Crypto Markets

The Top-3 Gainers and Losers on the Binance exchange

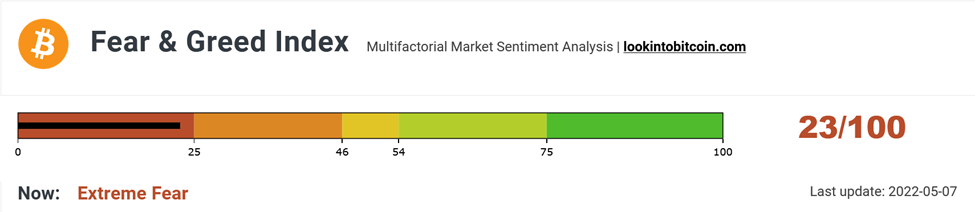

Crypto Sentiment

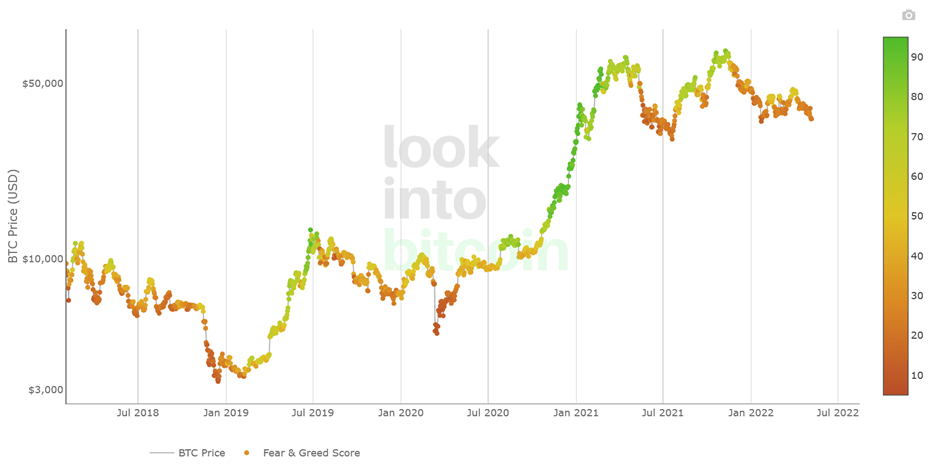

Since the beginning of 2022, the crypto markets have been in a state of extreme fear or Neutral at best. There has been no significant change in public sentiment towards Bitcoin and the overall crypto markets, we are back to extreme fear due to macroeconomic conditions.

Buy the fear and sell the greed is an ancient investment strategy and seems like it has paid off most of the time over the past 4 years. We have been sitting on this position for a couple of months,

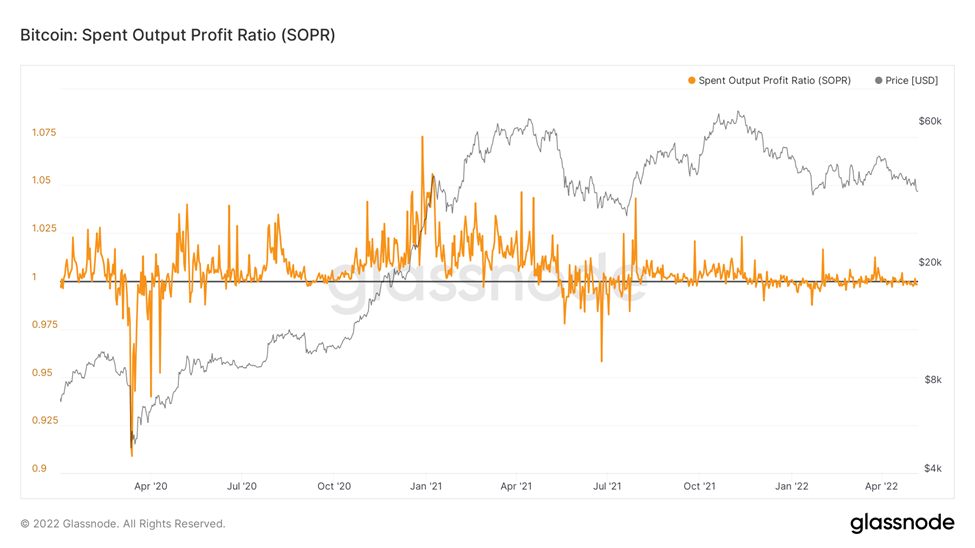

Another data to evaluate the sentiment of the general public would be to look at SpentOutput Profit Ratio (SOPR). What is SOPR? In laymen’s terms, it indicates if people have sold at a profit or if they sold at a loss. An SOPR value above 1 indicates that profit booking dominated loss booking and below 1 indicates that loss booking dominated profit booking. A value of 1 indicates that the coins were sold at their purchase price.

The SOPR is currently stagnant at the value of “1”. This indicates that Bitcoins that are currently in profit are not being sold and are being hodled. Bitcoins that are at their breakeven are being sold in the market.

