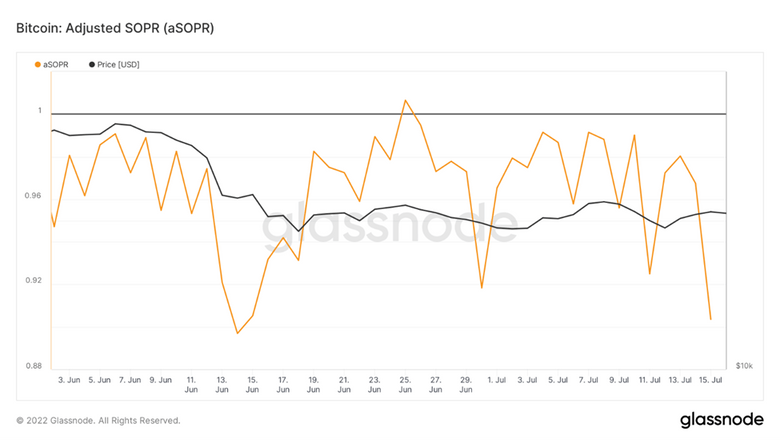

Another data to evaluate the sentiment of the general public would be to look at Spent

Output Profit Ratio (SOPR). What is SOPR? In laymen terms, it indicates if people have

sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit

booking dominated loss booking and below 1 indicates that loss booking dominated

profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The Adjusted SOPR filters out transactions that are younger than 1 hour, thus,

clearing out noise from the metric.

The aSOPR for this week is at 0.9. During bear markets we have seen that the metric

oscillates below 1. As aSOPR reaches a value of 1, investors start selling their coins and

the metric falls below 1. The oscillation continues for an extended period of time

before final capitulation happens and the trend reverses.

Is there any demand for Crypto?

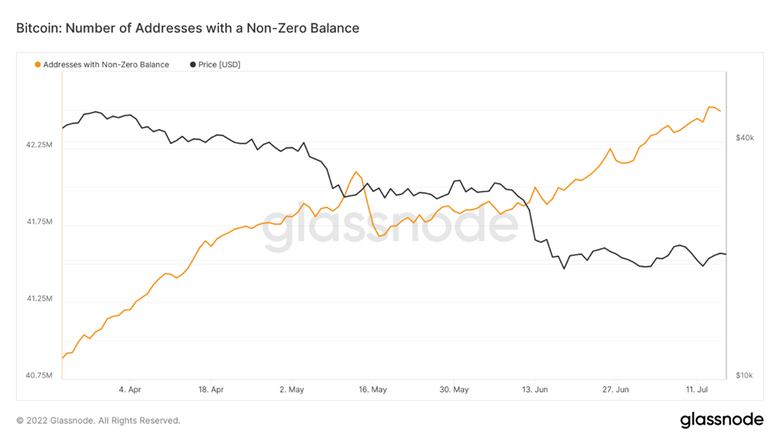

Balance on exchanges has reduced by 24% from its peak in March 2020. This signifies

more investors are transferring their coins from exchanges to their wallets. The

number of addresses with non-zero balance is at all-time high value of 42.5 million.

This can be attributed to high growth adoption of Bitcoin network.

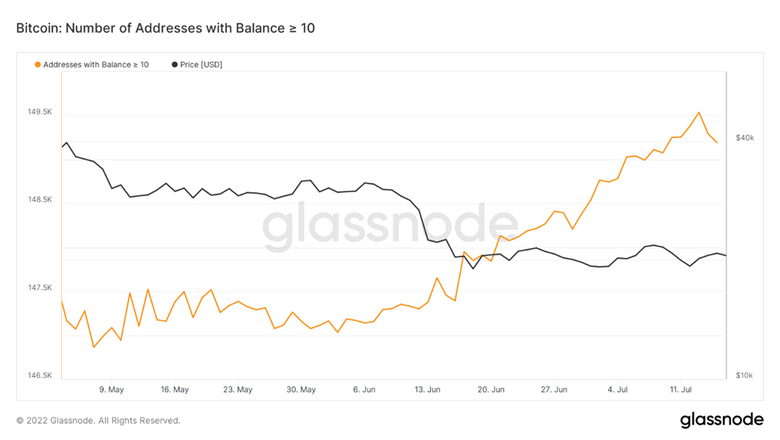

Increase in number of unique addresses holding at least 10 BTC is one of the positive

signs that we see in this bear market.