Is there a demand for Cryptocurrency?

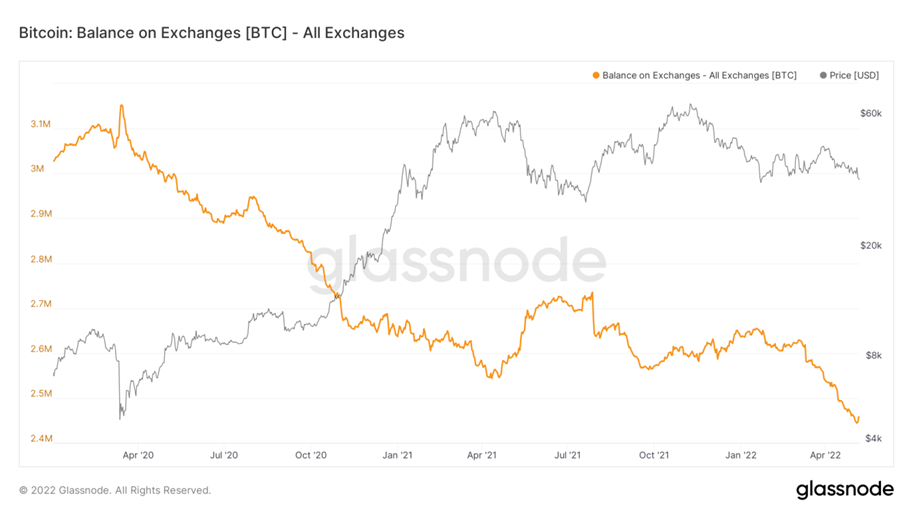

In the 1st week of May, the amount Bitcoins leaving crypto exchanges plummeted to a multi-year low. It is assumed that these Bitcoin will be taken off exchanges and will be kept in cold storage wallets with no intention to sell any time soon. Over the past 2days, the balance has started to reverse. Although relatively it is just a blip on the radar,it might become a concerning figure.

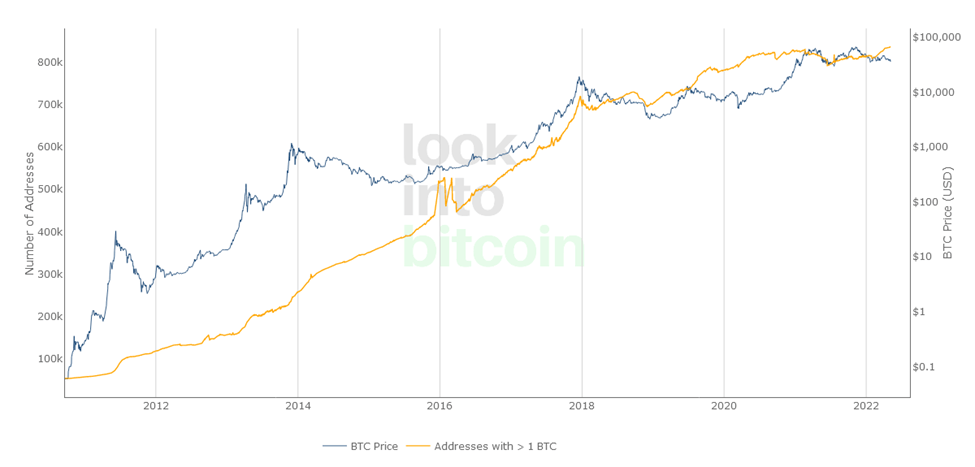

This data is also reflected in the number of addresses that own at least 1Bitcoin.

Is the Smart money buying?

The SOPR is currently stagnant at the value of “1”. This indicates that Bitcoins that are currently in profit are not being sold and are being hodled. Bitcoins that are at their breakeven are being sold in the market.

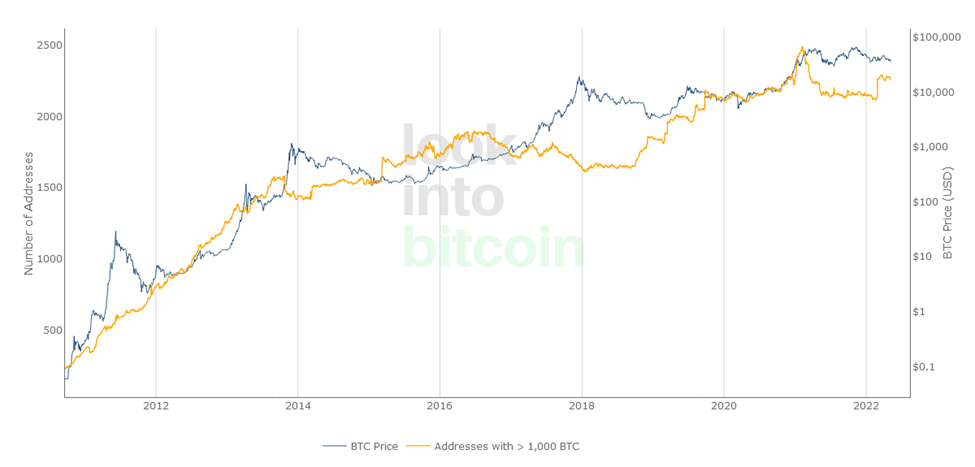

We can connect the dots with the prior chart on Bitcoins leaving exchanges with the above data point. There has been a massive surge in the number of addresses that hold more than 1000 BTC since the start of the year. It has, however, declined marginally in the past week.