What could play out?

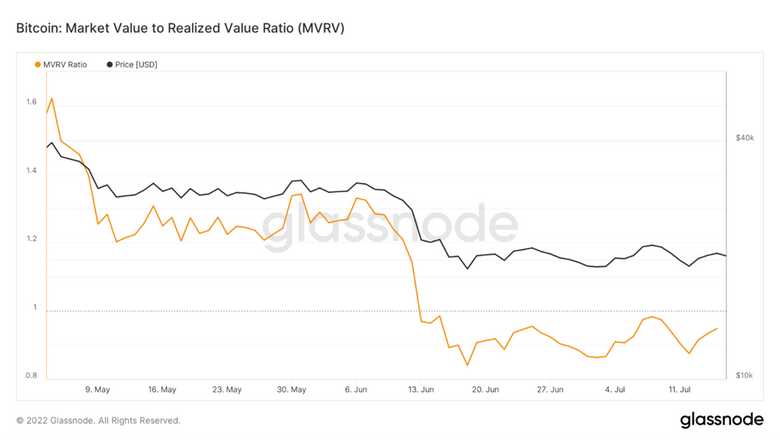

MVRV ratio is equal to the market capital divided by realized capital of Bitcoin. Realized

capital unlike market capital does not use the current market price, but rather uses the

prices each Bitcoin when they last moved.

So, for example if the price of most of the Bitcoin when they last moved was $10,000

and the current price is $60,000. Then the MVRV ratio would stand at 6. This means

that the market is extremely heated and profit booking is likely. On the other hand, if

the of most of the Bitcoin when they last moved was near the market price, then the

CMP can be considered as the bottom.

MVRV ratio has not changed much compared to last week. Currently the ratio stands

at 0.94. The metric is oscillating below 1 which is the general trend in most of the bear

cycles.

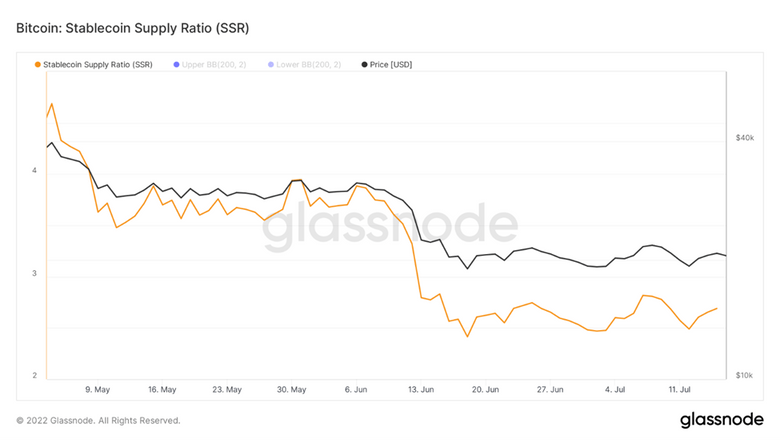

Stablecoin Supply Ratio (SSR) is the ratio of market cap of BTC divided by the market

cap of all stablecoins.

High SSR value indicates supply of stablecoins is low compared to the market cap

of BTC. This means low buying potential and possible price drop.

Low SSR value indicates supply of stablecoins is more compared to the market cap

of BTC. This means high buying potential and possible price rise.

Currently, SSR is at all-time low indicating high buying potential.

Overall Market Performance

DOW JONES

Dow Jones Industrial Average remained completely neutral in the last week. The daily

chart for Dow Jones continues to move in a megaphone down pattern. The next

resistance is expected at 32,800 and next support is expected at 28,900.

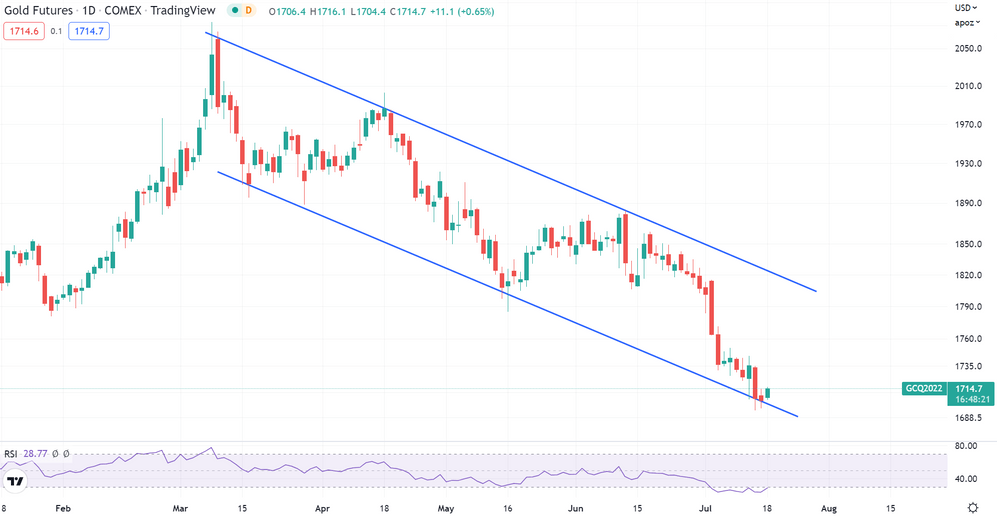

GOLD FUTURES

Gold Futures closed in red for the 5th consecutive week dropping 2.2% in the last

week. The daily trend for Gold is traversing within a descending channel pattern. An

immediate support is expected at $1,670

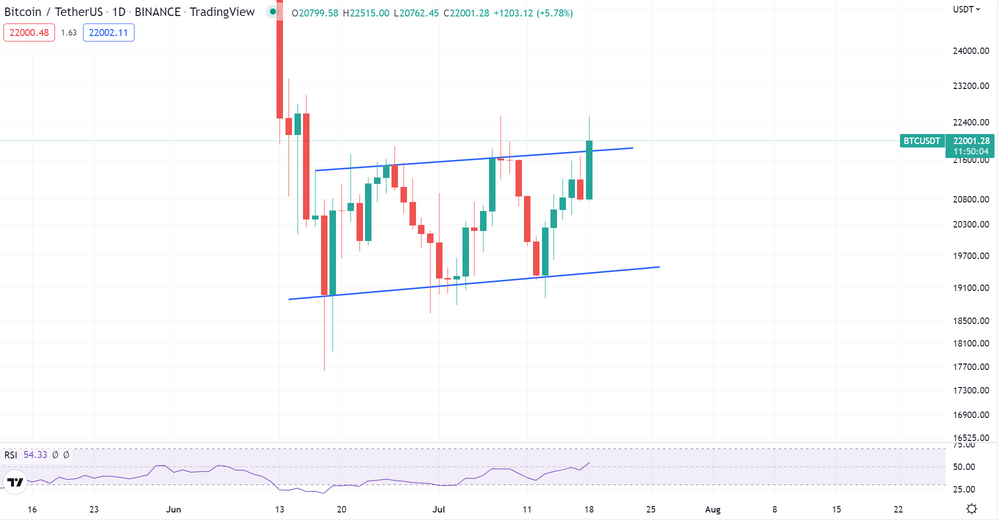

BITCOIN

Bitcoin remained fairly flat during the last week. The daily trend for BTC has broken out

of the channel pattern. The next resistance is expected at $32.3K and key support is

expected at $14K.

ETHEREUM

Ethereum against BTC surged by 15% in the last week. The weekly trend for ETH-BTC

continues to traverse within an ascending triangle pattern. The next resistance is

expected at 0.076 and an immediate support is expected at 0.046

Highlights of the week

Robinhood users can now withdraw crypto from their

platform. The first exchange to offer withdrawal service

amidst the bear market.

Revoto to sell NFTs that grant a lifetime subscription to

Netflix and Spotify. Once users acquire the NFT, Revuto will

provide the user with a digital debit card to pay for their

Netflix or Spotify subscriptions.

Disney chooses Polygon for entering Metaverse. Ethereum

scaling solution Polygon has been selected to participate in

Disney’s Accelerator Program to further Polygon’s

development of Web3 experiences.

Our Pick of the Week

Cartesi (CTSI)

We expect a gain of 15% from the Buy Price of 0.1763 USDT and

outperform BTC in the coming week.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today