With the above data points, we can make an educated guess that institutional investors are scooping Bitcoin from the Markets. However, we may need to keep a close eye on this data point as there has been a recent decline in this number.

Overall Market Performance

DOW JONES

The Dow Jones Industrial Average has now been correcting for six straight weeks. The daily trend for Dow Jones is moving within a descending channel pattern. Immediate support is expected at 31,000.

GOLD FUTURES

Gold Futures slid down by 1.5% over the past week to close below $1,900. The 4-hourly trend has formed a channel pattern.

Immediate support is expected at $1,850.

BITCOIN

Bitcoin plummeted by 10% during the last week to fall below $34K as the Dollar Indexstrengthened further. The daily trend for BTC has broken under the triangle pattern. The next resistance for BTC is expected at $48,400 and immediate support is expected at $33,000.

ETHEREUM

Ethereum gained almost 1% against Bitcoin over the week. The daily trend for ETHagainst BTC continues to move within a megaphone pattern. The next resistance is expected at 0.078 and the next support is expected at 0.0653.

What could play out

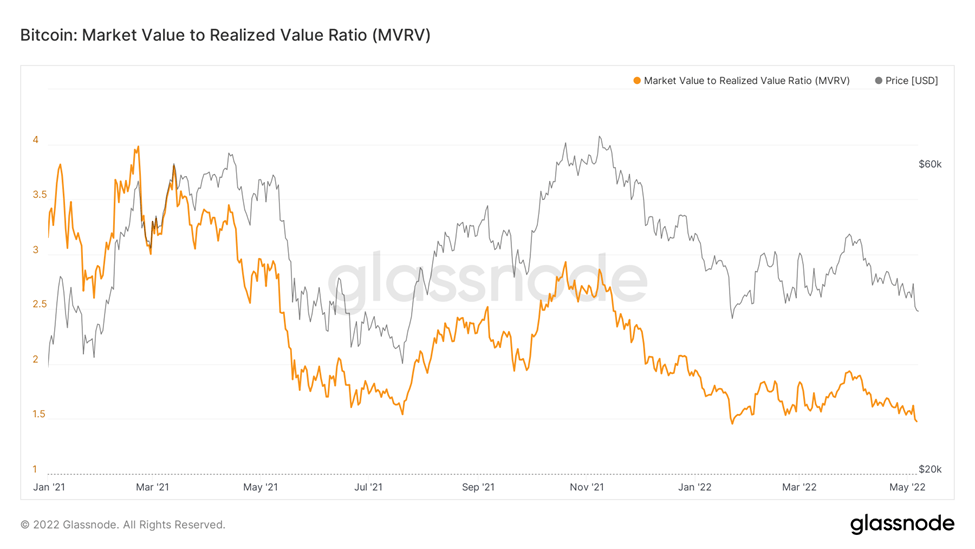

MVRV ratio is equal to the market capital divided by realized capital of Bitcoin. Realized capital, unlike market capital, does not use the current market price but rather uses the prices each Bitcoin when they last moved.

So for example if the price of most of the Bitcoin, when they last moved, was $10,000and the current price is $60,000. Then the MVRV ratio would stand at 6. This means that the market is extremely heated and profit booking is likely. On the other hand if the price of most of the Bitcoin, when they last moved, was near the market price, then the current market price can be considered as the bottom.

The current MVRV ratio stands at 1.5 and is trending towards to the downside.

Highlights of the week

- Argentina’s Central Bank bars banks from offering crypto services

- Binance commits $500M for Elon Musk’s takeover of Twitter

- Starbucks to launch NFTs this year offering access to ‘unique experiences and benefits.

- Yuga Labs “Otherside” NFT mint caused the largest gas spike in Ethereum’s history, over $150M was spent on gas fees.

- Dubai’s crypto regulator to launch metaverse headquarters in The Sandbox

- Swiss National Bank opposed to holding bitcoin as a reserve currency

Our Pick of the Week

Thorchain(RUNE)

We expect a gain of 10% from the CMP of 5.9 USDT and outperform BTC in the coming week.

Target Achieved

Tron(TRX)

TRX has achieved our target of 10% from the BUY Price of0.0669 USDT and has outperformed Bitcoin.

Get deeper insights into the crypto market’s weekly trends discussed on our Spotify podcast.

Start your Crypto Investments with XMINT Bots today